- Crypto volumes are sagging amid summer lull

- In greenback phrases, the quantity of Bitcoin transferring on-chain is at three-year lows

- Trading activity generally dies down in trad-fi markets presently of 12 months

- However, falling crypto volumes have been realised constantly over the past 12 months, whereas the dropoff has been starker than different asset courses

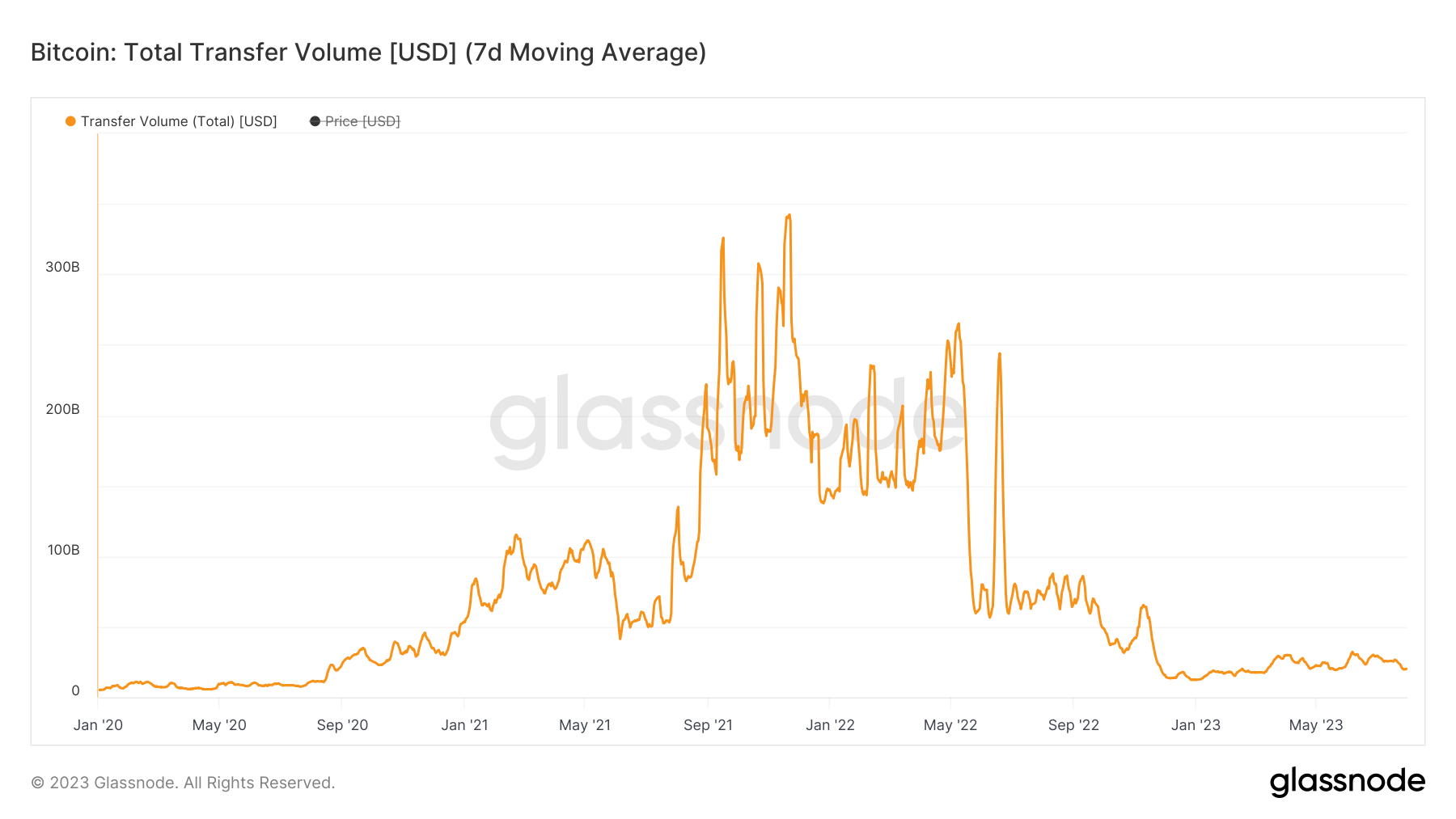

On-chain activity is moderately muted proper now. The seven-day transferring common of switch volume on the Bitcoin community is at present at its lowest degree since August 2020.

On the one hand, the falling volume represents a conventional summer lag in buying and selling activity. However, the lowly activity just isn’t far misplaced with what now we have seen to date this 12 months, with liquidity and volume markedly decrease for the reason that FTX collapse in November.

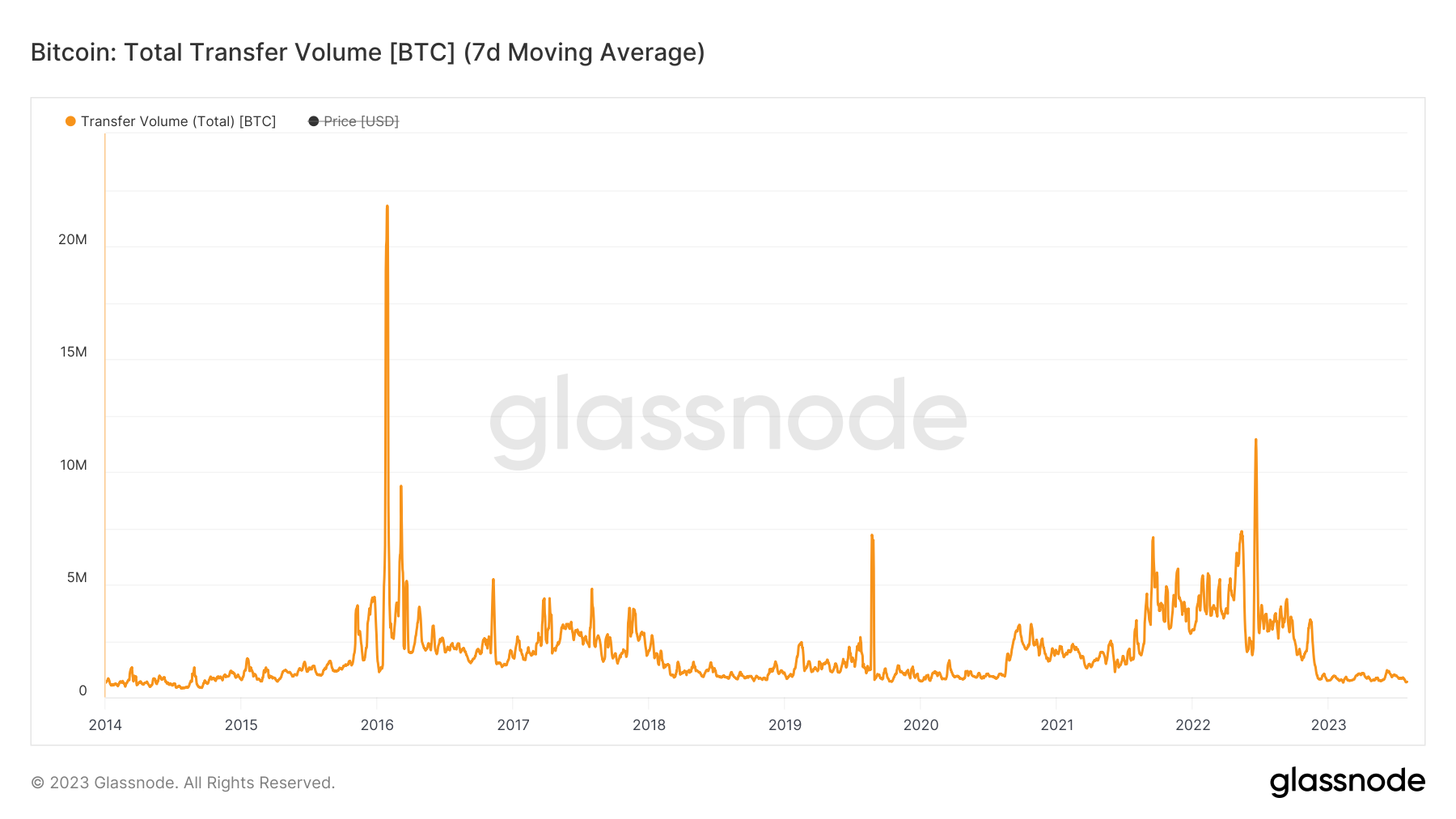

Looking at greenback volume, as per the above chart, additionally takes under consideration the rampant volatility within the BTC/USD worth through the years. If we assess activity in BTC phrases, the dropoff is much more stark. Measuring in Bitcoin, the seven-day transferring common is it at its lowest level since 2014, when Bitcoin was a distinct segment Internet asset buying and selling for a couple of hundred {dollars}.

Looking at greenback volume, as per the above chart, additionally takes under consideration the rampant volatility within the BTC/USD worth through the years. If we assess activity in BTC phrases, the dropoff is much more stark. Measuring in Bitcoin, the seven-day transferring common is it at its lowest level since 2014, when Bitcoin was a distinct segment Internet asset buying and selling for a couple of hundred {dollars}.

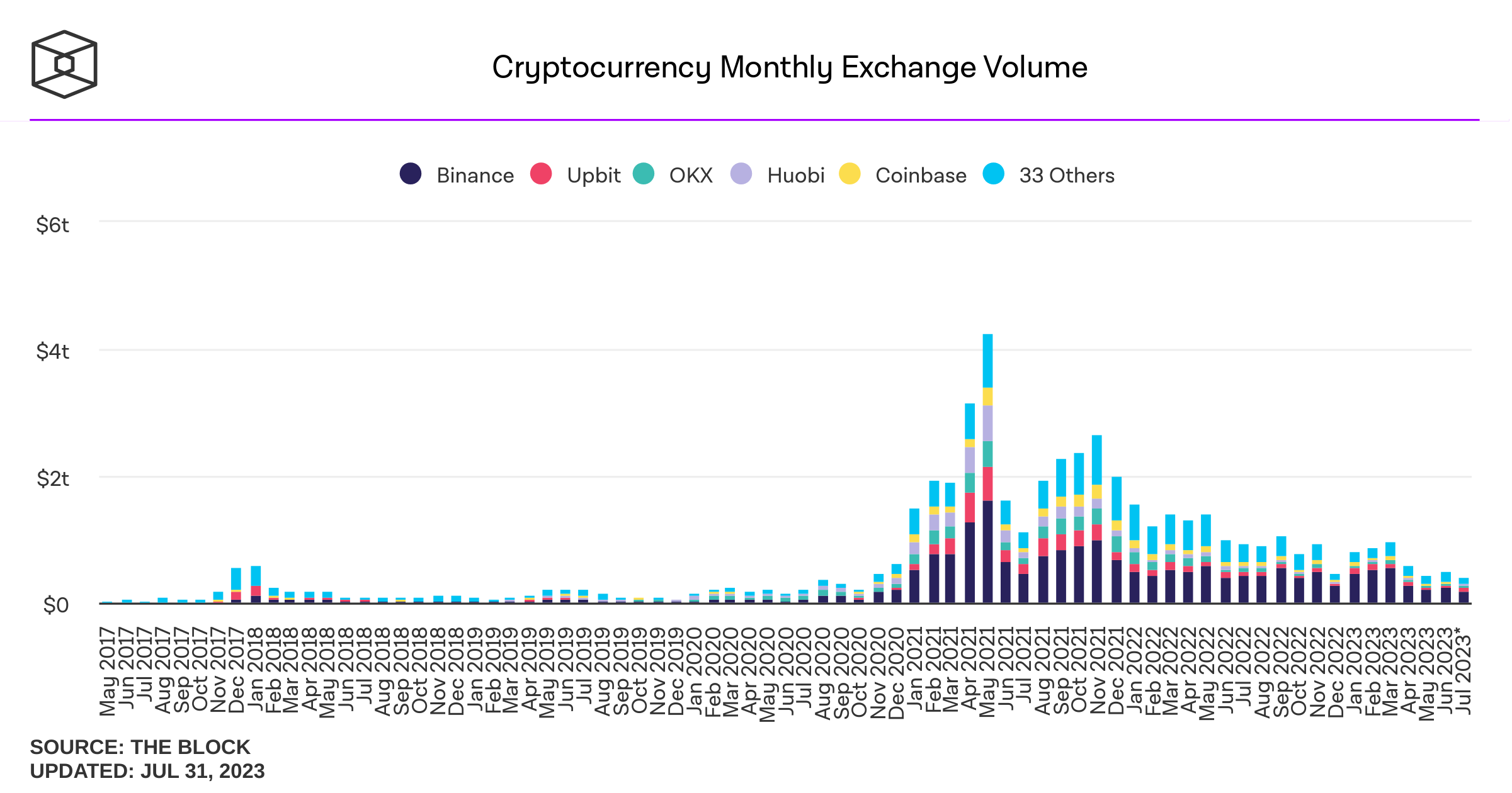

The dropoff just isn’t restricted to Bitcoin. Crypto exchanges have seen volume decimated within the final couple of years. According to information from the Block, there was $984 billion of buying and selling volume in March 2022. Last month, that determine learn $413 billion, a fall of 58%. The chart reveals the aggressive spike up in 2021, adopted by a protracted and regular downtrend to immediately.

The dropoff just isn’t restricted to Bitcoin. Crypto exchanges have seen volume decimated within the final couple of years. According to information from the Block, there was $984 billion of buying and selling volume in March 2022. Last month, that determine learn $413 billion, a fall of 58%. The chart reveals the aggressive spike up in 2021, adopted by a protracted and regular downtrend to immediately.

This follows according to the shift in financial coverage. The $984 billion of buying and selling volume in March 2022 got here in the identical month that the Federal Reserve first hiked charges. Since then, the will increase have come thick and quick, with buyers dumping danger property relentlessly.

This follows according to the shift in financial coverage. The $984 billion of buying and selling volume in March 2022 got here in the identical month that the Federal Reserve first hiked charges. Since then, the will increase have come thick and quick, with buyers dumping danger property relentlessly.

While there was a bounceback this 12 months as inflation has cooled and optimism over the top of the tightening cycle approaching picks up, costs stay far under the peaks of 2021. So too do volumes, liquidity and total activity within the house.

“The pace of interest rate rises from the Federal Reserve has been relentless”, says Max Coupland, director of CoinJournal. “This impacted risk assets across the financial landscape last year, and of course crypto prices are an obvious reminder of this. But while prices have begun to bounce back in 2023, volumes and liquidity in the industry are still trending down, to the point we are now at levels last seen in 2020”.

It’s arduous to understate how a lot of an impression the collapse of FTX in November had on this space. Sister agency of the fallen change, Alameda Research, was one of many largest market makers within the house; with its demise, there’s a large gap so as books that has not but been stuffed.

The different massive push issue for a lot of has been regulation. We noticed distinguished market makers Jump Crypto and Jane Street announce a scaling back of their operations earlier this 12 months as US lawmakers put the squeeze on the business, whereas final month each Binance and Coinbase had been sued by the SEC.

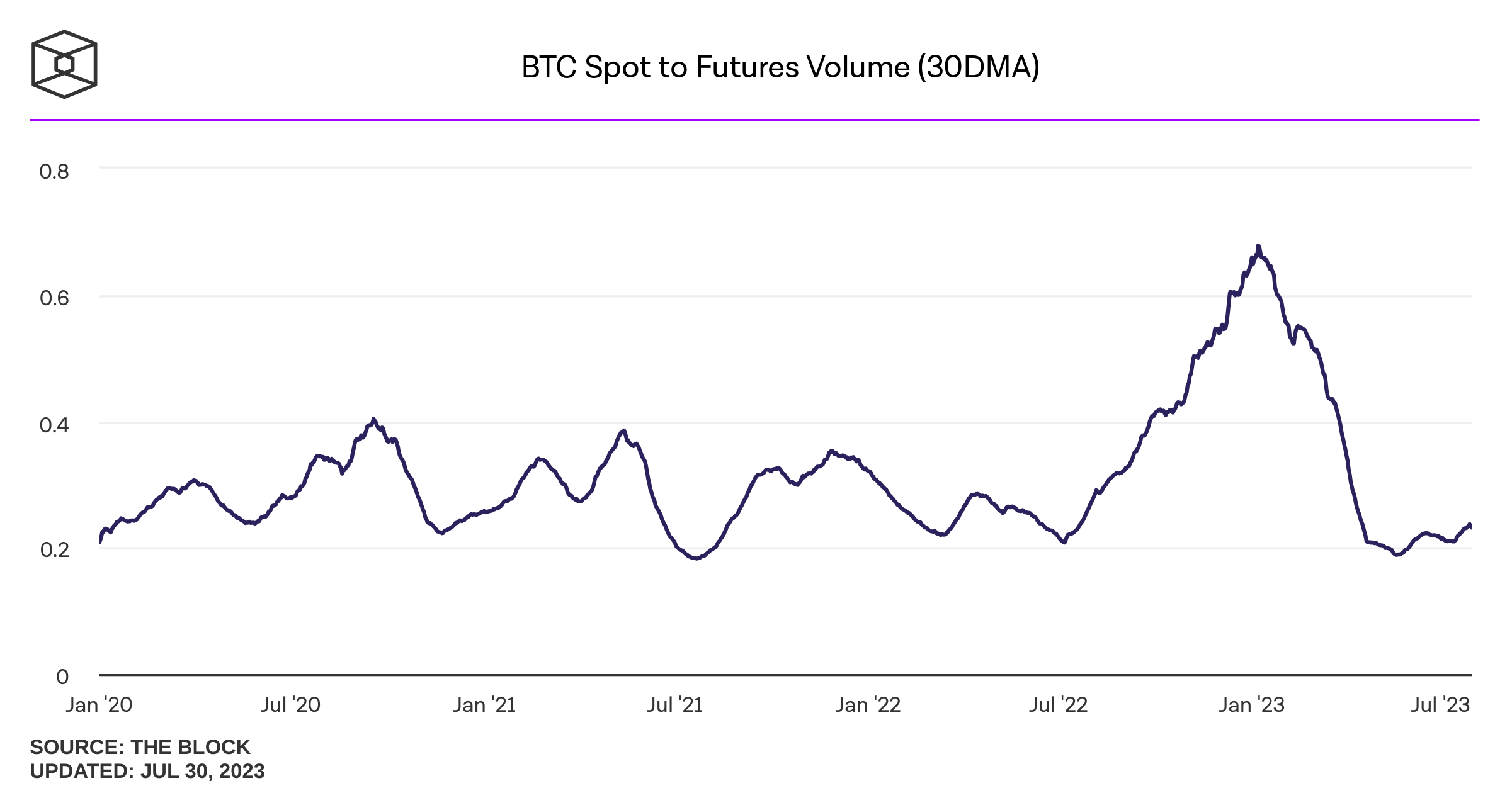

On a optimistic be aware, derivatives haven’t seen fairly as stark a dropoff in liquidity. Looking at information from The Block, we see the spot-to-futures volume ratio has fallen sharply in 2023, having risen within the second half of 2022.

However, there is no such thing as a denying that on an total foundation, liquidity and volume within the house are declining. Prices stay far under the mania of the bull market, regulators are squeezing arduous, and folks at the moment are going outdoors to contact grass, in distinction to a giant portion of the bull market when the COVID pandemic locked everyone in with out a lot to do past commerce a few of these humorous issues known as caryptocurrencies.

However, there is no such thing as a denying that on an total foundation, liquidity and volume within the house are declining. Prices stay far under the mania of the bull market, regulators are squeezing arduous, and folks at the moment are going outdoors to contact grass, in distinction to a giant portion of the bull market when the COVID pandemic locked everyone in with out a lot to do past commerce a few of these humorous issues known as caryptocurrencies.

There can also be the reputational harm suffered by the house, and it doesn’t really feel too outlandish to speculate that some customers merely grew uninterested in all of the shenanigans. But whereas Bitcoin switch volume falling to three-year lows is ominous, that is the center of summer and therefore a lag in activity is to be anticipated. As a outcome, we might even see volumes decide up a tad after summer. Even if so, the dimensions of the capital outflow has been exceptional, and crypto has a good distance to go but earlier than getting again to the great outdated days, a.okay.a. 2021 – not less than as far as liquidity and on-chain volume goes.

If you employ our information, then we’d admire a hyperlink again to https://coinjournal.net. Crediting our work with a hyperlink helps us to hold offering you with information evaluation analysis.