The Bitcoin market is as soon as once more in turmoil, and the reason being an outdated acquaintance: no, not the US Federal Reserve, however the worries and rumors about Tether’s stablecoin, USDT. Anyone who has been lively within the Bitcoin and crypto marketplace for some time is aware of that rumors about USDT’s lack of backing are a part of each bear market. And this bear market appears to imply it significantly “well” because the Tether FUD is now making a reappearance on this cycle.

As NewsBTC reported earlier in the present day, USDT has barely misplaced its peg to the US greenback because the Curve 3Pool has misplaced its steadiness. The cause for that is that whales are promoting USDT and buying and selling it for USDC in addition to DAI. However, in accordance with Tether CTO Paolo Arduino, the corporate is “ready to redeem any amount 1:1 against US dollars”.

Historically, the de-pegging of USDT isn’t an unusual prevalence. Samson Mow, CEO of Bitcoin centered firm JAN3, writes:

Tether FUD is at all times the FUD backside. It’s what they pull out when there’s nothing left. Up quickly.

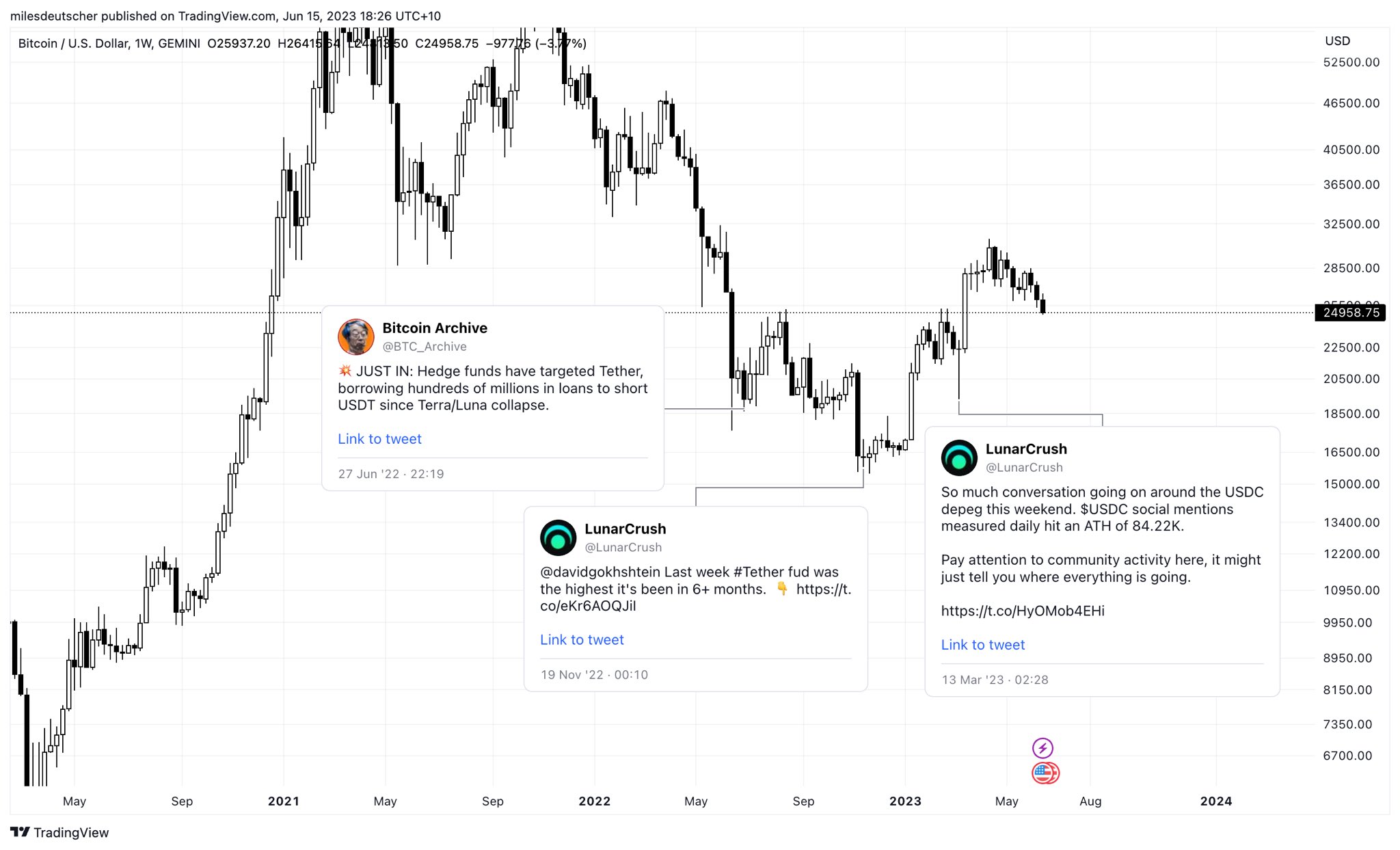

Analyst Miles Deutscher has an analogous view. He defined: “Fun Fact: Stablecoin FUD often marks local bottoms,” and shared the next chart.

Bottom Signal For The Bitcoin Price?

As might be seen within the chart, the Tether FUD first surfaced on the finish of June 2022. At the time, information emerged that hedge fund Fir Tree Capital Management was shorting Tether after the Terra ecosystem stablecoin Terra USD collapsed. Contrary to hypothesis, nevertheless, Tether was capable of course of all USDT redemptions, despite the fact that the worth of USDT had fallen to $0.9520 briefly.

In mid-November 2022, the cryptocurrency trade FTX went bankrupt after its competitor Binance backed out of a purchase order settlement. The Tether FUD hit a 6-month excessive and the value of USDT fell to $0.9970. Again, Tether was capable of deal with all redemptions, whereas the market discovered a neighborhood backside.

Most not too long ago, USDC depegging supplied the native backside sign in March this 12 months. The occasion was attributable to the collapse of the counterparty from stablecoin issuer Circle, Silicon Valley Bank (SVB). Crypto whales had additionally tried to take earnings from the scenario on the time, whereas different USDC holders offered out of panic.

Tether emerged because the clear winner from the latter scenario and was capable of seize massive market shares from USDC since then. Most not too long ago, Tether reported big earnings, a few of which they’re investing in Bitcoin, as NewsBTC reported.

This is one more reason why crypto skilled Thor Hartvigsen believes that the chance of Tether not having sufficient funds to settle all USDT redemptions is “pretty low”, adding: “According to Tether, the company made $1.48b in profits in Q1 alone which brought the reserve surplus to $2.44b. They’ve further been winding down bank deposits (hold less than $0.5b here) and acquired over $53b in US treasuries throughout 2022.”

Remarkably, the value of USDT has already returned to its default stage at press time. After the USDC/ USDT worth on Binance climbed briefly to $1.0042, it was now already again at $1.0019.

As of press time, the Bitcoin worth was bucking the Tether FUD and holding barely above $25,000. However, the drop beneath the 200-day EMA (blue line) is considerably important. Most not too long ago, BTC fell beneath this indicator which is named the “bull line” through the USDC de-pegging. Therefore, Bitcoin bulls are suggested to stage an analogous response as in March to stop an additional plunge.

Featured picture from iStock, chart from TradingView.com