Bitcoin volatility has declined immensely in the previous few years, because the BTC worth motion exhibits. Bloomberg senior macro strategist Mike McGlone says Bitcoin volatility has extra room to say no, making the highest crypto’s relative danger to fall constantly. However, it’s nonetheless greater when in comparison with the volatility of standard retailer of worth — gold.

Bitcoin to Gold Volatility Convergence

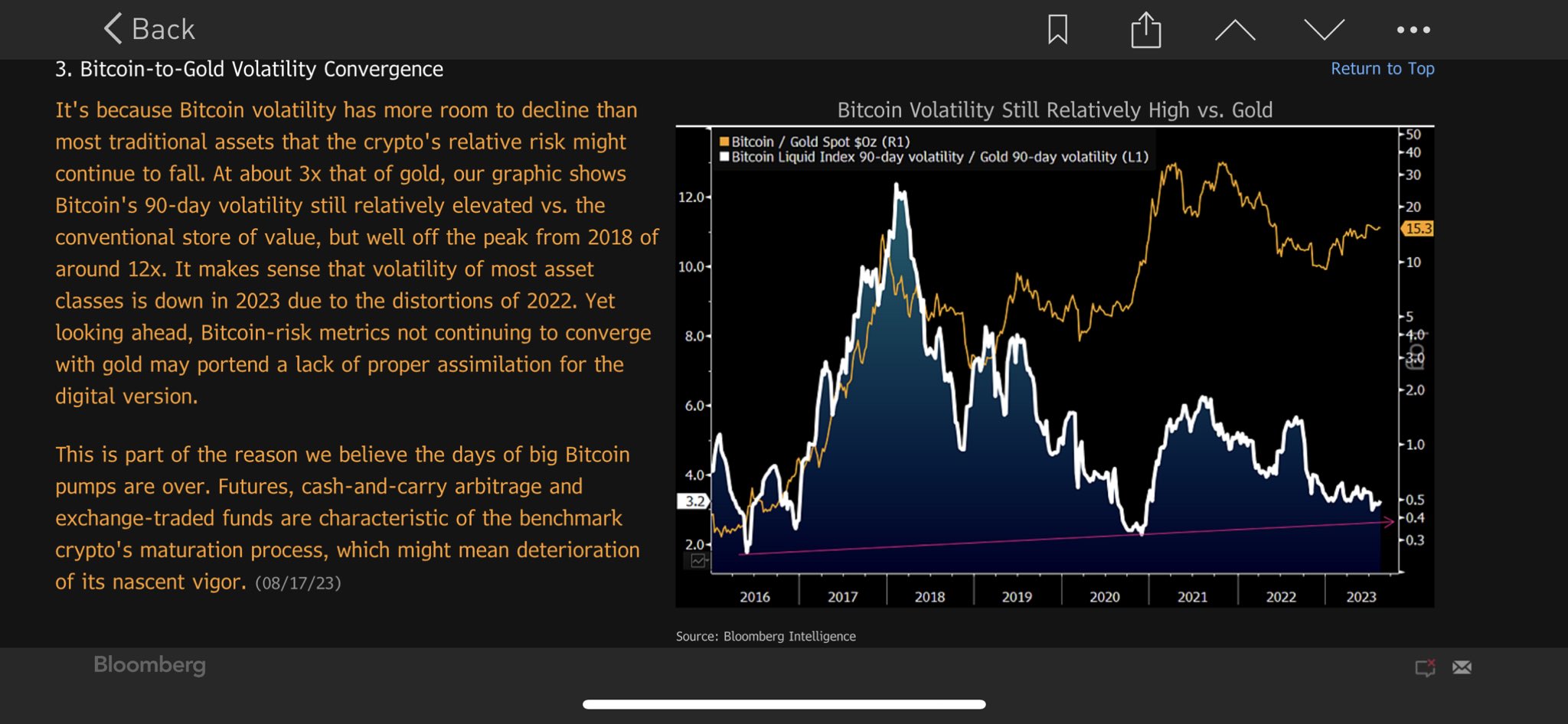

Mike McGlone, senior macro strategist at Bloomberg Intelligence, on August 21 shared information on Bitcoin-to-gold volatility convergence. According to McGlone, Bitcoin’s volatility continues to drop towards that of gold and has extra room to say no than most conventional belongings. Bitcoin’s volatility drop can also be inflicting crypto’s relative danger to say no, making it much less dangerous.

“At about 3x that of gold, my graphic shows Bitcoin’s 90-day volatility still relatively elevated vs. the conventional store of value, but well off the peak from 2018 of around 12x.”

According to the report, the times of huge strikes in BTC worth are over. Bitcoin might not see a sudden worth leap or swift transfer to an all-time excessive as a consequence of a big decline in volatility.

Bitcoin witnessing rising adoption within the conventional finance trade, particularly after BlackRock spot Bitcoin ETF submitting. Futures, cash-and-carry arbitrage, and exchange-traded funds are attribute of the benchmark crypto’s maturation course of.

Also Read: XRP Leads the Pack in Altcoin Space Recovery, Whales Buy the Dips

BTC Price to Witness Rebound?

The macro components together with a weak technical chart construction are placing stress on Bitcoin worth. The Federal Reserve’s plan to proceed fee hikes and the US greenback index (DXY) moved to 103.50 induced BTC worth to tumble just lately.

According to well-liked crypto analyst Ali Martinez, each time BTC had damaged beneath the 200-day SMA during the last 10 years, it touched the Realized Price. Currently, the Realized Price is round $20,350.

BTC price jumped 0.5% prior to now 24 hours, with the value presently buying and selling at $26,090. The 24-hour high and low are $26004 and $26260, respectively. However, buying and selling quantity has decreased by 10% within the final 24 hours.

Also Read: BTC Price Falls Under This Crucial Support, Next Bitcoin Target $20,350

The offered content material might embody the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty on your private monetary loss.