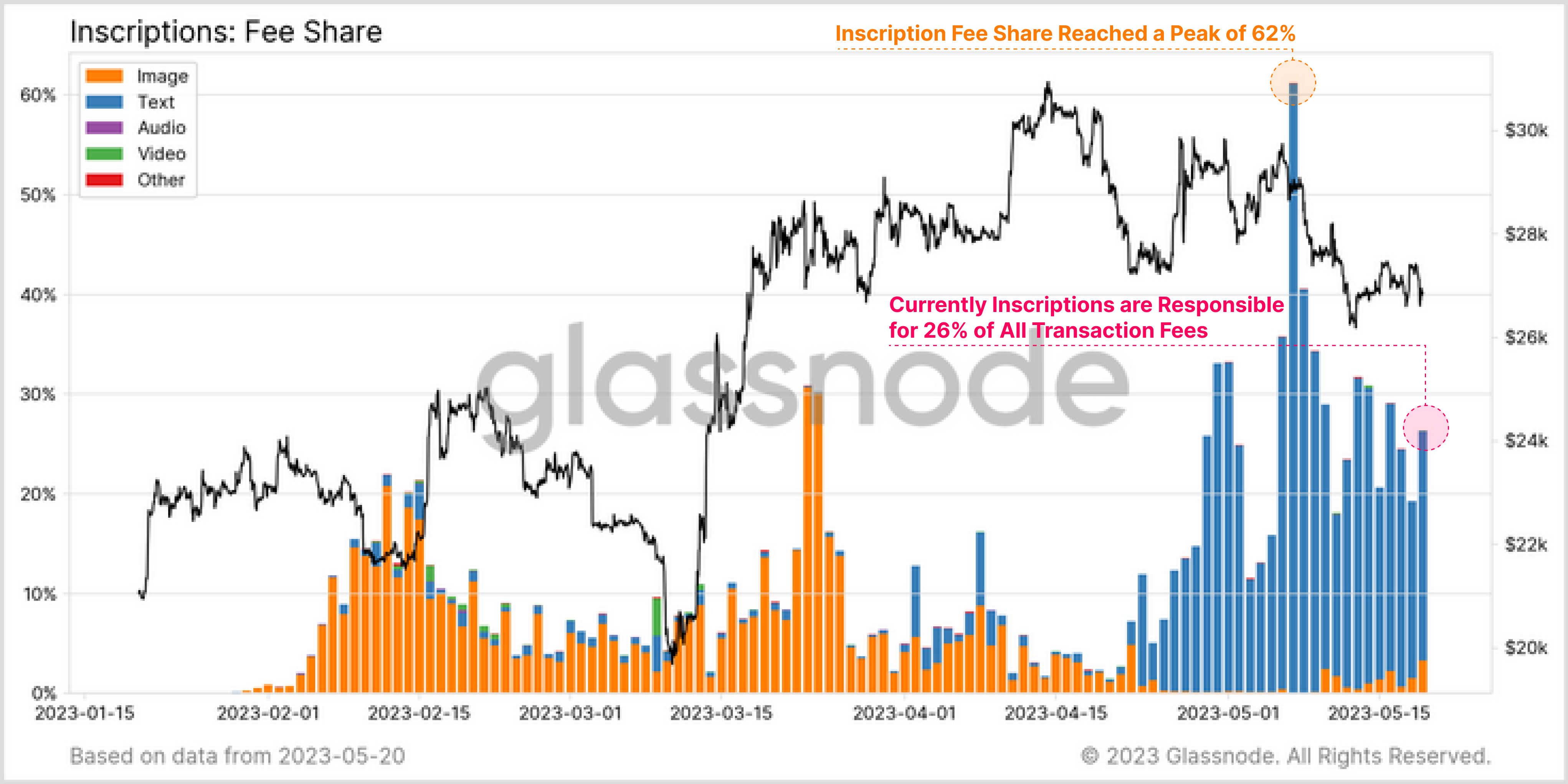

Data reveals the Bitcoin transaction price share of the Inscriptions has dropped to only 26% lately, an indication that the hype round them could also be fading.

Bitcoin Inscriptions Fee Share Remains High, But Much Lesser Compared To Peak

According to information from the on-chain analytics agency Glassnode, the price dominance of the Inscriptions was at 62% throughout their peak. An “Inscription” right here refers to any type of information instantly inscribed into the Bitcoin blockchain.

The Inscriptions solely turned attainable when the Ordinals protocol emerged earlier within the 12 months, and since then, they’ve seen numerous functions and have earned some fast reputation.

As Inscription transactions are like another switch on the community, they naturally affect the blockchain economics associated to transactions. An straightforward method to gauge the influence of the Inscriptions is thru the Bitcoin transaction fees.

Generally, the transaction charges range primarily based on the quantity of demand on the community. In occasions of low visitors on the blockchain, buyers haven’t any have to pay any important quantity of charges to get their transfers accomplished shortly, so the charges keep low.

When there may be excessive congestion on the community, nevertheless, holders might have to connect a excessive quantity of charges as there may be a considerable amount of competitors for the restricted transaction capability that the miners have.

Now, here’s a chart that reveals the share share of the transaction charges that the Bitcoin Inscriptions have occupied since their inception:

Looks like the worth of the metric has come down a bit lately | Source: Glassnode on Twitter

As displayed within the above graph, the Bitcoin Inscriptions price share had burst up not too lengthy after the tech had first emerged. Most of the contribution was coming from the image-based Inscriptions (coloured in orange within the chart), which had been taking part in the function of non-fungible tokens (NFTs) on the community.

In April, nevertheless, the picture Inscriptions fad had died out and the transaction price share of such a switch had registered a decline to low values.

Not too lengthy after the drop in curiosity across the Inscriptions, although, a brand new utility of the know-how had come forth: the BRC-20 tokens.

The BRC-20 tokens are fungible tokens much like the ERC-20 tokens on the Ethereum blockchain and are created in the identical kind because the text-based Inscriptions.

From the chart, it’s seen that the price transaction share of the Inscriptions had risen to a brand new all-time excessive (ATH) after the BRC-20 tokens had emerged, with many of the transfers unsurprisingly coming from the text-based kind (highlighted in blue).

At the ATH, the metric’s worth had reached round 62%, that means that the Bitcoin miners had been receiving 62% of the whole transaction charges from the Inscription-based transfers.

In the previous few days, nevertheless, the curiosity across the Inscriptions seems to have as soon as once more lightened, because the price share of such transfers has dropped to 26%.

This is clearly nonetheless a reasonably excessive stage, however nonetheless represents a really important decline from the height.

BTC Price

At the time of writing, Bitcoin is buying and selling round $26,800, down 2% within the final week.

BTC has gone stale previously few days | Source: BTCUSD on TradingView

Featured picture from Dmitry Demidko on Unsplash.com, charts from TradingView.com, Glassnode.com