- On-chain profit metrics have picked up as the Bitcoin worth has risen

- Net realised earnings have been positive for 17 days, the longest streak in a year

- 74% of the Bitcoin provide is in profit, three months after it dipped under 50% after FTX collapsed and the Bitcoin worth fell in the direction of $15,000

- Volatility has picked up however it’s the skinny liquidity which is admittedly serving to Bitcoin make a run

- It’s been a nice quarter for traders, however there stays peril, writes our Analyst

Bitcoin had an unforgettable year in 2022 for all the flawed causes, a collapse in worth coinciding with a number of ugly scandals that rocked the cryptocurrency market at giant.

Thus far this year, nonetheless, it has been bouncing again. Up 71% as we shut out Q1, it’s buying and selling north of $28,000 for the first time since June 2022.

Looking into on-chain metrics, the positive sentiment is evident.

Net realised profit at one-year highs

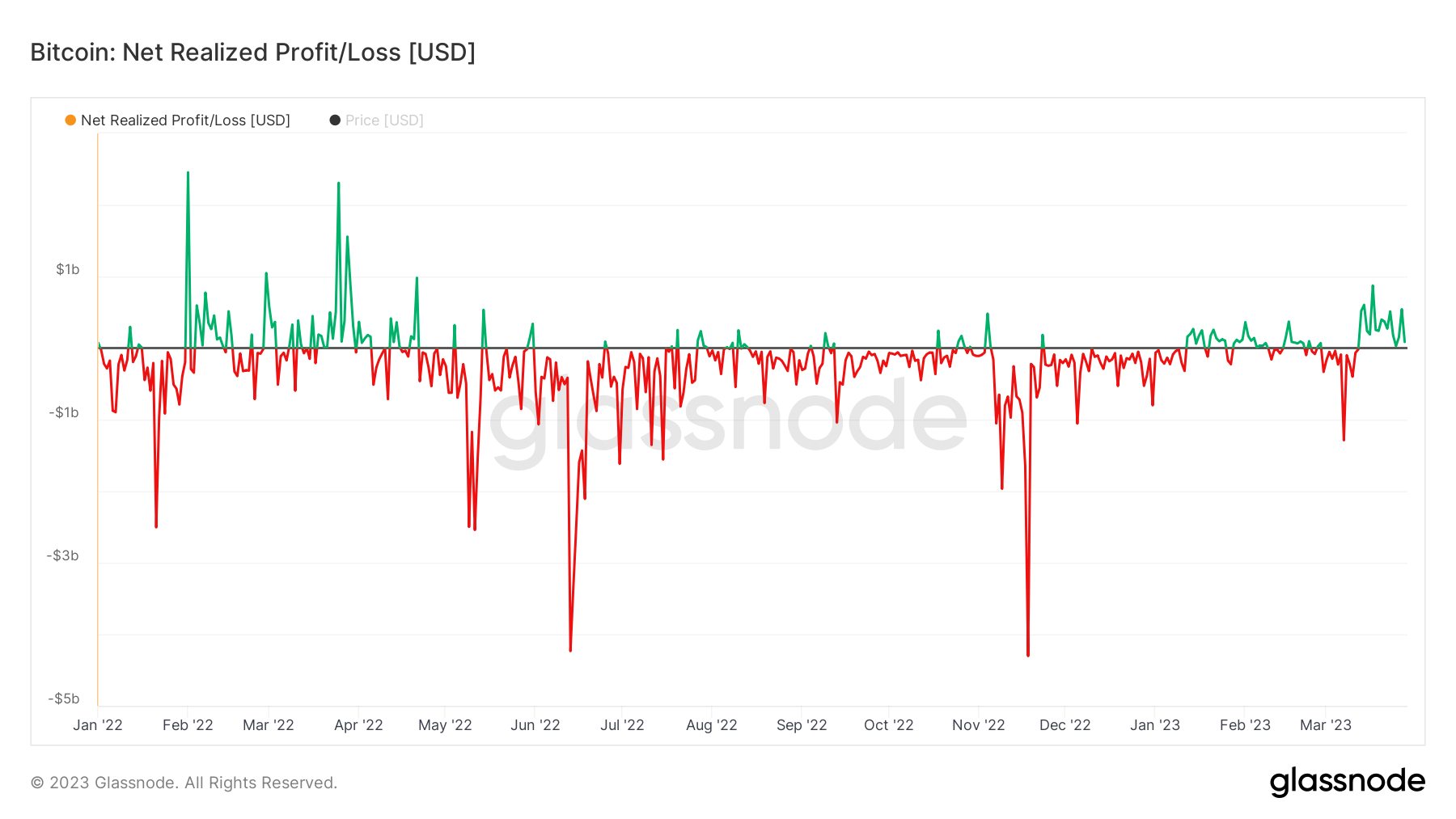

The web realised profit of all cash, that’s the distinction between the worth at which a coin strikes and the final worth it moved at, is on its longest positive run since this time final year, in March 2022.

For seventeen days now, the web realised profit has been positive. In different phrases, cash are shifting at costs increased than what they had been purchased at (or the worth at which they final moved).

There was an 18-day positive streak in late March / early April final year, and past that, we have to return to This fall of 2021 to see such a streak, when Bitcoin was buying and selling at all-time highs.

Granted, the dimension of the earnings over the final two weeks haven’t been as outsized as now we have seen in earlier durations, however the actual fact that it’s a positive run after the year Bitcoin has had is notable.

Three quarters of the provide is in profit

Another strategy to see how a lot issues have modified is that three-quarters of the whole provide is at the moment in profit.

Just earlier than Christmas, I reported when this determine dipped under 50%, which means for the first time since the transient flash crash at the begin of COVID in March 2020 when the monetary markets all went bananas, the majority of the Bitcoin provide was loss-making.

Three months later, the image is a lot brighter, with 74% of the whole provide now in profit.

Liquidity stays low as stablecoins fly off exchanges

Interestingly, this rise in costs and profit positions is all occurring at a time when liquidity is extraordinarily low in the market.

In a deep dive yesterday, I compiled an analysis exhibiting that the stability of stablecoins on exchanges has fallen 45% in the final 4 months and is at the moment the lowest since October 2021.

Perhaps that’s not a coincidence. The markets are ultra-thin proper now, and Bitcoin, which is risky at the finest of occasions, has discovered it simpler to maneuver aggressively as a outcome. This additionally helps clarify why it has outperformed the inventory market so considerably, regardless of being so tightly correlated with it not too long ago (though some believers are arguing it is because of banking failures pushing individuals to Bitcoin, however that seems like a attain).

Then once more, Bitcoin goes to Bitcoin, and its current volatility isn’t something to put in writing dwelling about when trying traditionally, even when it has picked up in comparison with the comparatively serene interval put up FTX collapse.

To wrap this up, it’s been a excellent few months to kick the year off for Bitcoin, which is a welcome reprieve for traders who obtained completely battered final year. On-chain profit metrics have come proper up as sentiment improves and costs leap.

But there’s additionally low liquidity which helps it run-up, whereas the wider economic system presents a lot of uncertainty. Sure, it’s a nice begin, but it surely’s not out of the woods but.