Renowned Bitcoin hater Peter Schiff has as soon as once more solid doubt on the cryptocurrency’s long-term sustainability. Schiff not too long ago expressed skepticism concerning the current Bitcoin rally that noticed its market capitalization earlier attain a powerful $31,000.

According to Schiff, the present surge in BTC value is merely a short lived factor, and he believes that “the party” will quickly come to an finish.

Schiff’s skepticism stems from his perception that cryptocurrency lacks intrinsic worth and is merely a speculative asset. As a gold bug, he advocates for investing in valuable metals like gold, which he considers to be a extra steady and dependable retailer of worth.

He typically factors out the historic significance and enduring worth of gold, contrasting it with what he perceives because the volatility and unpredictability of Bitcoin.

Bitcoin’s Advance And Peter Schiff’s Doubts

Schiff not too long ago took to Twitter to specific his doubts in regards to the sustainability of the current BTC rally. In his tweet, Schiff acknowledged, “rallies end when the lowest quality stuff finally participates,” referring to cryptocurrencies because the “lowest quality” property. His remark displays his long-standing skepticism towards Bitcoin and different digital currencies.

Until not too long ago the rally in extremely speculative property excluded #Bitcoin. Now that Bitcoin has lastly joined the occasion, maybe it’s an indication that the occasion will quickly finish. Usually rallies finish when the bottom high quality stuff lastly participates. There’s no decrease high quality than #crypto.

— Peter Schiff (@PeterSchiff) June 23, 2023

The surge in Bitcoin’s worth occurred shortly after US Federal Reserve Chair Jerome Powell testified before Congress in regards to the state of financial coverage.

During his testimony, Powell talked about that the battle towards inflation “has a long way to go” and hinted that charge hikes should be on the horizon, regardless of a beforehand agreed-upon pause earlier within the month.

Powell’s remarks created a way of uncertainty available in the market, prompting buyers to hunt different funding alternatives, together with BTC.

Betting On Institutional Adoption And ETF Approval

Investors have been more and more optimistic in regards to the prospects of elevated institutional adoption and the potential approval of a Bitcoin spot ETF (exchange-traded fund) within the close to future.

Several main gamers within the monetary trade, reminiscent of BlackRock, Bitwise, and WisdomTree, have not too long ago submitted functions for Bitcoin ETFs. The anticipation of such developments has contributed to the constructive sentiment and upward momentum within the Bitcoin market.

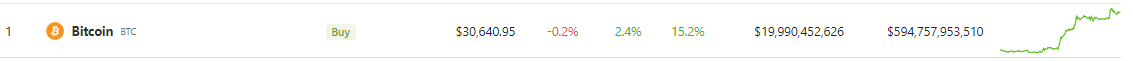

Source: Coingecko

Following its current surge, Bitcoin has skilled a slight adjustment, presently standing at $30,745.57 on CoinGecko. However, regardless of the correction, it nonetheless maintains a exceptional 17% enhance over the previous seven days.

BTC advancing to the $31K territory. Chart: TradingView.com

In an analogous vein, Ether (ETH), the second-largest cryptocurrency by market capitalization, has additionally seen features, rising by 3% and approaching the $2,000 mark.

While cryptocurrencies proceed their risky journey, conventional equities confronted a unique destiny. At the time of publication, the S&P 500 and Nasdaq Composite indexes had been each within the purple, experiencing losses of 0.5% and 0.7% respectively.

This distinction additional highlights the divergence between the cryptocurrency market and conventional monetary markets, with buyers in search of totally different alternatives and reacting to varied elements.

Featured picture from Reuters/Rick Wilking