DeFi platform Yearn Finance has suffers a flash mortgage assault, with thousands and thousands of funds withdrawn by the hacker. The exploit is targeting Aave V1 liquid protocol, blockchain safety agency PeckShield reported on Thursday. Yearn safety group is conscious of the problem and dealing on a repair.

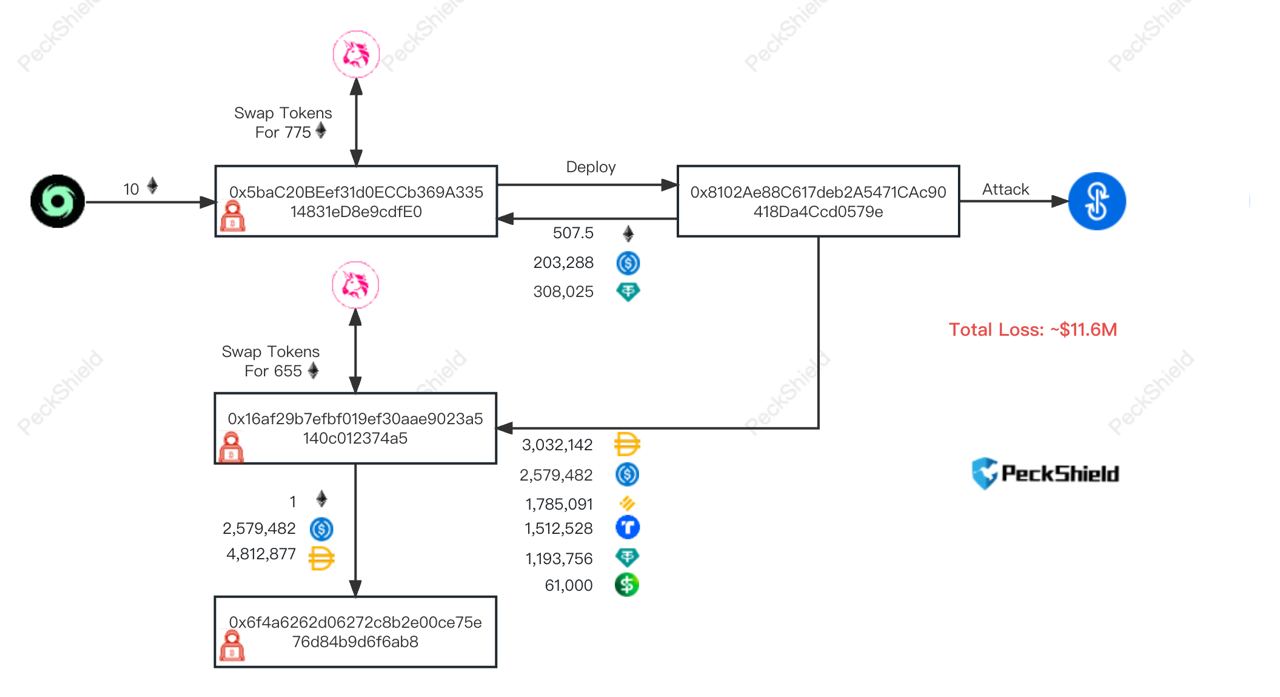

PeckShield in a subsequent tweet revealed that the foundation trigger is probably going as a result of misconfigured yUSDT, which is exploited to mint large yUSDT (approx. 1,252,660,242,212,927.5) from simply $10K USDT. The large yUSDT is then cashed out by swapping to different stablecoins. However, it must be confirmed if Aave has any function within the hack.

Also Read: Ethereum (ETH) Withdrawn After Shanghai (Shapella) Upgrade: Details

Beosin Alert noted that the full loss within the Yearn Finance hack is sort of $11,539,783. The blockchain safety platform additionally reported the wallets having essentially the most stolen funds from Yearn Finance. It additionally confirmed withdrawals of 996k USDC, 570k DAI, and 241k USDT from Aave Lending Pool Core V1.

Hackers grabbed practically $11.6 million price of stablecoins, together with 61K USDP, 1.5 million TUSD, 1.8 million BUSD, 1.2 million USDT, 2.58 million USDC, and three million DAI. The hackers transferred 1.5 million TUSD to AAVE, and borrowed 634 ETH from AAVE. They then swapped some stablecoins for 600 ETH, with 1,000 ETH already transferred into Tornado Cash.

Aave Not Impacted By Yearn Finance Hack

Crypto researcher Samczsun claimed that Yearn Finance’s model of USDT, referred to as yUSDT, has been damaged because it was deployed round three years in the past. He mentioned it was “misconfigured to use the Fulcrum iUSDC token instead of the Fulcrum iUSDT token.”

Aave group confirmed that the Aave V1 protocol was used however is just not impacted by the hack. Aave CEO Stani Kulechov took to Twitter to substantiate this.

We are conscious of this transaction, and it didn’t have an effect on Aave V2 and Aave V3.

We are actually confirming whether or not there may be any impression on Aave V1, the oldest model of the protocol which has been frozen. We’re monitoring the state of affairs intently to make sure no additional issues. https://t.co/uM9wtLNJMl

— Aave (@AaveAave) April 13, 2023

The introduced content material could embrace the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability in your private monetary loss.