After sinking roughly 30% from 2023 highs, Ethereum seems to be bouncing off from the pits of the crypto winter. Looking at candlestick preparations within the each day and weekly charts, the coin has major assist at round $1,500 and is agency, bouncing off with respectable buying and selling quantity.

At spot charges, ETH is up roughly 3% following constructive developments sparked by the rising adoption of its layer-2 scaling answer and the current information that VanEck, a participant managing billions of property, is getting ready to launch an Ethereum derivatives product.

Ethereum Layer-2 Solutions Exploding

Taking to X on September 28, Alex Masmej, the founding father of Showtime, believes that Ethereum’s layer-2 ecosystem has expanded to such an extent that it no “longer makes sense to build on other platforms.”

The growth and deployment of Ethereum layer-2 options took heart stage following community congestion, which pressured gasoline charges to spike to file highs within the final bull run.

Developers have responded to the community co-founder Vitalik Buterin’s urging. The professional believes they’re shortly setting up and deploying secure, common platforms which have gained widespread recognition.

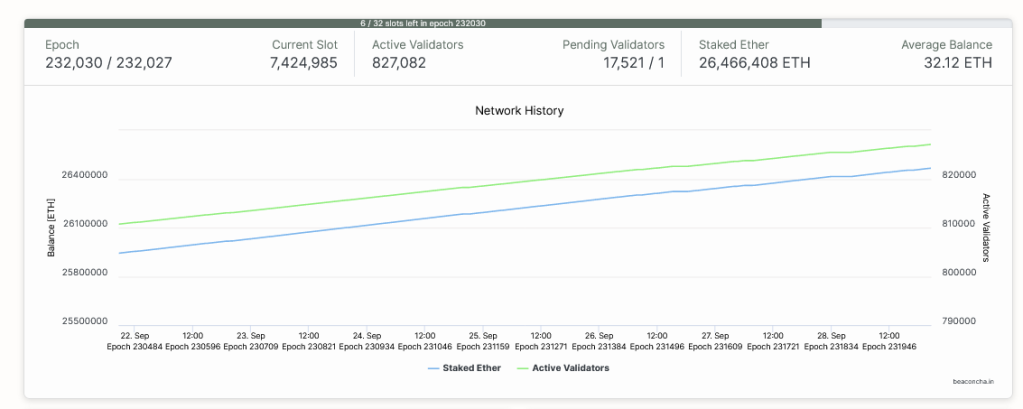

Layer-2 platforms bundle transactions off-chain earlier than confirming them on-chain, permitting for quicker and less expensive operations whereas benefiting from the safety of Ethereum. As of September 28, there have been over 827,000 validators whose job is to substantiate transactions and be certain that the community is safe, thanks partly to their geographic distribution.

Most layer-2 options use optimistic rollups, together with Arbitrum, Base, and OP Mainnet. However, Masmej additionally stated that when ZK rollups, which make the most of zero-knowledge proofs to validate transactions with out revealing delicate information, can be found, it can finish the scalability trilemma, additional boosting the capabilities of layer-2 options.

In the founder’s evaluation, excessive throughput choices, together with Solana, shall be a hedge. At the identical time, Cosmos, which drives blockchain interoperability, will act as a long-term supply of inspiration. Meanwhile, Ethereum will proceed to flourish as Layer-2 choices acquire traction.

Rising TVL And ETH Complex Products Launching

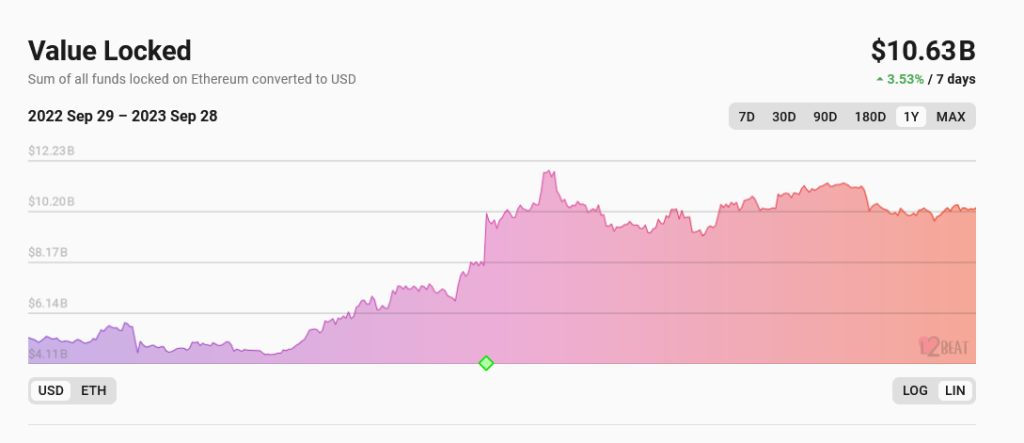

According to l2Beat data, well-liked options like Arbitrum and Base, which supply quicker and cheaper processing environments whereas remaining coupled with Ethereum and having fun with the pioneer community’s fast-move benefit, have bigger whole worth locked (TVL). As of September 28, layer-2 platforms have a TVL of over $10.6 billion, greater than Solana’s market cap, which stood at $8 billion, in response to CoinMarketCap.

Beyond layer-2 adoption, ETH is being catalyzed by the news that VanEck, a worldwide asset supervisor, is getting ready to introduce its Ethereum futures exchange-traded fund (ETF). Specifically, the VanEck Ethereum Strategy ETF (EFUT) will put money into ETH futures contracts supplied by exchanges permitted by the Commodity Futures Trading Commission (CFTC).

Like the Bitcoin Futures ETF product, which is already being supplied, the Ethereum by-product product will permit establishments to achieve publicity, boosting liquidity.

Feature picture from Canva, chart from TradingView