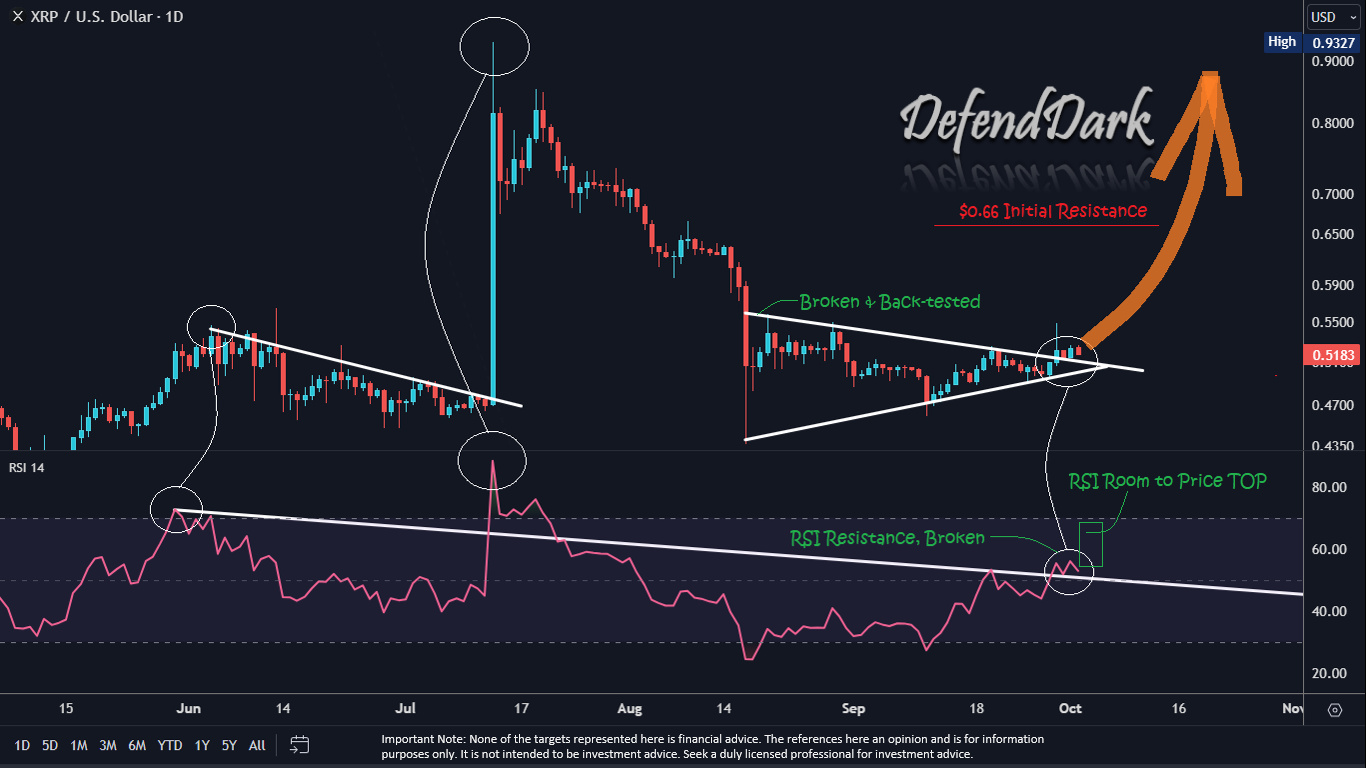

Renowned crypto analyst “Dark Defender” has forecasted a short-term bullish motion for the XRP value, with expectations that the cryptocurrency may hit the $0.66 mark this week. Sharing his insights on Twitter, the analyst referenced XRP’s 1-day chart, highlighting current value dynamics and key technical indicators.

“Hi there. XRP in the daily chart broke the initial resistance & back-tested it. We had a similar move on 13-Jul-23. The next Fibonacci level stands at exactly $0.6649. If we don’t see XRP below $0.50 support, we expect to hit $0.66 this week,” the analyst tweeted.

A Deep Dive Into The XRP Price Analysis

The chart offered by Dark Defender exhibits that on September 29, XRP skilled an upward breakout from an ascending triangle. The XRP value enhance by 8% was pushed by market members’ expectations of Ripple’s Proper Party. Although “major news” didn’t materialize, the value of XRP nonetheless managed to remain above the development line.

Historically, ascending triangles are thought-about continuation or consolidation formations, indicating a possible resumption of the earlier development following a short interval of consolidation. Given XRP’s upward trajectory since January, this breakout suggests the doable continuation of its bullish development.

As Dark Defender highlights, the cryptocurrency underwent a back-test over the next three days, a course of the crypto asset has to this point confirmed. If the asset sustains above the $0.50 mark, it might efficiently clear the back-test as per Dark Defender’s evaluation.

Drawing a parallel to the previous, Dark Defender identified an analogous value conduct on July 13. That day marked the discharge of the summary judgment within the lawsuit between Ripple Labs and the US Securities and Exchange Commission (SEC).

Amid this backdrop, XRP broke out of its consolidation part, triggering an nearly 100% value rally. Remarkably, the Relative Strength Index (RSI) entered a cooling part after a short surge to 74 in late May. The eventual upside break of this descending development in RSI coincided with XRP’s vital rally.

Observing the current chart conduct, Dark Defender famous that the RSI’s prolonged trendline was as soon as once more damaged upwards final Friday. Although there wasn’t a big information catalyst from Ripple to push XRP’s value dramatically, an RSI trendline back-test occurred in current days. If that is confirmed, it might sign a surge towards the “next” Fibonacci stage at $0.66 as talked about by the analyst.

Long-Term Price Targets

Dark Defender, in a tweet from October 1, expressed optimism in regards to the XRP value trajectory, particularly highlighting its current shut with a doji candle sample in September. He remarked, “XRP closed the September candle with a doji. I take this positive, as always, and expect a re-test towards $0.66 in a couple of days.”

Expanding on this remark, Dark Defender means that if XRP breaks the $0.55 threshold, it’s going to acquire vital momentum. This is because of the asset probably positioning itself above the weekly Ichimoku Clouds, a situation he views as very bullish. Following this, he anticipates:

[…] We proceed with the second resistance at $0.91 (Yellow Resistance) will probably be damaged above $0.66, and XRP will instantly proceed with $1.33. Above $1.8815 (In Violet :)), we are going to focus on –> New All-Time High, presumably at $5.85 at first!

At press time, XRP traded at $0.50797. After the value was rejected on the 23.6% Fibonacci retracement stage at $0.5272, the cryptocurrency is now on the lookout for help on the 38.2% Fibonacci retracement stage at $0.5083 on the 4-hour chart.

Featured picture from Top1 Markets, chart from TradingView.com