Institutional traders have been the main pressure behind the Bitcoin rally in 2021, realizing its potential use circumstances sooner or later. Institutional traders corresponding to JPMorgan, Ark Invest, MicroStrategy, Tesla, Andreessen Horowitz, and others turned supporters of Bitcoin and different cryptocurrencies. However, institutional traders are extra prepared to put money into Ethereum (ETH) than Bitcoin (BTC).

Institutional Investors Prefer Investing in Ethereum Than Bitcoin

The narrative concerning Ethereum overtaking Bitcoin continues to rise after Ethereum Merge and Shanghai improve. Traders anticipate smaller swings in Ethereum than Bitcoin within the close to time period.

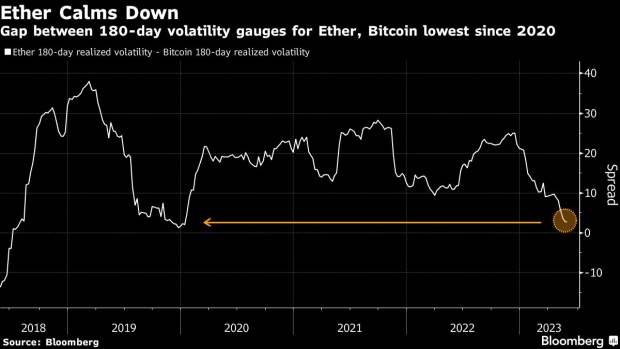

Ethereum’s 30-day volatility index now trails greater than Bitcoin volatility index. Moreover, the 180-day realized or historic volatility of Ether relative to Bitcoin has decreased immensely since 2020, according to Bloomberg.

This makes institutional traders extra occupied with investing in ETH than BTC as decrease volatility usually allows institutional traders to allocate extra capital to crypto. Long-term traders usually tend to improve publicity to Ethereum.

Bitcoin and Ether implied volatility indexes are based mostly on choices pricing. Both indexes fell from latest peaks in March however the Ethereum index dropped extra.

Richard Galvin, co-founder at fund supervisor Digital Asset Capital Management, argues Ethereum staking yields rising after the Shanghai improve in April will additional suppress volatility. However, the US SEC refuses to think about Ethereum as non-security. SEC Chair Gary Gensler believes Ethereum’s proof-of-stake (PoS) transition transformed it right into a safety.

Meanwhile, Bitcoin blockchain is impacted by Bitcoin ordinals non-fungible tokens and meme cash. Moreover, Bitcoin and Ethereum worth correlation fell to its lowest since 2021.

Also Read: Ethereum Client Releases Pruning Update After Vitalik Buterin Updated The Roadmap

ETH Price Remains Stable As in comparison with BTC Price

ETH price continues to commerce above $1800 regardless of a number of macro elements, regulatory points, and the looming US debt ceiling disaster impacting the worldwide market immensely. The worth is at present buying and selling at $1813, up 1% within the final 24 hours.

BTC price stays susceptible to falling under $25,000. The worth is down 1% up to now 24hrs, with the 24-hour high and low of $26,549 and $26,986, respectively.

Also Read: Peter Brandt Predicts Bitcoin Price Fall Below $25K In May

The introduced content material could embrace the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty on your private monetary loss.