Data from Glassnode reveals the Bitcoin provide has been observing a shift from wallets primarily based in America to these in Asia not too long ago.

Bitcoin Supplies Held By Asian And US Investors Have Gone Opposite Ways Recently

According to knowledge from the on-chain analytics agency Glassnode, an fascinating dichotomy has shaped between the totally different regional provides of the cryptocurrency not too long ago.

Glassnode has divided the Bitcoin addresses into totally different areas primarily based on the hours they’ve been making transactions in. “Geolocation of Bitcoin supply is performed probabilistically at the entity level,” notes Glassnode. An “entity” right here refers to a number of wallets which can be beneath the management of a single investor (or an investor group).

“The timestamps of all transactions created by an entity are correlated with the working hours of different geographical regions to determine the probabilities for each entity being located in the US, Europe, or Asia,” explains the analytics agency.

The three principal areas are the US (13:00 to 01:00 UTC), Europe (07:00 to 19:00 UTC), and Asia (00:00 to 12:00 UTC). In the context of the present dialogue, nonetheless, solely the provides primarily based within the US and Asia are related.

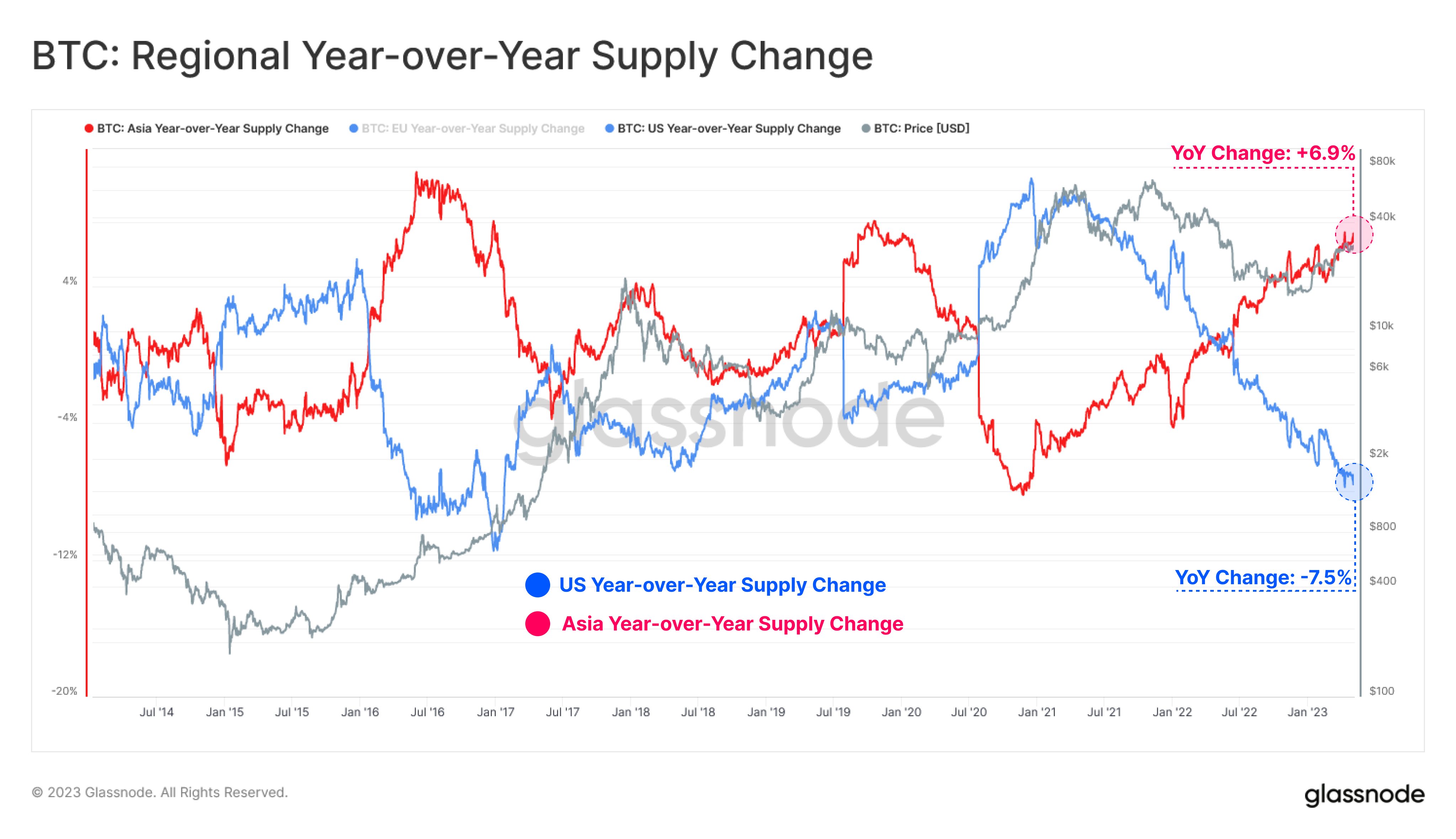

Here is a chart that exhibits the development within the year-over-year provide change in these two regional Bitcoin provides over the previous couple of years:

Looks just like the values of the 2 metrics have been going precisely the alternative instructions in latest months | Source: Glassnode on Twitter

As displayed within the above graph, the Bitcoin provide held by the US buyers was rising quicker and quicker within the leadup to and throughout the bull run within the first half of 2021 because the year-over-year change was continuously going up.

The change slowed down within the second half of the 12 months, however nonetheless remained optimistic, suggesting that the availability was nonetheless rising, albeit at a slower tempo. In 2022, nonetheless, the availability began lowering, because the bear market took over and the LUNA and 3AC crashes passed off.

The year-over-year change of the US-based BTC provide has continued to develop extra adverse since then and at present stands at a price of -7.5%, suggesting that the availability has shrunken by 7.5% since May 2022.

The Asian Bitcoin provide, nonetheless, has displayed a really contrasting conduct, because it began going up simply because the American buyers began shedding their holdings.

Interestingly, the tempo at which the availability held by the Asian merchants has remodeled is nearly precisely the identical as what the balances of the US-based wallets noticed (though, after all, the change has been in the wrong way).

Currently, the year-over-year change within the Asian provide stands at +6.9%. The incontrovertible fact that the Asian buyers have purchased an identical quantity to what the US holders have bought suggests a direct switch of cash between the 2 provides.

Now, as for why this continued transition of provide has taken place, the principle cause is prone to be the truth that the US has been tightening up laws associated to the cryptocurrency sector not too long ago.

One of essentially the most distinguished examples of this has been the regulatory crackdown that Coinbase has noticed from the Securities and Exchange Commission (SEC) not too long ago.

BTC Price

At the time of writing, Bitcoin is buying and selling round $28,200, down 1% within the final week.

BTC has surged prior to now day | Source: BTCUSD on TradingView

Featured picture from iStock.com, charts from TradingView.com, Glassnode.com