On-chain information exhibits the Bitcoin shrimp provide has continued to rise just lately, which might be optimistic for the BTC ecosystem.

Bitcoin Shrimps Now Hold 6.7% Of The Entire Circulating Supply

According to information from the on-chain analytics agency Glassnode, the BTC shrimps have added 1.78% of the cryptocurrency’s provide to their holdings for the reason that LUNA crash final 12 months.

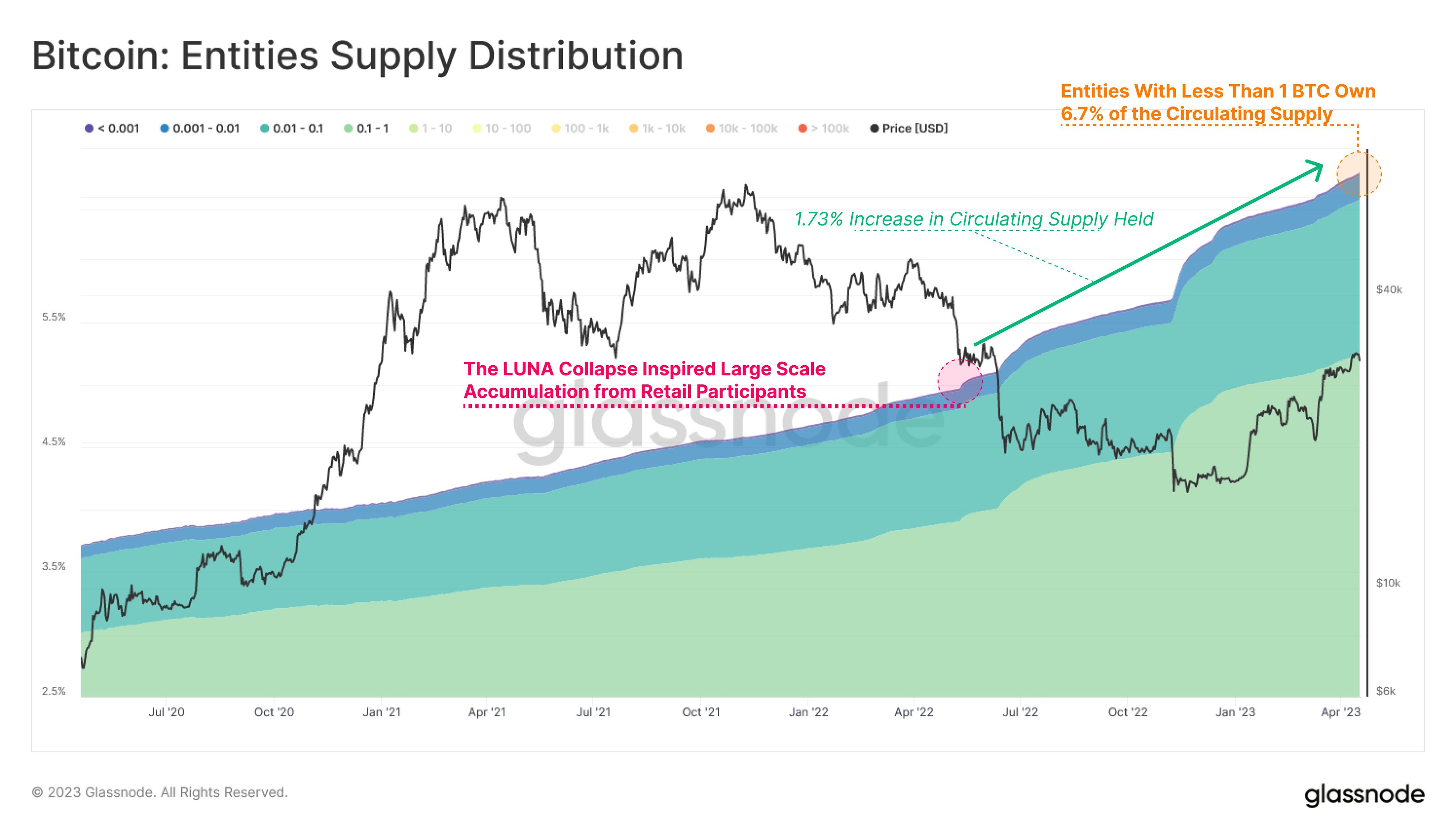

The related indicator right here is the “Entities Supply Distribution,” which measures the whole proportion of the Bitcoin provide that every entity group available in the market is presently holding.

Investors are divided into these entities primarily based on the whole variety of cash they carry of their wallets. For instance, the 0.001 to 0.01 group consists of all addresses holding not less than 0.001 and 0.01 BTC.

When the Entities Supply Distribution metric is utilized to this particular group, it tells us concerning the proportion of the BTC provide that the quantities of wallets falling on this vary add as much as.

The “shrimps” are holders with lower than 1 BTC of their pockets balances. This implies that this cohort consists of all entity teams within the 0 to 1 vary (to be extra exact, 4 teams satisfying this situation: lower than 0.001, 0.001 to 0.01, 0.01 to 0.1, and 0.1 to1).

Here is a chart that exhibits the Entities Supply Distribution for the entities belonging particularly to the shrimps’ cohort:

The values of those metrics appear to have been rising in current days | Source: Glassnode on Twitter

As displayed within the above graph, the share of the whole Bitcoin circulating provide held by the shrimps has notably elevated throughout the previous 12 months or so. As an entire, these traders now maintain 6.7% of the complete BTC provide.

The shrimps symbolize the retail investor section of the BTC market, so their provide rising up throughout this era implies that retail participation has been rising within the sector.

The proportion of the availability held by these smallholders had already elevated throughout the previous couple of years, however the development had been slower. In the previous 12 months, a couple of occasions have resulted within the development of this cohort to speed up.

The chart exhibits that the primary of those was the LUNA collapse again in May 2022, whereas the second was the 3AC bankruptcy, which passed off just a few weeks later. The most important impact seems to have been from the FTX crash again in November, as the availability held by these holders quickly rose shortly after it occurred.

Accumulation from retail traders might be constructive for the Bitcoin market in the long run because it represents development within the adoption of the cryptocurrency. Adoption typically offers a strong basis for the sector, on which later worth strikes can sustainably carry off from.

BTC Price

At the time of writing, Bitcoin is buying and selling round $29,300, up 2% within the final week.

Looks like the worth of the cryptocurrency has plunged throughout the previous day | Source: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com