Stablecoins have grow to be an more and more ubiquitous a part of the crypto ecosystem in recent times. But with their rise comes unprecedented scrutiny. In an unique BeInCrypto interview, Wade Guenther, a accomplice at asset supervisor Wilshire Phoenix, shared his ideas on their long-term prospects.

Stablecoins lately are as helpful as they’re controversial. They supply a medium of trade and a retailer of worth for merchants who don’t need to off-ramp from the crypto ecosystem. Unlike nearly each different crypto token, they provide stability, no less than in concept. In crypto, a value fluctuation of 10% is frequent. Whereas, on foreign exchange markets, a 2% change in a fiat forex’s value over 24 hours is taken into account important.

How Much Can You Trust Stablecoins?

Earlier this month, nevertheless, TrueUSD depegged—the phrase denotes an uncoupling from the asset it’s pegged to. In this case, the US greenback. As with all extensively used stablecoins, the depeg stoked panic throughout the market as contributors apprehensive about its knock-on results.

The identical occurred throughout the spring banking disaster within the United States. In March, as regional banks started to fail, Circle, the issuer of the USDC, revealed a $3.3 billion exposure to Silicon Valley Bank. On June 15, the largest stablecoin by market capitalization, Tether’s USDT, depegged after dropping the boldness of buyers. Markets panicked because the USDT steadiness on Curve’s 3pool rose to 72%.

Given the latest crises, can buyers safely “park their cash” in stablecoins?

“Conceptually, it could make sense for investors to park their cash in asset-backed stablecoins if the stablecoin company follows the mandate,” mentioned Guenther.

“However, asset-backed stablecoins have a major drawback when compared to other US-issued cash or cash equivalents. Namely, they’re not directly backed by the full faith and credit of the US Federal Reserve.”

So the query turns into: whom do you belief extra? The Fed or the stablecoin issuer?

“Asset-backed stablecoins are not decentralized and are run by companies and corporations,” continued Guenther. “This is especially true for fiat currency-backed stablecoins. The issuer company manages the fiat currency reserves, and there can often be a lack of transparency on actual reserves.”

Concerns About Transparency

The lack of transparency with regard to stablecoin reserves has been a working sore for the business. Tether as soon as held important short-term debt issued by corporations. But the corporate didn’t disclose particulars concerning the corporations whose debt it owned. Later, Tether switched to US Treasurys, that are seen as a extra steady asset for its reserves.

In response to widespread business concern about its openness and accountability, Tether employed the accounting agency BDO Italia to publish attestations and assurance reports and reassure the market about its property. However, these experiences are usually not as sturdy or intensive as a full audit.

“The trust is placed in the stablecoin company’s internal management,” mentioned Guenther. “Tether has experienced multiple investigations into its stated reserves. So far, USDT has survived these investigations, but the risks due to its centralized control will always remain.”

Even so, regardless of widespread concern concerning the stability of stablecoins, together with a report out this week from the Bank of Italy saying they “have not proved stable at all,” Guenther sees causes to be optimistic.

“Stablecoins play an important role within crypto as the oil that greases the market and also serves as major collateral,” he defined.

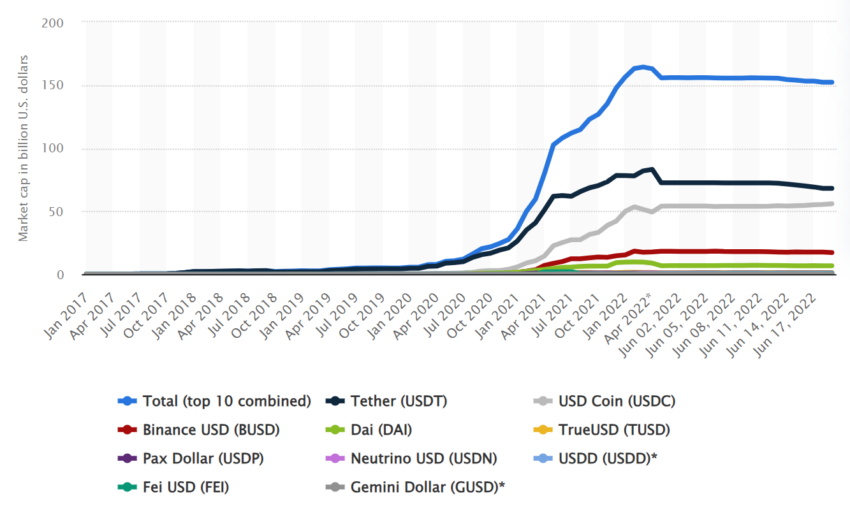

“[They] both strengthen and propel the financial crypto system. With the recovery and growth of crypto going forward, we expect the stablecoin market to expand both within the crypto space and within traditional finance.”

An Inflation Hedge?

Guenther mentioned he and his colleagues at Wilshire Phoenix see fiat-backed stablecoin adoption as an rising long-term development. There are many advantages right here, he argued. Namely that regulators can implement transparency. Plus central banks could choose to problem their very own fiat-backed stablecoins. This will initiative a flight to high quality, Guenter believes.

“Central bank backing of stablecoin reserves could help reduce the runs on stablecoins that sometimes occur,” Guenther added.

This shouldn’t be a shock. The use of stablecoins may help sustain buying energy. Not to point out counter the results of hyper-inflation, given USDT’s peg to the US greenback, he acknowledged.

“We believe the largest growth potential is in regions with high levels of inflation. The public has relatively easy access to USDT, whereas this type of hedging instrument would have been more of an institutional solution ten years ago,” mentioned Guenther.

Guenther pointed to quite a few issues to watch within the stablecoin house. Namely, modifications round know-your-customer (KYC) and anti-money laundering (AML) rules. And broader shifts in banking tradition.

“The traditional banking system will likely evolve as broad adoption of stablecoins continues,” he added. “Observing the banking system’s evolution as potential stablecoin credit intermediaries will be an interesting development.”

Disclaimer

In adherence to the Trust Project pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to present correct, well timed info. However, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any choices primarily based on this content material.