Data reveals the mixed buying and selling quantity of Bitcoin and the altcoins have hit the bottom worth in additional than a 12 months. Here’s what this will likely imply.

7-Day Volumes Across The Cryptocurrency Market Have Dropped Recently

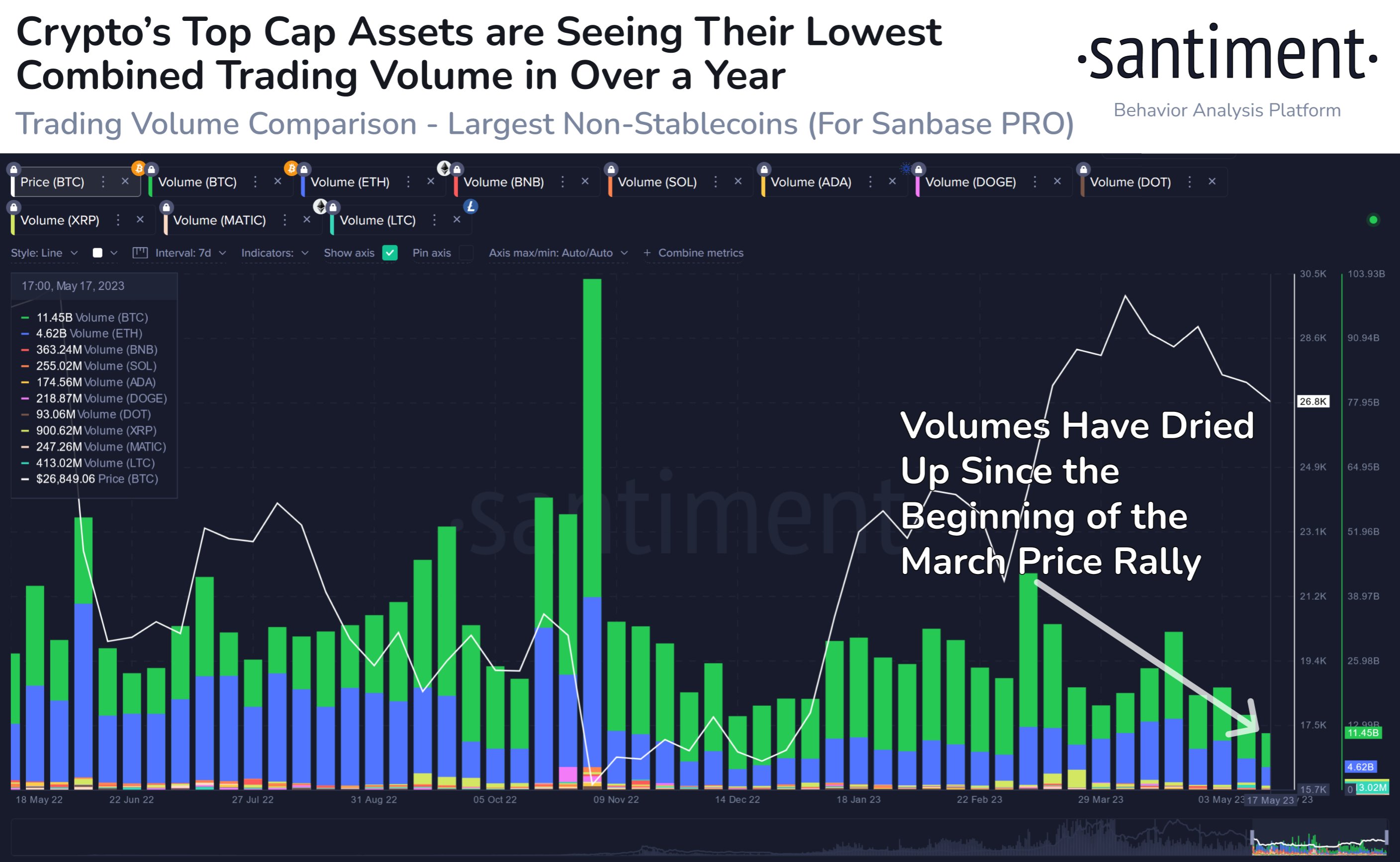

According to knowledge from the on-chain analytics agency Santiment, the volumes had been final at any important ranges again in March of this 12 months. The “trading volume” is an indicator that measures the day by day whole quantity of a given asset that’s being moved round on the blockchain.

When the worth of this metric is excessive, it means the cryptocurrency in query is observing the motion of a excessive variety of cash proper now. Such a development means that the traders are actively buying and selling out there presently.

On the opposite hand, low values of the indicator generally is a signal that there isn’t a lot curiosity within the asset among the many traders in the meanwhile, as they aren’t participating in any important transaction exercise on the community.

Now, here’s a chart that reveals the development within the 7-day buying and selling quantity for among the largest belongings by market cap within the sector over the past 12 months:

The worth of the metric appears to have noticed some decline in current days | Source: Santiment on Twitter

As you’ll be able to see within the above graph, the mixed 7-day buying and selling quantity of those high belongings surged again in March when Bitcoin and different cash had noticed a pointy rally out of an area backside.

Since then, nonetheless, the indicator has seen an total downtrend, and now the metric has hit some fairly low values. This implies that over the last seven days, the belongings have noticed transactions of a little or no quantity.

The present mixed buying and selling quantity for these giant cap belongings is in truth the bottom it has been since greater than a 12 months in the past. From the chart, it’s seen that out of those cash, solely Bitcoin (highlighted in inexperienced) and Ethereum (coloured in blue) have any considerable volumes nonetheless left.

The indicator’s worth for the altcoin market has at all times been fairly low compared to Bitcoin and Ethereum, however lately, it has seen the buying and selling volumes actually dry up.

Naturally, the present low volumes all through the highest belongings would possibly counsel that there isn’t a lot curiosity in buying and selling cryptocurrencies left among the many basic investor.

Generally, sharp worth motion resembling a rally or a crash attracts a excessive variety of customers to the market as a result of such strikes are typically thrilling to them. Such strikes are additionally solely sustainable if they will proceed to carry consideration to the cryptocurrency, as numerous merchants are wanted to gasoline strikes of this sort.

Moves that fail to amass any important consideration, nonetheless, finally find yourself dying out. Because of this cause, the most recent low volumes generally is a worrying signal for the sustainability of the rally within the costs of Bitcoin and different belongings.

BTC worth

At the time of writing, Bitcoin is buying and selling round $27,300, up 1% within the final week.

Looks like BTC has been shifting sideways | Source: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Santiment.internet