Here’s how a lot share of the entire circulating provide the 10 largest Ethereum whales maintain, in line with on-chain information.

Ethereum’s Top 10 Addresses Have Only Continued To Grow Their Holdings Recently

In a brand new put up on X, the on-chain analytics agency Santiment has revealed how a lot share of the entire provide is held by the ten largest Ethereum wallets proper now.

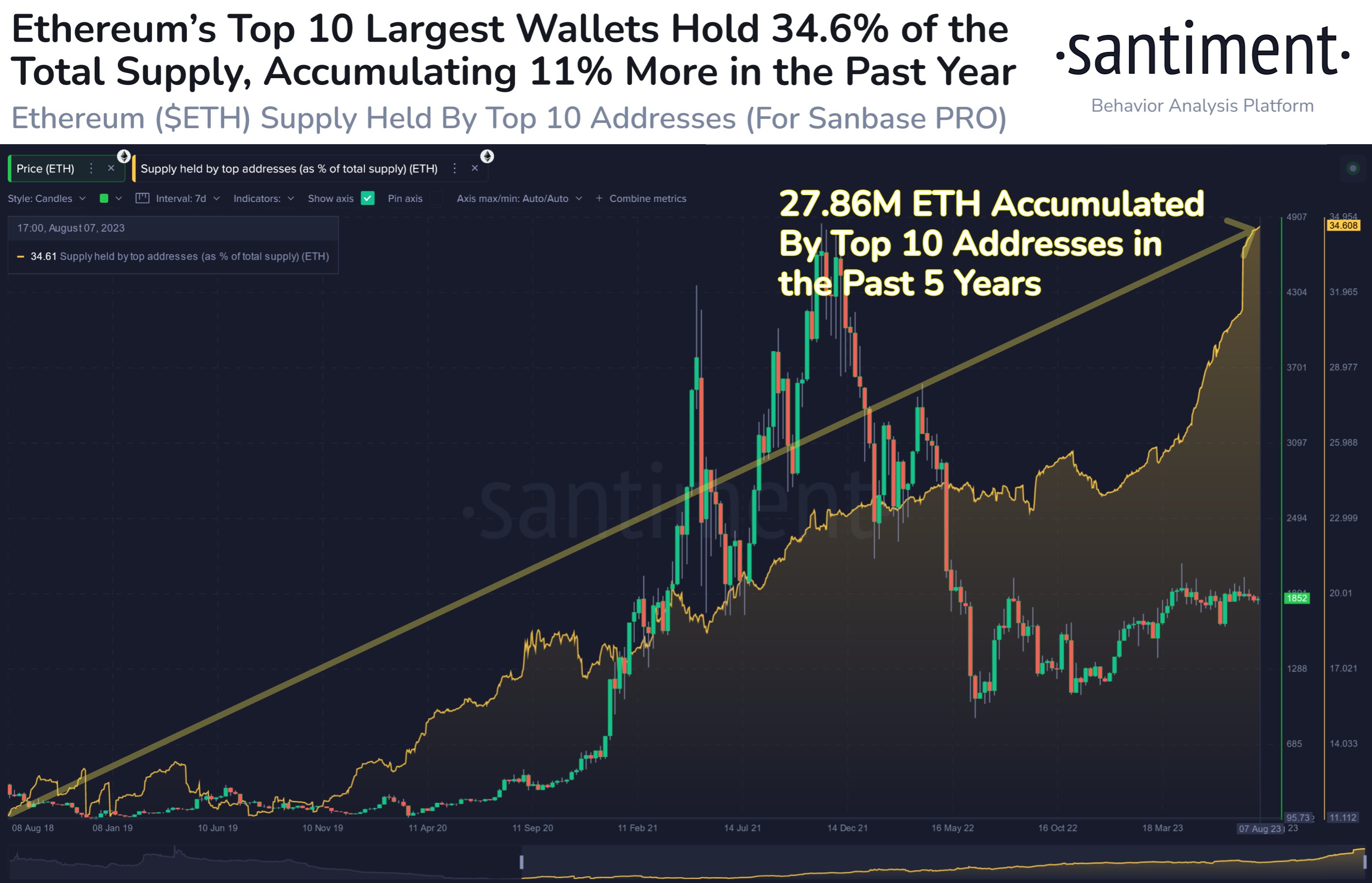

Here is the chart that shows this metric, in addition to the way it has modified in the course of the previous few years:

Looks like the worth of the metric has been going up in latest months | Source: Santiment on X

As displayed within the above graph, the proportion of the entire circulating provide held by these whales was solely 11.2% round 5 years in the past. Since then, nonetheless, they’ve always expanded their holdings and now maintain 34.6% of the provision.

Currently, 34.6% of the provision implies that they maintain 27.86 million ETH, which is equal to about $51.6 billion. Five years in the past, the ETH provide seems to have been extra unfold out among the many buyers, however now it seems to be to be frequently getting extra focused on these ten greatest gamers within the sector.

From the chart, it’s seen that a big chunk of this accumulation has come this yr alone, as these holders have ramped up their shopping for. In phrases of the numbers, they’ve bought 11% of the provision throughout the previous yr.

Just a few days again, the market intelligence platform IntoTheBlock revealed how wealth distribution differs between Bitcoin, Dogecoin, and Ethereum. For BTC, about 80% of the provision is held by 0.32% of the addresses (which embrace Satoshi’s dormant wallets).

For ETH and DOGE, alternatively, an identical share of the provision is managed by simply 0.01% and 0.014% of the addresses, respectively. All three of the cryptocurrencies seem imbalanced in how their wealth is distributed, however BTC continues to be higher off than these two.

IntoTheBlock additionally broke down the Bitcoin provide information for the completely different pockets ranges in one other latest put up on X:

The quantity of BTC that every cohort holds within the sector | Source: IntoTheBlock on X

From the desk, it’s seen that the most important cohort with buyers proudly owning upwards of 100,000 BTC has 4 wallets and these addresses management 3.39% of the provision. The subsequent largest group, the 10,000-100,000 BTC vary, has 103 buyers who maintain 11.66% of the provision.

The high 10 addresses for BTC would come with the 4 largest wallets, plus the highest six from the following group. But even when all 103 addresses of the following group are included with the highest 4, the entire provide held by these buyers would nonetheless simply be 15.05%, as soon as once more showcasing how the Bitcoin provide is extra decentralized than Ethereum.

Generally, the provision being focused on just a few holders isn’t perfect for the market’s stability, because it implies that only some fingers can transfer their cash round to induce volatility within the value.

ETH Price

At the time of writing, Ethereum is buying and selling round $1,800, up 1% within the final week.

ETH has been shifting sideways within the final couple of days | Source: (*10*)

Featured picture from Jievani Weerasinghe on Unsplash.com, charts from TradingView.com, Santiment.internet