Bitcoin has recorded an total constructive value motion within the final week, gaining by 2.39%, in response to data from CoinMarketCap. The premier cryptocurrency suffered a slight dip between Tuesday and Thursday however quickly rose on Friday to commerce above $27,000 once more.

Meanwhile, in celebrating the brand new month of October, fashionable crypto analyst Michaël van de Poppe has predicted an incoming bullish run for Bitcoin in Q4 2033 based mostly on sure anticipated occasions.

Analyst Projects Bitcoin To Reach $40K In Q4 2023 Starting With A Positive ‘Uptober’

Via a post on X on October 1, Michaël van der Poppe welcomed his 667,000 followers to October with a lot optimism in the direction of the BTC market, renaming the month as “Uptober.”

In common, the well-known analyst believes the crypto bear market is sort of over, and Bitcoin may quickly file some important beneficial properties, as he expressed in a previous post on September 30.

Interestingly, van de Poppe’s optimism extends past October to the entire of Q4 2023, as he predicts Bitcoin may attain $40,000 earlier than the 12 months runs out. Albeit, this prediction is hinged on the incidence of sure occasions.

Welcome to Uptober.

Welcome to Q4, which is main in the direction of an excellent quarter, doubtlessly fueled by ETF approvals and the pre-halving rally.

Potentially #Bitcoin to $40,000 is cheap.

— Michaël van de Poppe (@CryptoMichNL) October 1, 2023

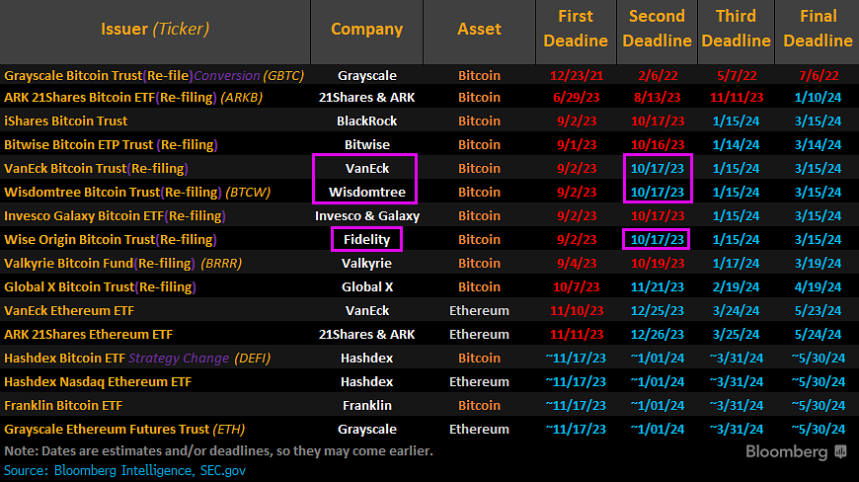

Firstly, Michaël van der Poppe mentions the potential approval of ETF purposes. The ongoing Bitcoin spot ETF saga within the US has drawn a lot consideration over the previous few months as a consequence of its attainable results on the BTC market.

Currently, analysts are fairly optimistic in regards to the possibilities of approval of a Bitcoin spot ETF, which may end in massive gains for the most important crypto asset upon realization.

Realistically, this approval may happen in Q4 2023, because it incorporates the second deadline date for many purposes.

However, the US Securities and Exchange Commission may determine to delay its responses to those proposals until the ultimate deadlines, most of that are slated for Q1 2024. The US securities regulator is already using such ways, as seen with the primary deadline dates for many purposes.

In the final week, the SEC additionally introduced it could be pushing again its response to sure purposes past their second deadline date. These purposes included proposals from BlackRock, 21Shares, Bitwise, and Valkyrie.

Source: Bloomberg Intelligence

The Bitcoin Pre-Halving Rally

In addition to potential ETF approvals, Michaël van de Poppe additionally talked about a attainable bitcoin pre-halving rally as an element that might spur the asset development to $40,000 in Q4 2023.

Historically, the months main as much as the halving occasion are marked by a Bitcoin rally, as seen in 2012 and 2016.

Based on van de Poppe’s prediction, he foresees an identical BTC value motion within the coming months forward of the subsequent Bitcoin halving set for April 2024, throughout which the mining rewards can be slashed from 6.25 BTC to three.125 BTC.

However, traders ought to be aware of black swan occasions, as seen with the final Bitcoin halving in 2020. In the months earlier than this halving occasion occurred, the BTC pre-halving rally was quickly affected by the unfavorable market results of the COVID-19 pandemic.

At the time of writing, Bitcoin is buying and selling at $27.138 with a 1.07% achieve within the final day. Meanwhile, the asset’s every day buying and selling quantity is down by 21.37% and valued at $6.28 billion.

BTC buying and selling at $27,170 on the hourly chart | Source: BTCUSDT chart on Tradingview.com

Featured picture from Analytics Insight, chart from Tradingview

Source: Bloomberg Intelligence

Source: Bloomberg Intelligence