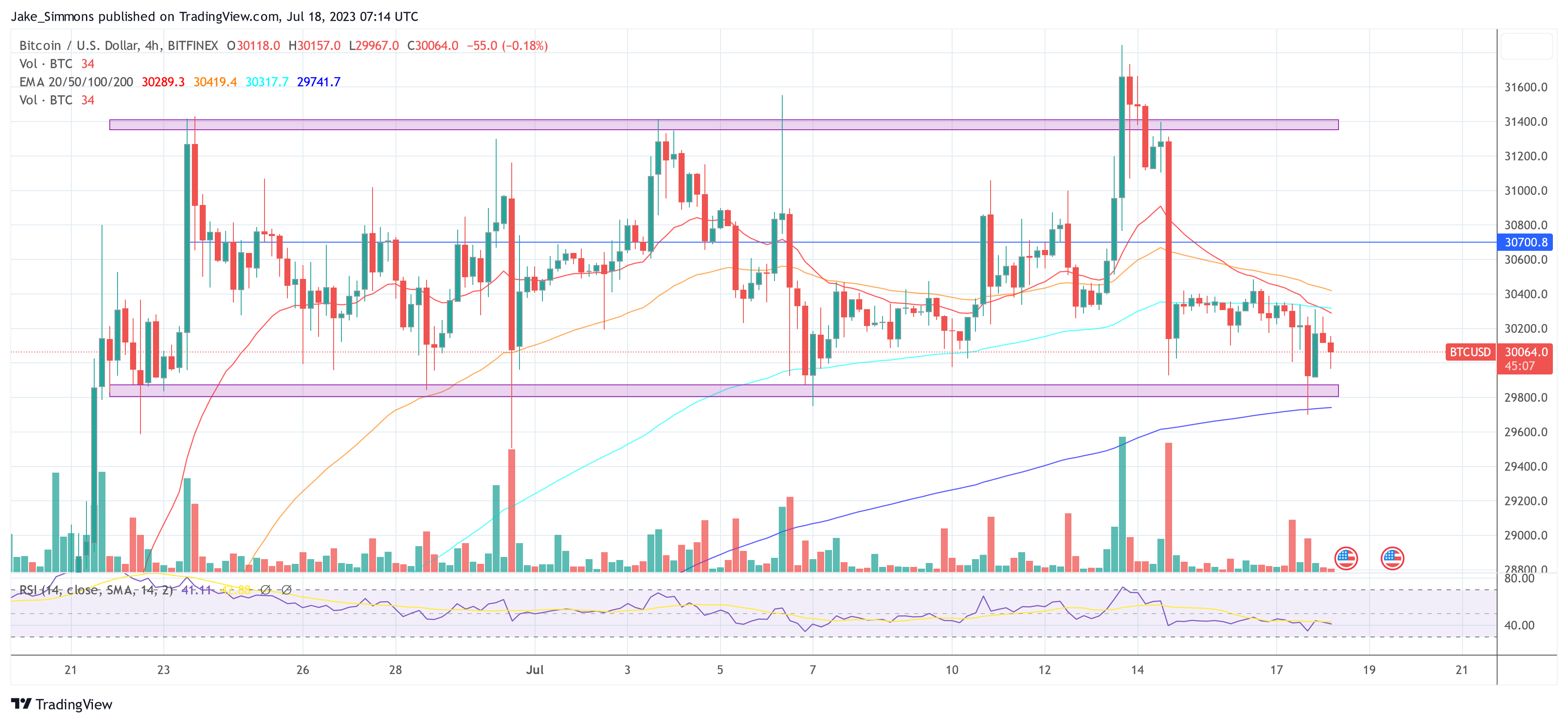

The Bitcoin value has fallen to the decrease finish of its nearly one-month buying and selling vary between $29,800 and $31,300. Already yesterday, BTC briefly fell to as little as $29,704, solely to recuperate to $30,306 inside a couple of hours. At press time, BTC was once more transferring in the direction of the $30,000 mark, and one other fall and liquidity seize appears doubtless.

While this week the macro information releases are fairly quiet, it’s value having a look at what’s occurring within the Bitcoin market itself.

Why Is Bitcoin Down Today?

Swissblock Insights observed a peculiar calm out there when Bitcoin reached a brand new yearly excessive of $31.840 final week. However, the momentum shortly light, and promoting strain elevated, inflicting BTC to drop to the low $30ks. They spotlight the slender Bollinger Bands, stating, “The Bollinger Bands are very narrow, with only a 4.2% value difference separating the upper and lower bands. A move is brewing.”

Moreover, the analysts emphasize the necessity for a major catalyst to inject life into the present lackluster state of affairs:

Volatility is predicted to look on the scene, though, within the brief time period, we’re in no man’s land; liquidity stays low, open curiosity continues to be flat and shorts are nowhere to be seen. There’s no command within the route we’re going, and solely a major catalyst can spice issues up on this uninteresting state of affairs we’re in.

According to the analysts, a breakdown of the $29.650 help degree would invalidate an extended setup. On the opposite hand, a bullish leg up $31.500 may reignite momentum and surge the worth to $33,000. But for this to occur, spot demand must reignite strongly and longs must enter the market, “otherwise momentum will continue to fading.”

Glassnode, an on-chain information supplier, additional illuminates the present state of the Bitcoin market. Despite the non permanent yearly excessive, they describe the market as “extremely quiet”, additionally pointing to the Bollinger Bands. This compression in volatility alerts a market paying homage to the calm noticed in early January, as NewsBTC reported yesterday.

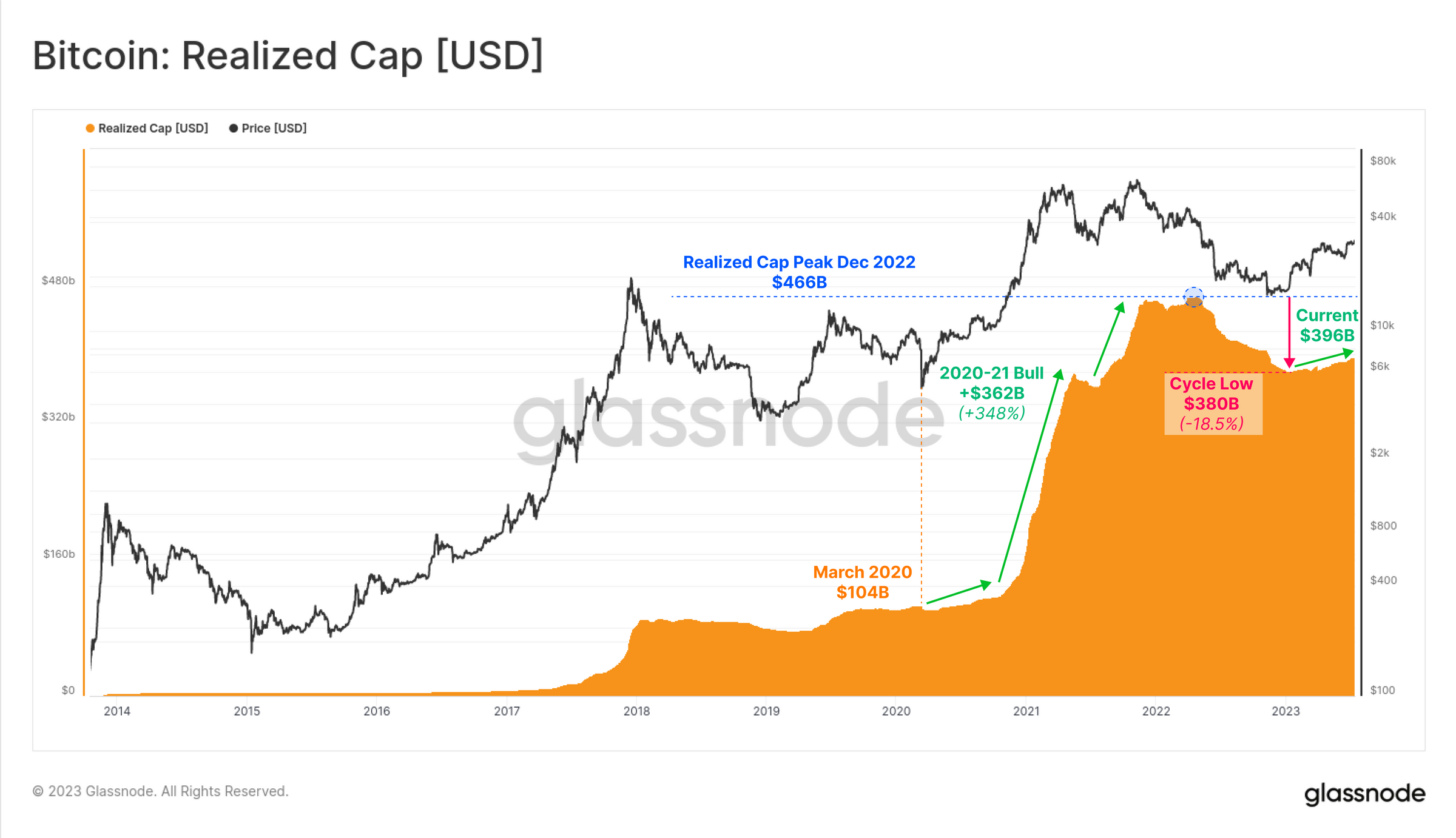

Furthermore, Glassnode’s evaluation reveals a sluggish however regular influx of capital into Bitcoin. The Realized Cap presently sits simply shy at $396 billion. After hitting a cycle low at $380 billion, the metric signifies {that a} sluggish however regular stream of capital is getting into the market all through 2023.

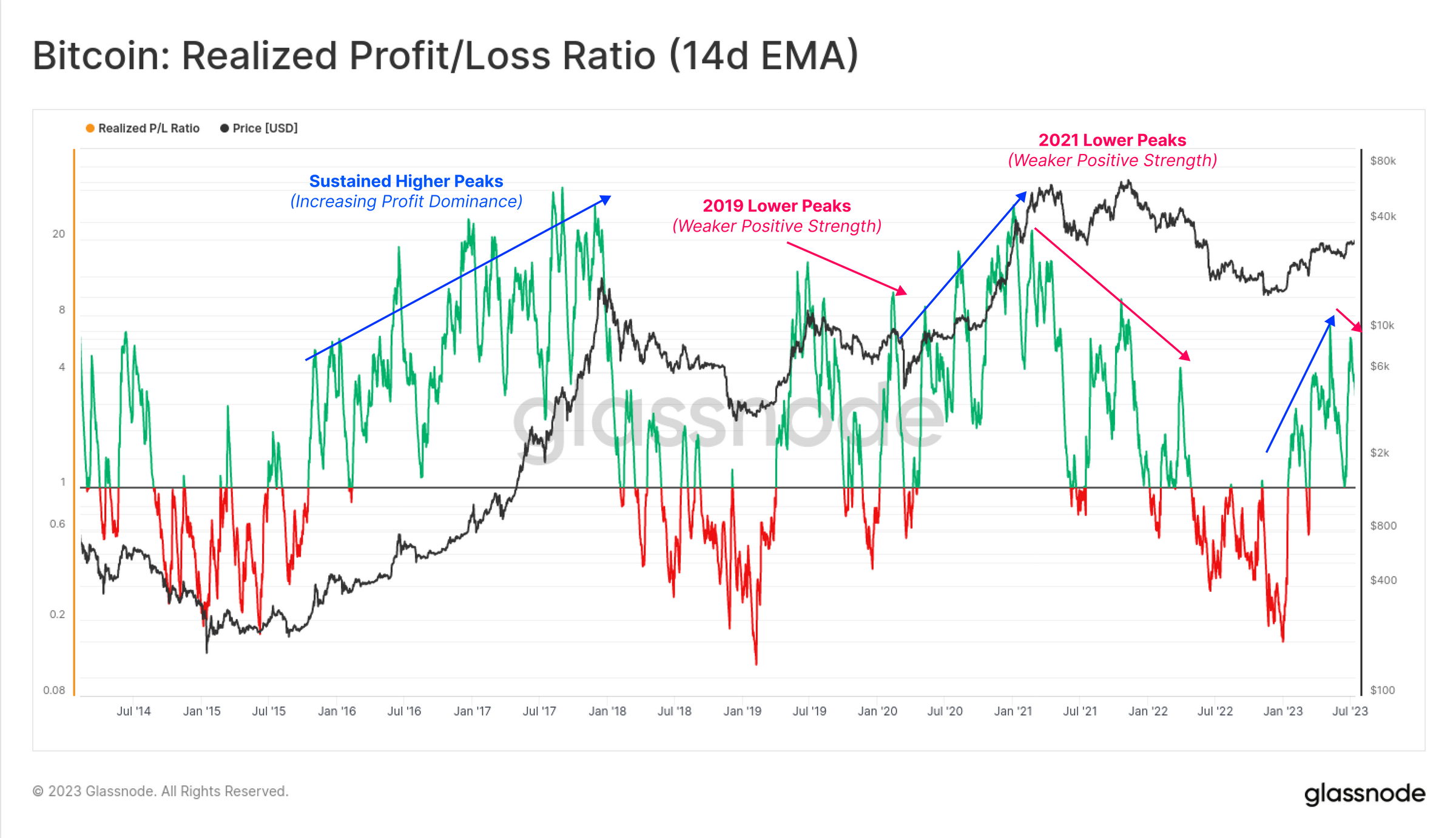

Glasnode additionally emphasizes that traders stay unwilling to half with their held provide, leading to uneven market circumstances just like these seen in 2016 and 2019-20 intervals. Total realized revenue and loss resembles the historic development:

If we take a ratio between whole realized revenue and loss, […] we are able to additionally notice {that a} decrease excessive on this ratio was set this week. If sustained, it could allude to related uneven market circumstances seen in each 2019-20, and once more within the second half of 2021.

The evaluation additionally highlights the profit-locking habits amongst Bitcoin holders, with the vast majority of each short-term (88%) and long-term holders’ balances (73%) held in revenue. However, short-term holders are the first entities which might be energetic out there.

Out of the whole 39.600 BTC in every day change inflows, 78% of that is related to the STH cohort. This signifies that brief time period holders could should trim their earnings in the meanwhile earlier than promoting strain eases and the bulls can take the higher hand once more.

GreekLive, an choices professional, explains that the Bitcoin market continues to be dropping liquidity, which makes it extremely vulnerable to spikes and V-shaped recoveries:

Cryptocurrencies encountered a V-shaped market at the moment, with BTC falling under $29,700 and ETH under $1,875, earlier than rebounding in a V-shaped throughout Asian buying and selling hours to regain the spherical variety of factors, however the choices market barely reacted to this.

The evaluation advises sellers to deal with static safety and have threat management plans for holding choices till expiration. For consumers, well timed profit-taking and utilizing futures to hedge choices are advisable threat administration methods.

At press time, BTC traded at $30,064.

Featured picture from iStock, chart from TradingView.com