Bitcoin correlation with Gold continues to rise since March as a result of uncertainty amid the banking disaster and better rates of interest. The banking disaster led traders to place their cash in Bitcoin slightly than gold because it gave greater returns than gold and US equities.

The BTC price at the moment trades close to the $30,000 psychological stage, recording a powerful rally of 85% this 12 months. Experts imagine the BTC value can hit over $135k after the Bitcoin halving subsequent 12 months.

Bitcoin-Gold Correlation Rises Higher

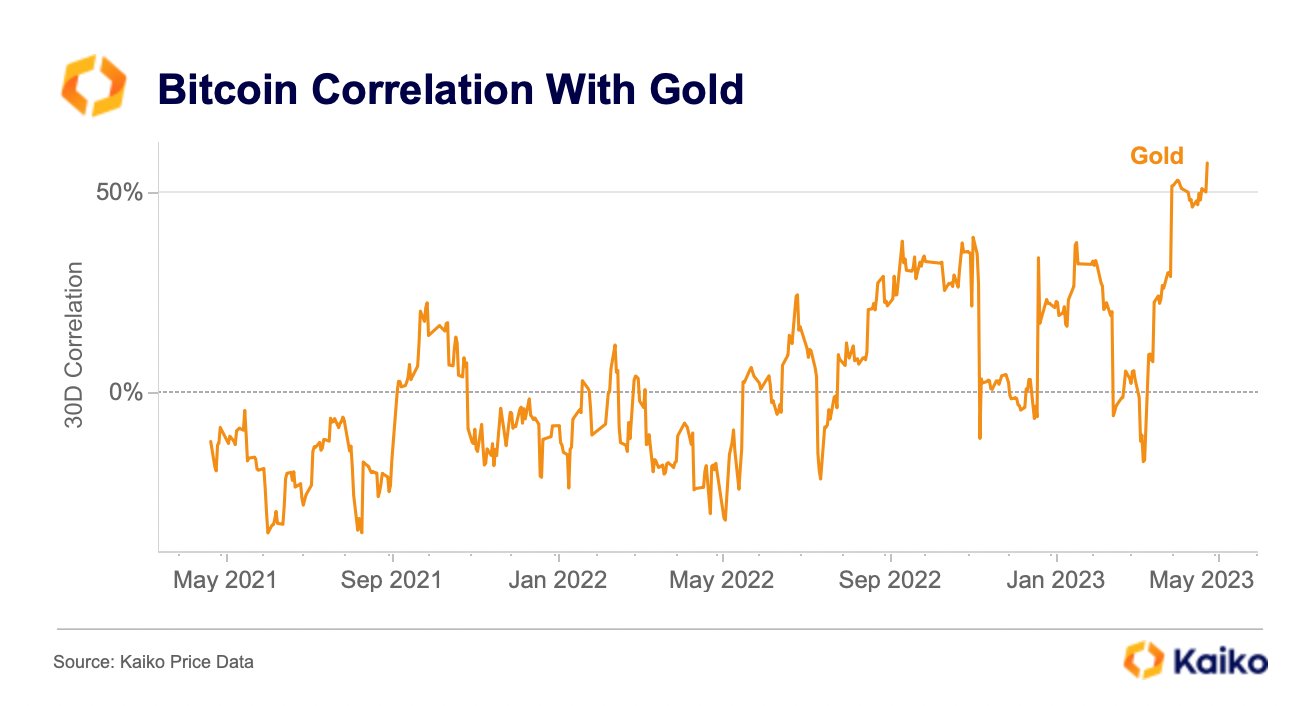

Bitcoin 30-day correlation with gold has surpassed the 50% stage and now stands at 57%, as per data by market analytics agency Kaiko. The correlation is rising since March after regulators closed crypto-friendly banks inflicting a banking disaster.

It signifies Bitcoin has emerged as a secure haven for its hedge towards inflation and a retailer of worth traits. During inflation and uncertainty, traders put their cash in gold, however Bitcoin witnessed extra influx of cash than gold.

For a protracted time frame, BTC has proven an in depth correlation to US equities. However, it has outperformed all three indices by almost 4 occasions in Q1 2023.

Amid issues over the potential financial collapse, “Rich Dad Poor Dad” writer Robert Kiyosaki, warned in regards to the state of the worldwide economic system. He claims that the U.S. Federal Reserve can be a catalyst for an imminent market crash.

The banking disaster shouldn’t be over but as First Republic Bank shares fell over 25% right this moment after a decline of fifty% on Tuesday, with the federal government not inclined to take part within the negotiations.

Bitcoin Price Gains Momentum

BTC value is at the moment buying and selling at $29,756, up 10% within the final 24 hours. The 24-hour high and low are $27,284 and $30,000, respectively. Furthermore, the buying and selling quantity has elevated by 70% within the final 24 hours, indicating an increase in curiosity amongst merchants.

Experts predict Bitcoin can hit $35k amid the most recent rally within the subsequent few weeks. The Fed will announce its price hike determination on May 2, with likely a 25 bps price hike as per the present information.

Also Read: Crypto Market Recovery: Bitcoin and Ethereum Price Begins Major FOMO Rally

The offered content material could embrace the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability on your private monetary loss.