Justin Bons, the chief funding officer (CIO) and founding father of Cyber Capital, one in all Europe’s oldest crypto funds, is convinced Ethereum is essentially the most “robust” community, contemplating its degree of consumer range.

Bons identified the distribution of full nodes throughout numerous Ethereum purchasers as proof of the community’s “unparalleled” degree of decentralization. The skilled believes decentralization is commonly missed in crypto, however Ethereum units “the bar high.”

Client Diversity: Impact On Security And Reliability

Bons in contrast the variety of purchasers in Ethereum and the dominance of Bitcoin core in Bitcoin. Although Bitcoin and Ethereum are legacy blockchains, the method taken by builders to avail purchasers is clear.

Client range is vital as it could present how effectively full node operators choose a given consumer rail over one other. Ethereum, like Bitcoin and different public chains, is decentralized and will depend on a neighborhood of validators to maintain the community safe.

Validators, or miners in Bitcoin, function full nodes to maintain the community operations. However, the blockchain is damaged with out a consumer. A consumer is a software program that implements the general public community’s specification, enabling safe and efficient peer-to-peer (P2P) communication between nodes.

Client range is essential for the safety and resilience of public networks. To illustrate, if all node operators have been to make use of the identical consumer or software program implementation, a bug might trigger a community outage and even trigger different disruptions. With extra purchasers, it turns into tougher to halt community operations even when there’s a bug, bettering reliability.

The improved reliability from range and distribution of purchasers additionally means higher safety. An attacker wishing to disrupt operations has to disable all of the obtainable purchasers utilized by node operators earlier than continuing.

Ethereum Versus Bitcoin Full Node Distribution

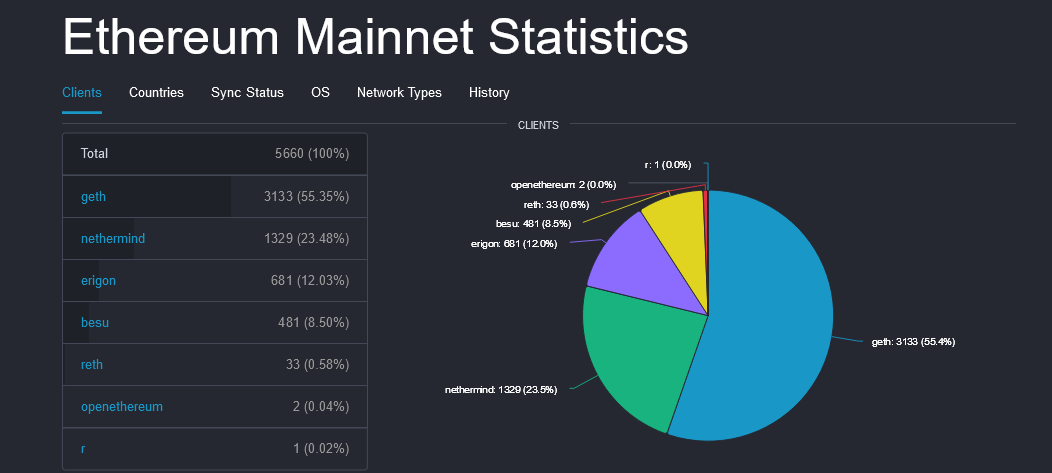

As of September 25, there have been a number of Ethereum purchasers, together with Geth, Besu, Erigon, and Nethermind. However, greater than half of all Ethereum full node operators choose Geth, which has a 55.35% market share. Other common choices are Nethermind and Erigon, with a share of 23.48% and 12.03%, respectively.

Of all of the nodes in operation, over 74% have synced with the Ethereum community, whereas round 26% are nonetheless syncing.

Looking at full node focus, most are operated from the United States, at over 43%, and an even bigger share from Germany, at roughly 13%. A small focus of full Ethereum nodes from the United Kingdom, Singapore, and France exists.

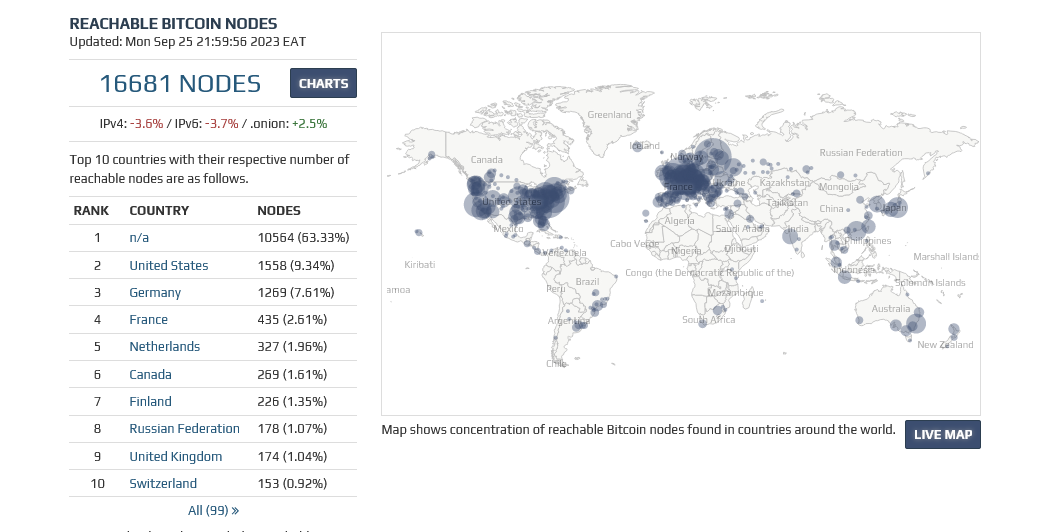

On the opposite hand, Bitcoin full node operators principally completely depend on Bitcoin core. According to statistics, 16,681 nodes are primarily distributed globally. There is not any nation from which over 10% of Bitcoin’s full nodes are operated.

Feature picture from Canva, chart from TradingView