In a swift turnaround from yesterday’s dip, Bitcoin (BTC) surged to just about $26,000 throughout Asian buying and selling hours on Tuesday. This restoration, which noticed the BTC climb from $25,210 to $25,973 in a mere half-hour (from 3:00 am to three:30 am UTC), was not pushed by any particular information occasion. Instead, the dynamics throughout the Bitcoin futures market performed a pivotal function.

Why Has The Bitcoin Price Bounced Upwards?

Renowned analyst Skew provided a technical perspective on the value motion, referring to it as a “textbook short squeeze.” Delving deeper into Skew’s evaluation, he identified a transparent divergence within the Cumulative Volume Delta (CVD) of perpetual contracts (or “perps”) with the precise value. In buying and selling, a divergence between CVD and value can sign a possible reversal. In this context, whereas sellers had been making an attempt to push the value beneath $25,000, the CVD indicated that purchasing strain was mounting.

Furthermore, the futures market had a excessive variety of quick positions relative to the open curiosity (OI), and the funding charge was adverse. A adverse funding charge sometimes implies that shorts are paying longs, indicating a bearish sentiment. Despite makes an attempt to drive the value down, Bitcoin was reclaiming its swing lengthy value stage at $25,300 and failed to keep up the bearish development within the decrease timeframe (LTF).

The spot market, the place belongings are purchased and offered for speedy supply, was displaying indicators of a bullish construction change, with costs step by step transferring greater. Skew recommended that the fruits of those components led to a brief squeeze, the place those that wager in opposition to the market (quick sellers) are pressured to purchase again into the market to cowl their positions, additional driving up the value.

Skew’s evaluation primarily highlights that whereas there was a bearish sentiment with many merchants betting in opposition to Bitcoin, underlying indicators had been hinting at a possible bullish reversal. For merchants, the speedy purpose post-squeeze is to reclaim $26,000.

TheKingfisher supplied a extra succinct take, hinting on the quick squeeze and its influence on those that had been betting in opposition to Bitcoin: “See you around high lev shorters. BTC Cleared them again.”

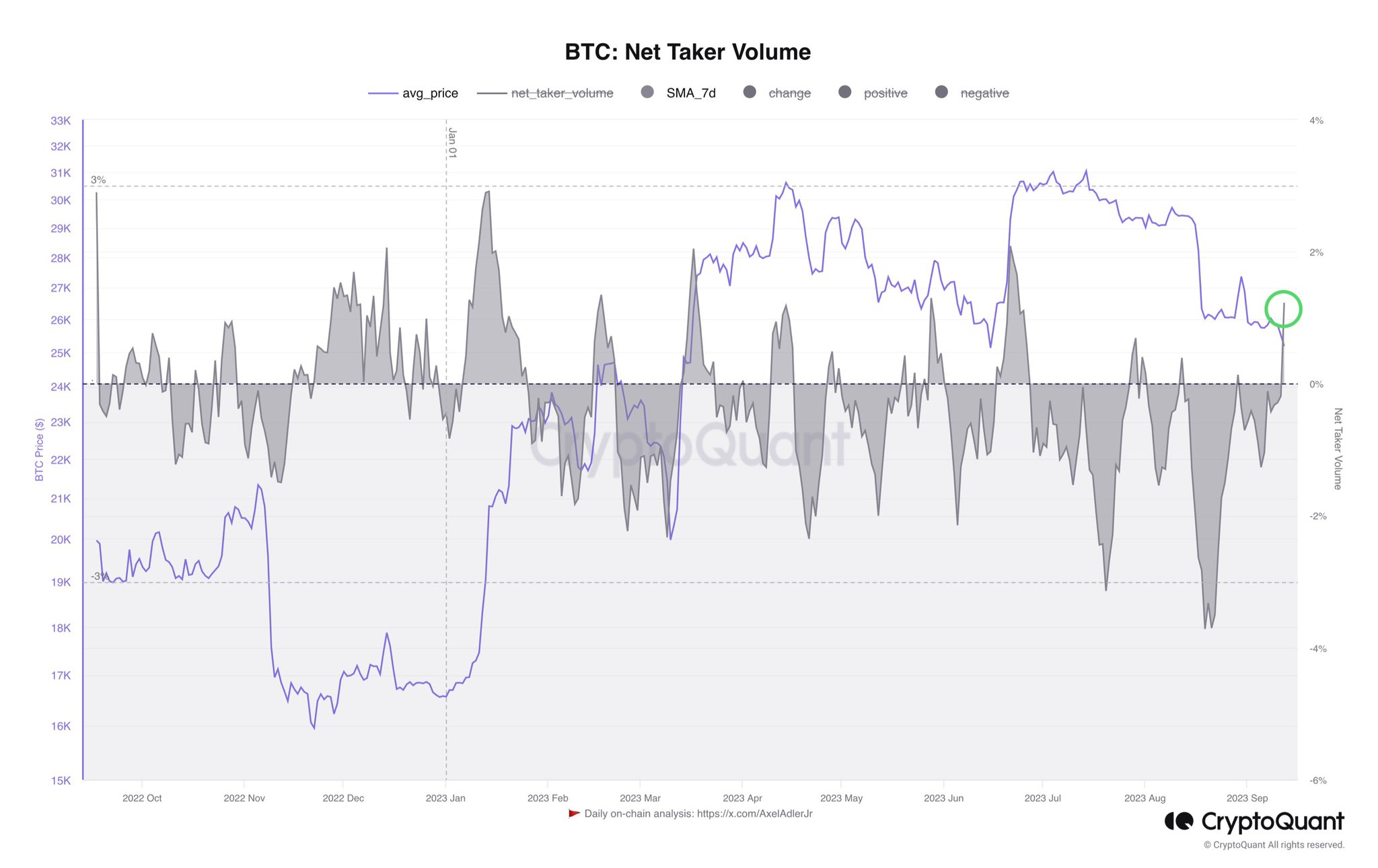

Axel Adler Jr. make clear the broader market sentiment, noting, “Traders do not plan to go any lower. Net Taker Volume has risen by 9.79%. Over the past year, this is a new record for the balance of open Taker orders with long positions.”

Despite the fast value motion, the quick squeeze’s magnitude was comparatively modest. Coinglass information reveals that about $12.32 million in BTC shorts had been liquidated. For context, essentially the most important quick liquidation occasion within the final three months occurred on August 17, amounting to $120 million, when BTC briefly dipped to $24,700 earlier than making a fast restoration above $26,600.

The decline in open curiosity in futures on the main exchanges was additionally reasonably small. According to Coinglass, open curiosity fell from $10.66 billion to $10.65 billion. This slight decline means that few merchants needed to shut their bets, with funding charges turning constructive, signaling a shift from bearish to bullish sentiment.

At press time, BTC stood at $25,768.

Featured picture from Millionero Magazine, chart from TradingView.com