On-chain knowledge exhibits the Bitcoin shrimp provide has hit all-time excessive values as these small buyers have continued to aggressively accumulate.

Bitcoin Shrimp Supply Has Hit A New All-Time High Value

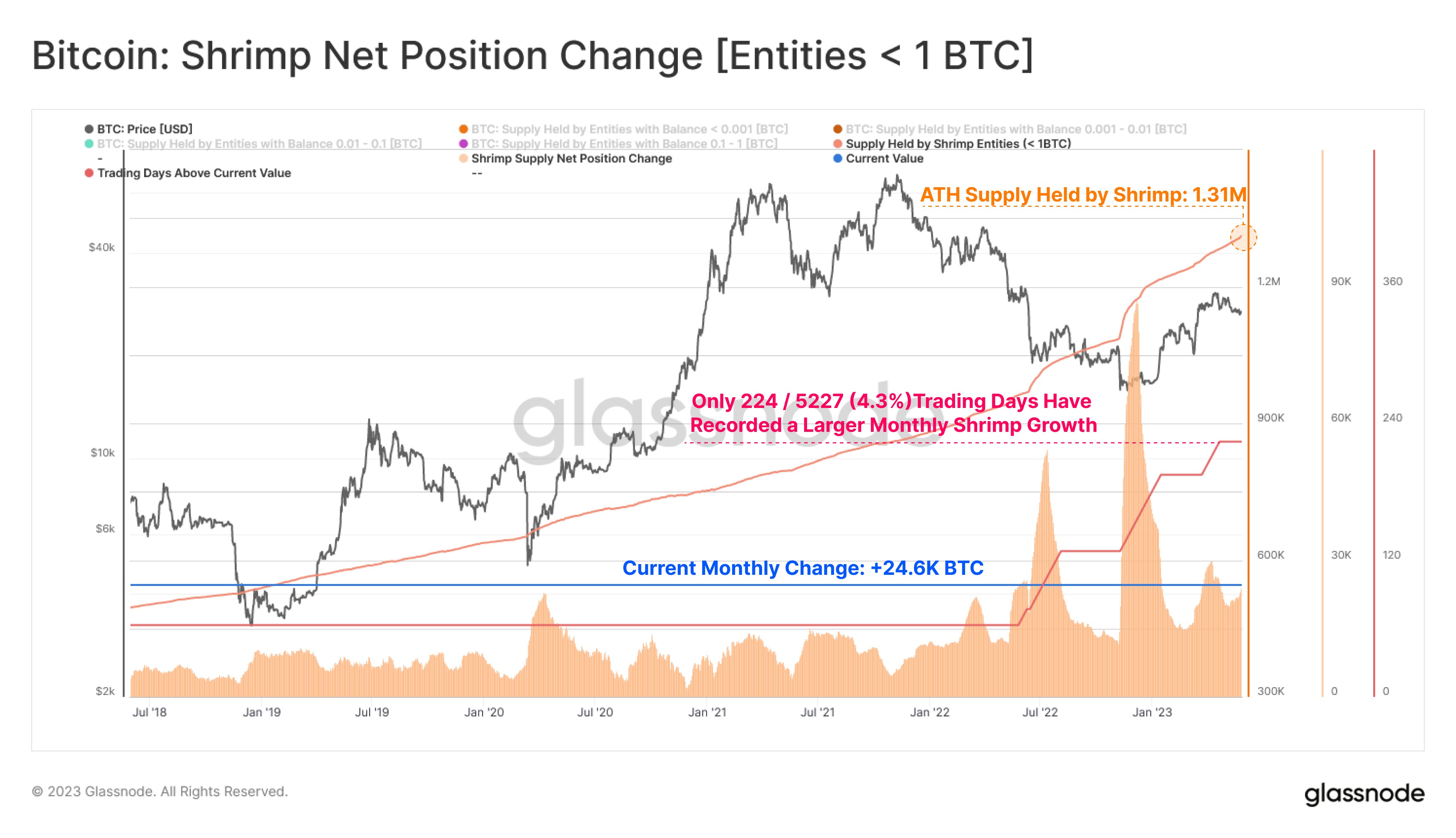

According to knowledge from the on-chain analytics agency Glassnode, the availability held by shrimps has gone up by 24,600 BTC prior to now month alone. The “shrimps” right here seek advice from Bitcoin holders which might be presently carrying a pockets stability of lower than 1 BTC.

As these buyers are holding such low quantities, they’re prone to be retail buyers. This implies that the “shrimp supply” (which is of course the whole quantity of Bitcoin that the mixed addresses of such holders are holding in the intervening time) can present perception into the habits of the retail buyers.

When the shrimp provide traits are up, it implies that the shrimps are accumulating proper now, whereas a downtrend of the indicator means that these holders could also be distributing their holdings presently.

Now, here’s a chart that exhibits the pattern within the Bitcoins shrimp provide over the previous couple of years:

The worth of the metric has continued to go up in latest weeks | Source: Glassnode on Twitter

As displayed within the above graph, the Bitcoin shrimp provide had been observing a gradual improve till across the center of the 12 months 2022, however since then, the rise appears to have accelerated.

This means that whereas retail buyers have at all times been rising their provide with out stopping, the buildup has change into particularly aggressive prior to now 12 months or so.

The chart additionally incorporates the info for one more on-chain indicator, known as the “shrimp supply net position change.” As the metric’s title would already counsel, it tracks the web change within the provide of those small buyers. More particularly, the change prior to now 30 days (that’s, the month-to-month change) is being measured by the indicator right here.

When this indicator has a worth lower than zero, it implies that the shrimps have been promoting a internet quantity of their cash throughout the previous month. On the opposite hand, constructive values suggest a internet progress of their provide.

From the graph, it’s seen that this indicator hasn’t actually gone into unfavorable territory in the previous couple of years in any respect, suggesting that this cohort has solely seen constructive progress on this interval.

There are two occasions specifically the place the Bitcoin shrimp internet provide change appears to have seen particularly giant spikes; the 3AC bankruptcy in June 2022 and the FTX collapse in November 2022.

Both of those occasions concerned centralized platforms happening, which result in FUD out there round retaining cash within the custody of such platforms. So, the accelerated progress within the shrimp provide throughout these occasions might have come partially as a result of some bigger holders withdrawing from these platforms and retaining their cash in a batch of smaller wallets.

Recently, the month-to-month change within the indicator once more appears to have been excessive, though not on the extent of those spikes. Around 24,600 BTC has entered into the wallets of the shrimps, taking their mixed provide to a brand new all-time excessive.

In your complete historical past of the cryptocurrency, there have solely been 224 days (4.3% of buying and selling life) which have registered month-to-month modifications increased than this. The latest aggressive accumulation from the retail buyers generally is a constructive signal for the cryptocurrency, because it’s an indication that the adoption of the coin is catching on.

BTC Price

At the time of writing, Bitcoin is buying and selling round $27,900, up 4% within the final week.

BTC has registered an uplift in the present day | Source: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com