The crypto market witnessed over $1 billion in liquidation. Traders and whales cite weak market construction and liquidations as causes for the selloff, not SpaceX’s bitcoin gross sales or China’s actual property big Evergrande’s chapter submitting.

CoinGape Media first reported a chance of an enormous selloff after the FOMC Minutes launch. US inventory market indices continued to fall this week amid banking issues and weakening China’s financial system. US Federal Reserve searching for additional charge hikes and crypto longs liquidations amid weak market construction on Wednesday already triggered a correction.

Traders now await the probably choice within the Grayscale vs SEC lawsuit on Friday, which is able to give a transparent path to the market. Approval of a Bitcoin ETF this 12 months majorly relies upon upon Grayscale’s win towards the SEC. In reality, GBTC is wanting robust regardless of a fall in BTC value, as per information by Coinglass. Grayscale Investments has additionally put out an advert to make use of a Senior ETF Associate because it nears the tail finish of its lawsuit with the SEC.

Also Read: XRP Price Plunges 20% to Pre-Court Ruling Levels, More Correction Likely?

Indicators That Signaled A Crypto Market Selloff

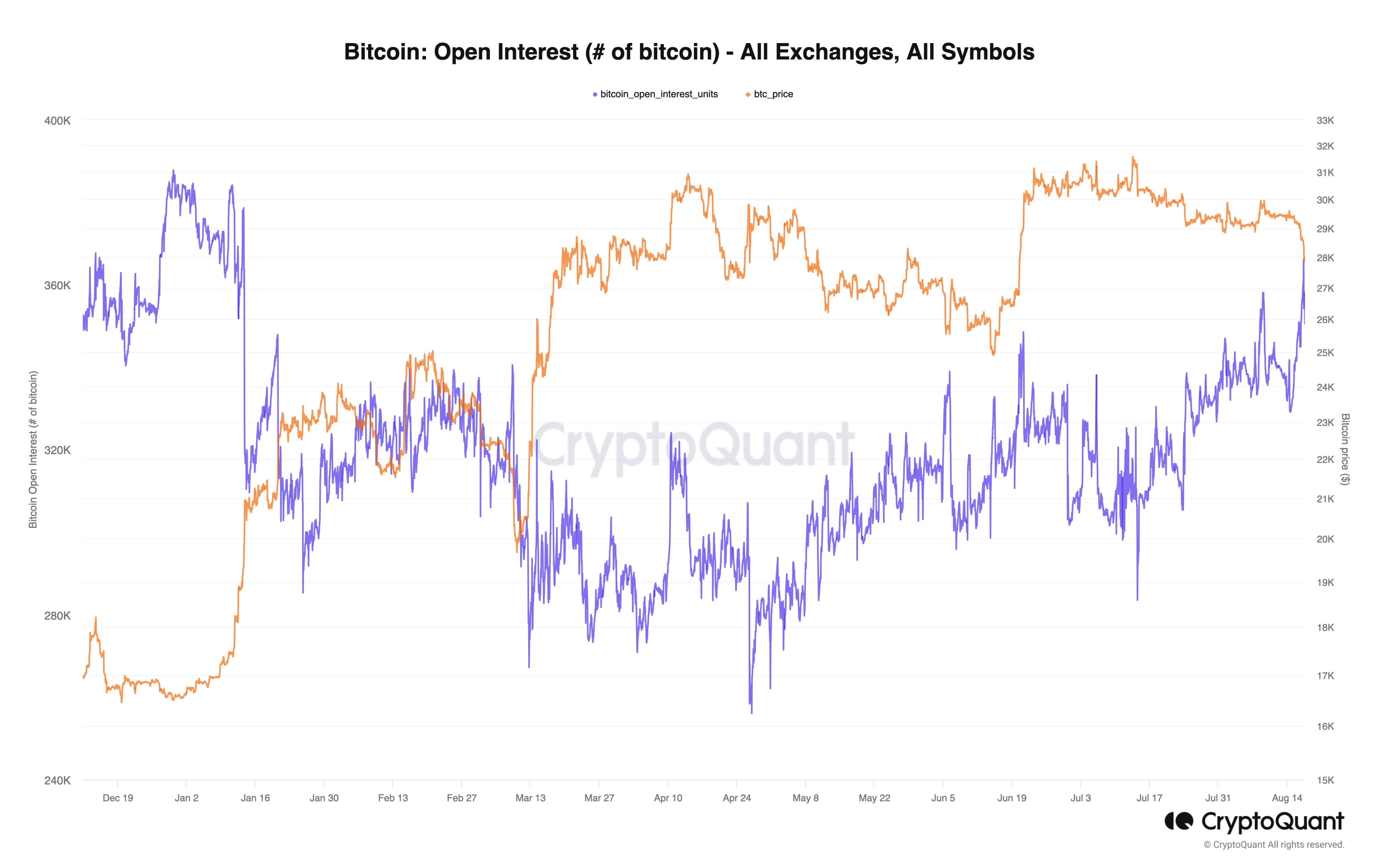

CryptoQuant revealed that the market construction was weakening since mid-July after Bitcoin failed to carry the $30k psychological stage. Bitcoin open curiosity (OI) of quick positions was growing since mid-July amid value declines.

In addition, the selloff was preceded by a interval of low demand for Bitcoin, leading to a adverse Coinbase premium. The BTC value remained caught in a variety close to $29300. Also, a rise in whale spending exercise earlier than and throughout the selloff was recorded.

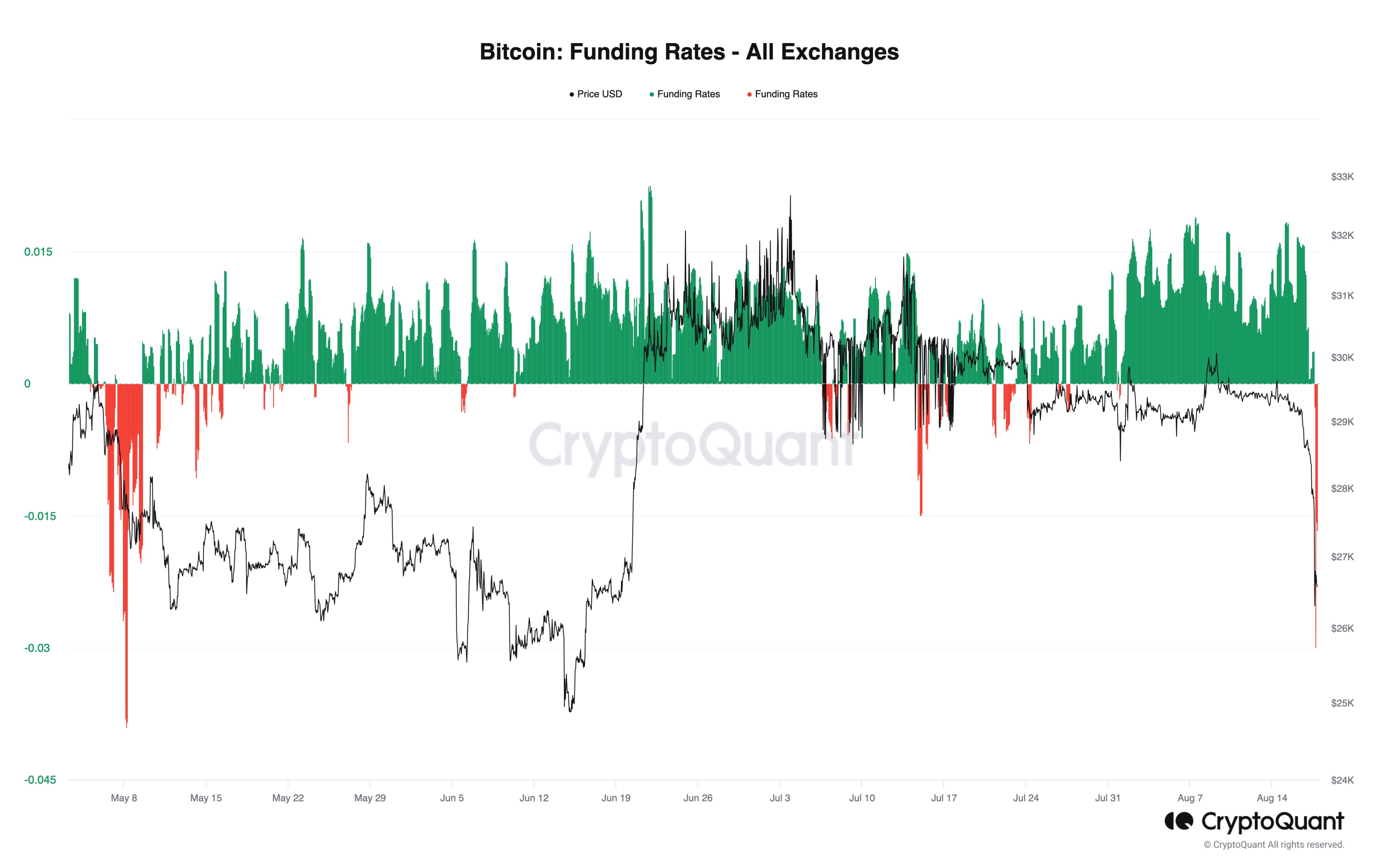

Currently, the sentiment stays adverse, with adverse funding charges indicating that merchants are keen to go quick. Traders are skeptical about restoration after longs liquidation. Thus, the value motion to probably stay weak till the tip of the month.

BTC price trades at $26,577, down 7% prior to now 24 hours. Meanwhile, ETH price is buying and selling at $1694, recovering from a 24-hour low after studies of SEC to approve Ether futures ETF.

Evergrande submitting for chapter?

Space X supposedly promoting its #BTC holdings?

Largest $BTC liquidation occasion since FTX crash in November 2022?

Whatever the narrative

Whatever the catalyst

It doesn’t matter how you can clarify the transfer now that it has occurred

Those who’ve… pic.twitter.com/p3zjqzi38U

— Rekt Capital (@rektcapital) August 18, 2023

Also Read: Shibarium Restarts Block Production, SHIB And BONE Rebounds

The introduced content material might embody the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty on your private monetary loss.