Crypto Market News: The US regional banking disaster confirmed a disparity between the large Wall Street banks and smaller banks when it comes to stability. Overall, the collapse of Silicon Valley Bank and Signature Bank had a blanked impact on the U.S. banking shares, as prospects withdrew in worry of additional contagion results. While worry and uncertainty dominated the market sentiment, some traders checked out it as an awesome shopping for alternative. Meanwhile, the crypto market is going through a downturn after the regional banks appear much less fragile and the U.S. Fed’s price hike resolution remains to be beneath over the following few months.

Also Read: Balaji Predicts US Election 2024 To Be Fought Over Bitcoin

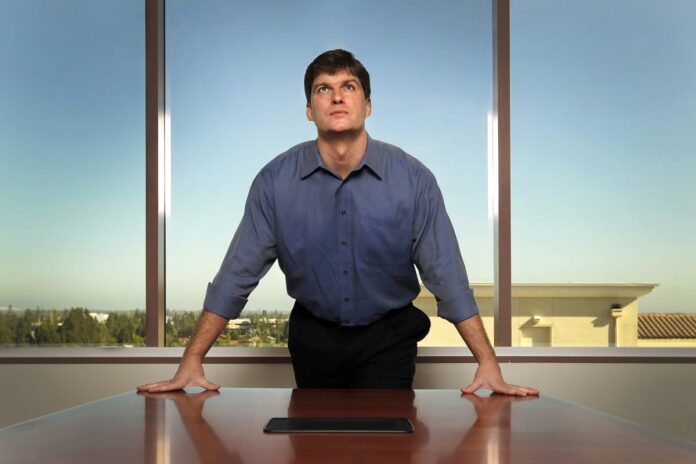

Earlier, CoinGape reported that well-liked investor Michael Burry purchased shares of distressed banks like First Republic Bank, PacWest Bancorp, Western Alliance Bank and New York Community Bancorp. At that point, these shares have been buying and selling at lowest ranges, and any important restoration would have meant wholesome positive factors. The sentiment was additionally conducive for getting on the low costs as fears over additional financial institution collapses rose.

Michael Burry Portfolio Revealed

According to an annual shareholder report of Burry shared by Compounding Quality, the large quick invested in New York Community Bancorp, Capital One, Wells Fargo, Western Alliance Bancorp, Huntington Bancshares, PacWest and First Republic Bank. Among his different main shares in his portfolio are JD.com and Alibaba Group which type the very best share shares in his portfolio, moreover vitality shares Coterra Energy and Devon Energy, the report said. He additionally reportedly purchased the shares of healthcare and insurance coverage firm Cigna Group.

In the wake of the current US banking disaster, Burry predicted yet one more market backside state of affairs in March 2023, just like his shorting the 2007 mortgage bond market.

Also Read: XRP News: SEC Could Still Win Ripple Lawsuit Says Former Ripple Executive

The offered content material might embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty in your private monetary loss.