In the wake of the latest crash in Bitcoin’s value, analysts have been rife with hypothesis concerning the market’s subsequent steps. The BTC value briefly dipped to a low of $24,800 final week, and with the Bitcoin concern and greed index plunging from impartial to 38 (indicating concern), market sentiment is palpable. Renowned analyst Rekt Capital weighed in on the state of affairs, providing an intensive technical breakdown.

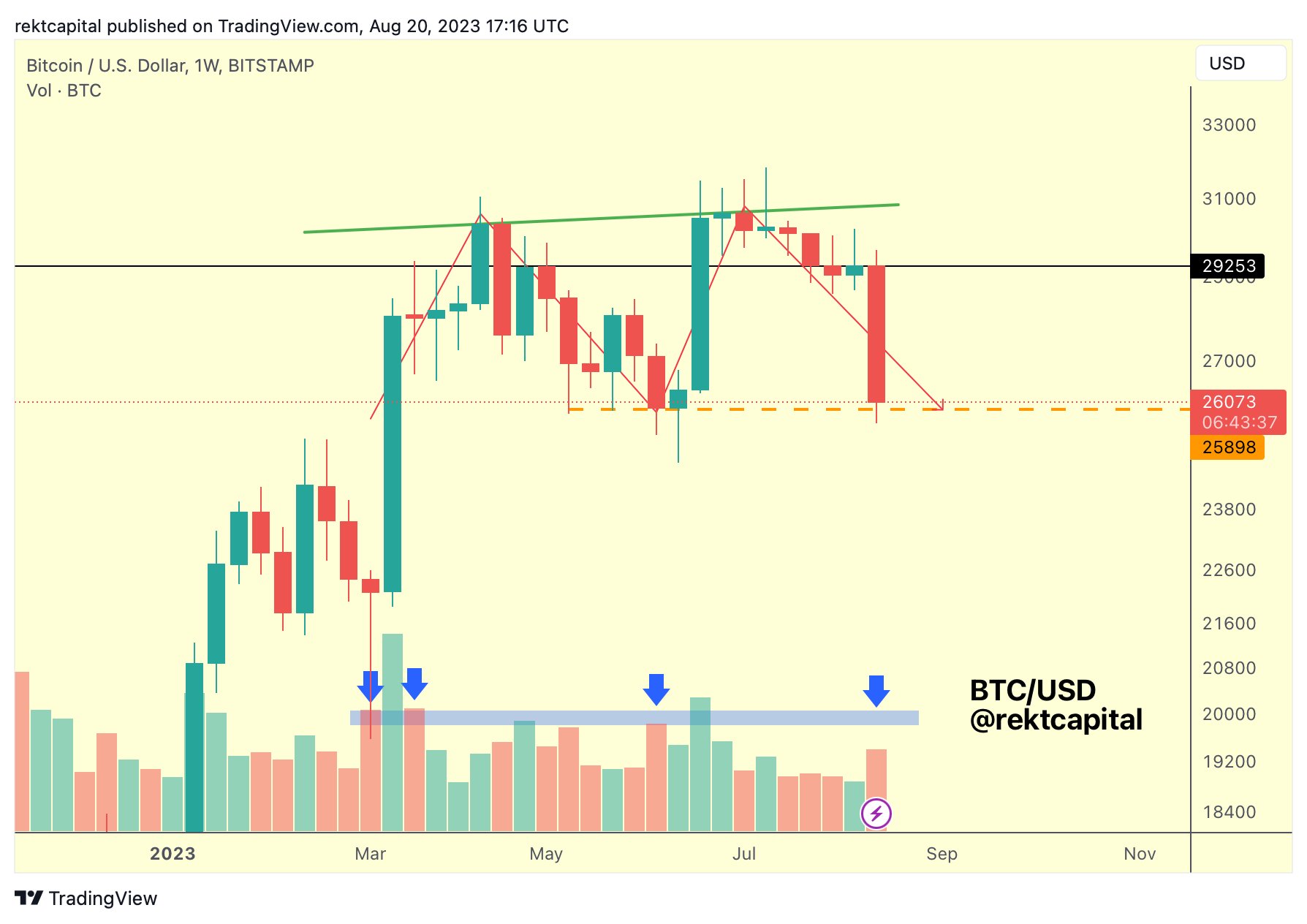

“BTC is officially at the base of the double top. The double top has completed,” states Rekt Capital. Highlighting the market’s present vulnerability, the analyst continues, “Downside wicking below ~$26,000 like in mid-June will occur. But a Weekly Close below ~$260,00 is what would validate the double top and start breakdown continuation.”

Though the double prime’s completion has ratcheted up bearish sentiment, there’s no definitive breakdown but. “BTC has completed the double top but still no breakdown confirmation as BTC holds ~$26k support,” Rekt Capital provides. The state of affairs turns into much more intriguing as “seller volume has increased in recent days.” The evaluation reveals that the “seller volume would need to increase by about +30%” to match the sell-side quantity Bitcoin noticed throughout earlier value reversals.

Drawing consideration to Bitcoin’s quantity dynamics, Rekt Capital elucidates, “BTC formed its higher high at ~$31,000 on inclining volume. But price formed the second half of its double top on declining volume.” Even although there was a spike in promoting quantity through the latest crash, it stays removed from the vendor exhaustion quantity ranges seen throughout earlier BTC reversals. As the analyst starkly places it, the present “seller volume would need to probably double” to reflect the degrees that triggered value turnarounds in March and June.

Remarkably, yesterday’s weekly shut noticed Bitcoin failing to retain assist above key bull market shifting averages, together with the 21-week EMA, 50-week EMA, and 200-week MA. “All of these bullish momentum indicators were confirmed as lost support with the weekly close yesterday,” the evaluation factors out.

How Low Will Bitcoin Price Drop?

In phrases of future projections, Rekt Capital speculates that if the double prime’s base at $26,000 is misplaced, it may propel a transfer in direction of $22,000. The analyst elucidates that “if we see a weekly close below $26,000, followed by a rejection from $26,000, then we probably see a confirmed breakdown from this double top.”

However, each bearish observe comes with a caveat. Rekt Capital provides, “It’s really easy to get caught up in bearish euphoria… So it’s really important not to get caught in these downside wicks (below $26,000).” And for these searching for potential bullish eventualities, the analyst has one in thoughts: “Even if we break down from this double top… one of the main areas is this inverse head and shoulders formation that we saw play out earlier this year.” A retest of this sample’s neckline, roughly round $24,000, may spell bullish prospects for the premier cryptocurrency.

Historical knowledge additionally lends a hand in making sense of Bitcoin’s trajectory. “A drawdown of 18% to $24,000 would be totally normal for an August month,” the analyst shares, reminding traders that Bitcoin has usually underperformed in August. Drawing parallels with 2015, Rekt Capital argues that Bitcoin additionally approached a halving and misplaced 18% in August, suggesting that historical past may repeat, particularly with the subsequent halving anticipated in April of the approaching 12 months.

At press time, the BTC value was at $26,069.

Featured picture from iStock, chart from TradingView.com