- Cryptocurrencies keep growing in recognition

- Bitcoin’s price dynamics changed with institutional buyers’ adoption

- Bitcoin is now correlated with belongings in the normal monetary market

Since digital currencies exist, the business developed exponentially in a bit of greater than a decade. Currently, greater than 22,000 cryptocurrencies are a part of one of the crucial dynamic markets in the world.

The big variety of currencies brings just a few challenges to merchants and buyers. First, crypto exchanges discover it tough to record all cryptocurrencies; thus, buyers could miss some alternatives.

Second, many initiatives in the crypto area failed. Statistics say that 9 in ten blockchain initiatives will fail.

For instance, in 2023 alone, 83 cash disappeared for varied causes, comparable to failing ICO, no goal, scams, or that they had no quantity.

Therefore, to keep away from being caught in initiatives doomed to fail or to be scammed, many buyers favor cryptocurrencies with a big market capitalization and well-established in the investing neighborhood. In different phrases, if a cryptocurrency turns into a part of institutional buyers’ portfolios, the probabilities are that it’s going to nonetheless exist in the medium and long run.

Bitcoin is such a digital forex.

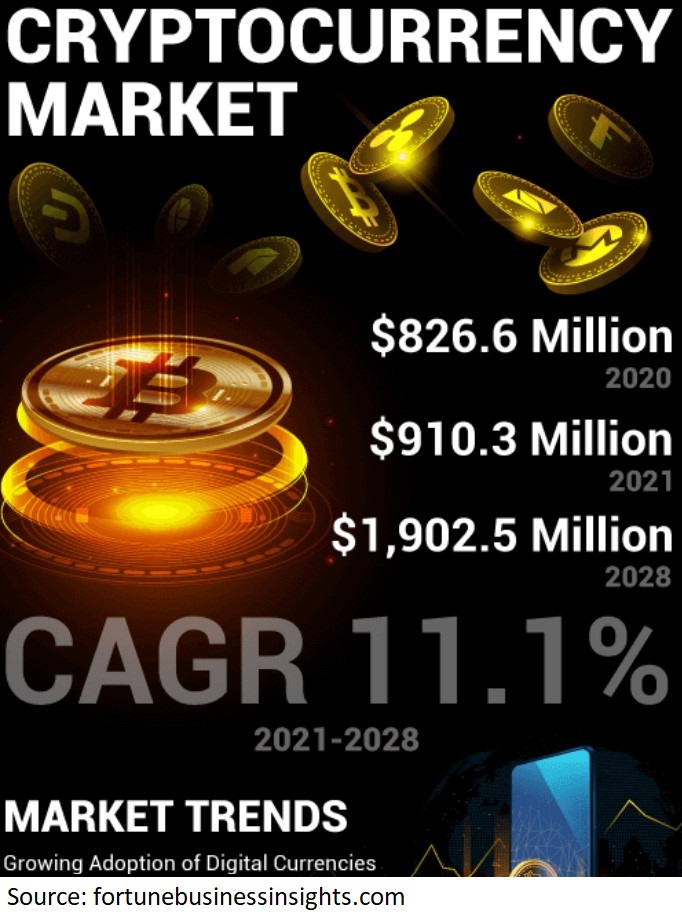

Bitcoin’s dynamics changed with the growing adoption of digital currencies

As the investing neighborhood embraced digital currencies, Bitcoin grew to become a part of increasingly more institutional buyers’ portfolios.

But the adoption got here with some prices.

Take the chart above. It exhibits Bitcoin’s price evolution since its inception.

When it first traded above $1,000, Bitcoin caught everybody’s consideration. Then, when it reached $20,000 for the primary time, everybody talked a couple of bubble.

So robust was the resistance stage that it took Bitcoin just a few years to beat it. Respecting the interchangeability precept, resistance has grow to be assist just lately.

But such ample strikes are unlikely to be seen in the longer term. Because Bitcoin’s correlation to conventional monetary markets elevated, it’s unlikely for the price to triple or double with out related strikes elsewhere.

Summing up, Bitcoin could also be a superb funding for the long run, however the rising adoption of cryptocurrencies will make it increasingly more tough for the price to maneuver the way in which it did earlier than.