Cryptocurrencies together with Bitcoin and Ethereum can witness huge selloffs subsequent week because the US debt default deadline nears, Blockchain.com CEO stated on Thursday. Stocks and crypto costs may even fall after a debt ceiling deal because the US Treasury Department expects to issue $700 billion in Treasury bills to make up misplaced funds this quarter.

US Debt Situation To Bring Crypto Market Correction

During the Qatar Economic Forum organized by Bloomberg, Blockchain.com CEO Peter Smith stated US default or recession may even impression crypto initially. However, crypto costs will get well after a brief interval.

“On a long horizon, these are probably good for crypto…If the U.S. government defaults, we’ll probably see a quick pull-back and then a very strong push upward in the crypto market.”

Smith additionally agreed that the crypto market recovering slowly this yr and 2024 shall be an enormous yr for crypto Bitcoin halving will occur in April.

“I think the crypto market is going to be much bigger in the future than it is today,” @blockchain‘s @OneMorePeter #QatarEconomicForum #منتدى_قطر_الاقتصادي @jennzaba pic.twitter.com/WneSNQr6iV

— Bloomberg Live (@BloombergLive) May 25, 2023

Blockchain.com can be contemplating an growth of its small Middle Eastern workplace in Dubai, the United Arab Emirates. Dubai regulators and digital asset laws are progressive in crypto adoption. Blockchain.com gained approval from Virtual Assets Regulatory Authority (VARA) in September.

If the debt ceiling deal between President Joe Biden and Republicans failed, it will likely be “catastrophic” for the worldwide market. However, if the deal is reached, it should pull liquidity out of economic markets.

Moreover, the US Federal Reserve to pivot this yr. Fed officers are calling for two more hikes as inflation stays larger and the roles market continues to be tight.

Also Read: Bitcoin, Crypto Slides As Fitch Puts US Rating Watch Negative On Debt Ceiling Standoff

Bitcoin Price Loses Momentum

BTC price briefly fell under the $26k degree right now as Bitcoin buyers panic as a result of political partisanship in debt ceiling talks. Bitcoin fell 2% prior to now 24 hours, with the worth at present buying and selling at $26,400. Meanwhile, the second largest crypto ETH price trades above $1800, after falling to an intraday low of $1763.

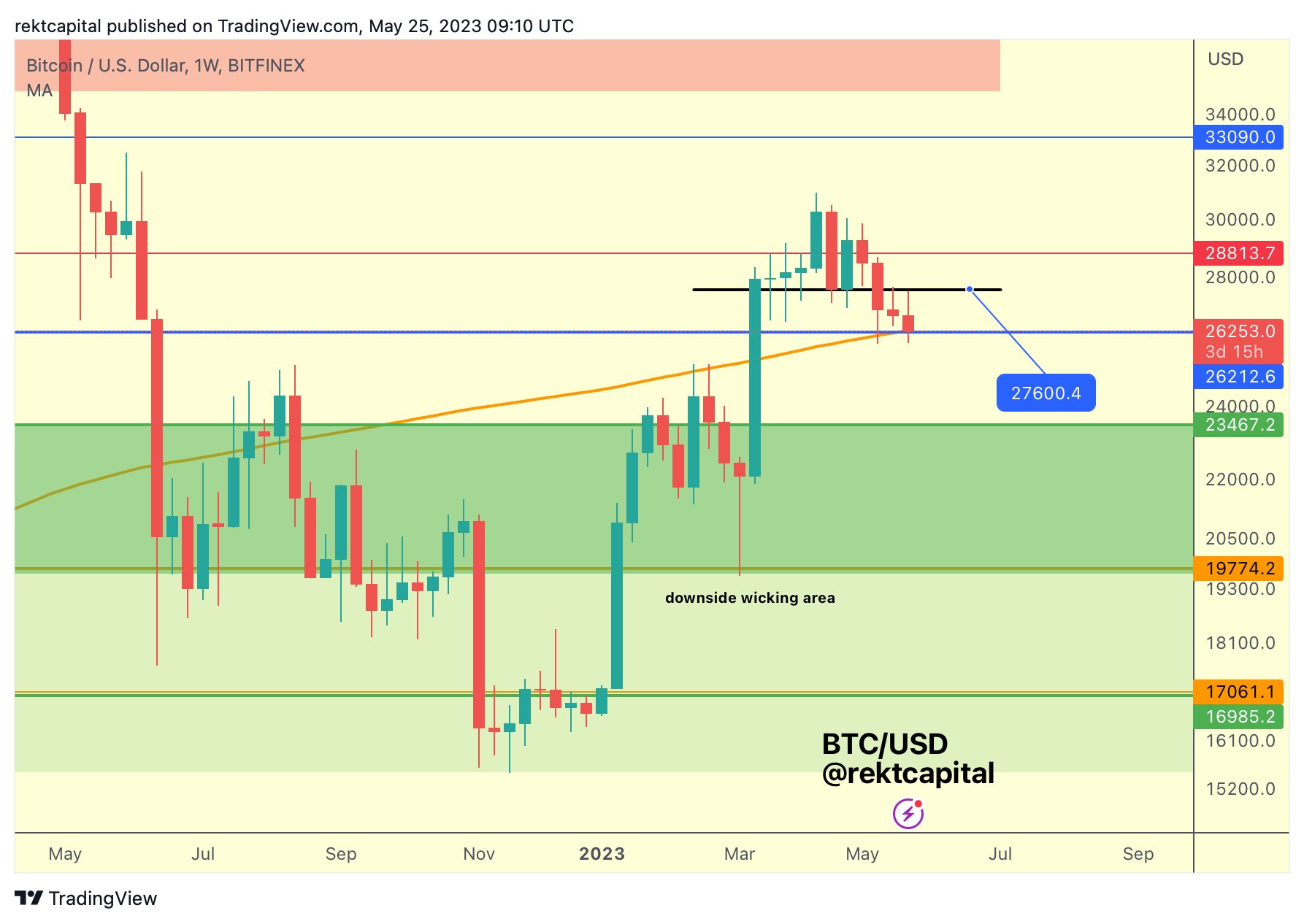

Popular analyst Rekt Capital predicts that if Bitcoin loses the $26,200 help then the worth would drop into the decrease $20,000. The $26200 occurs to be confluent help with the 200-week MA.

Also Read: Binance Suspends Crypto Deposits As Multichain CEO Remains Missing

The introduced content material might embody the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty to your private monetary loss.