Bitcoin worth fell from $28K to $26.5K after the US CFTC sued crypto exchange Binance and its CEO Changpeng “CZ” Zhao for violating U.S. crypto buying and selling and derivatives laws. The crypto market considers this transfer as a continued regulatory crackdown towards crypto.

With the crypto market already dealing with liquidity points, motion towards Binance will additional worsen the liquidity downside because it’s the world’s largest crypto trade. According to knowledge, Bitcoin buying and selling on Binance accounts for over 80% after the collapse of FTX and Operation Choke Point 2.0.

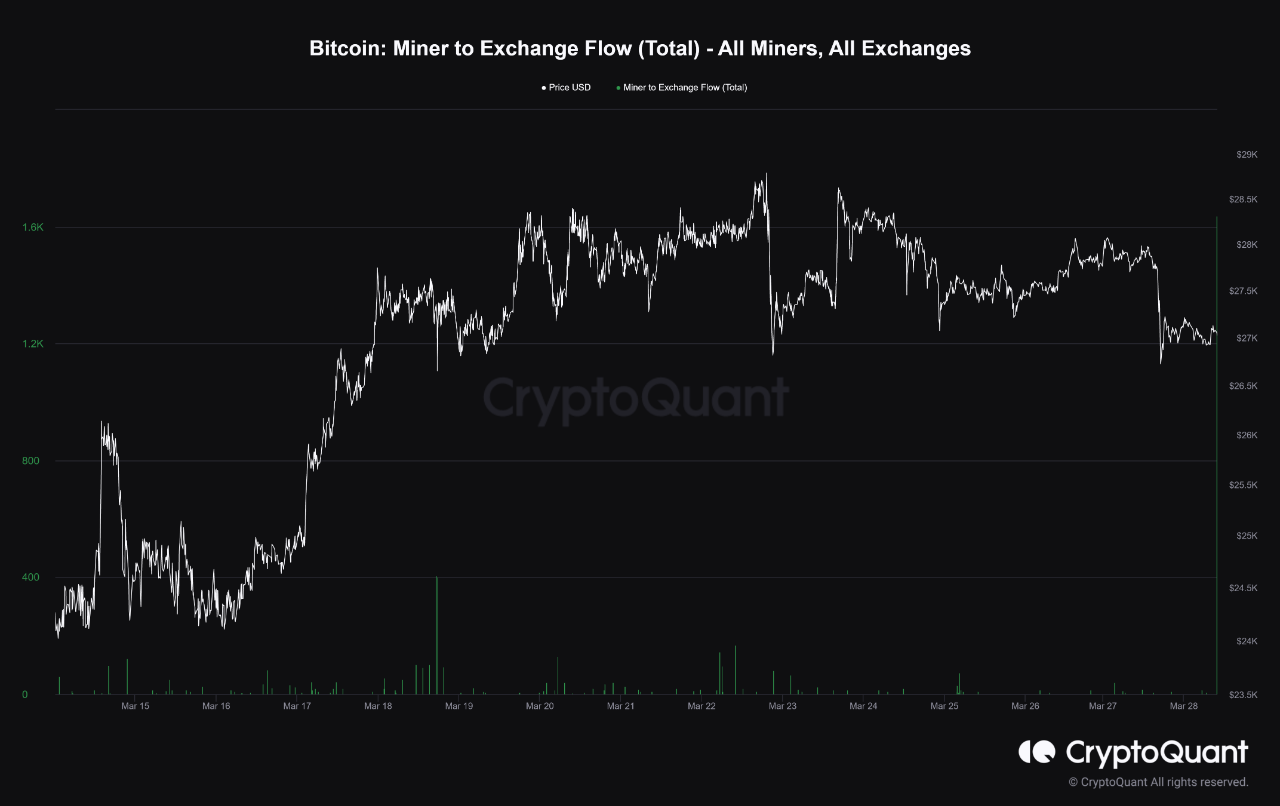

Miners have began promoting their Bitcoin holdings. Bitcoin Miner to Exchange Flow metric signifies miners have transferred nearly 1700 BTC to crypto exchanges on Tuesday. It will increase promoting strain on Bitcoin from miners. This is the second-largest selloff by miners YTD after over 3K BTC selloff on January 19.

Moreover, Bitcoin Miner Reserve metric exhibits miners’ BTC holdings additionally decreased. It confirms miners have began promoting their Bitcoin holdings and it’ll set off Bitcoin worth downfall. It is vital to observe the scenario every day.

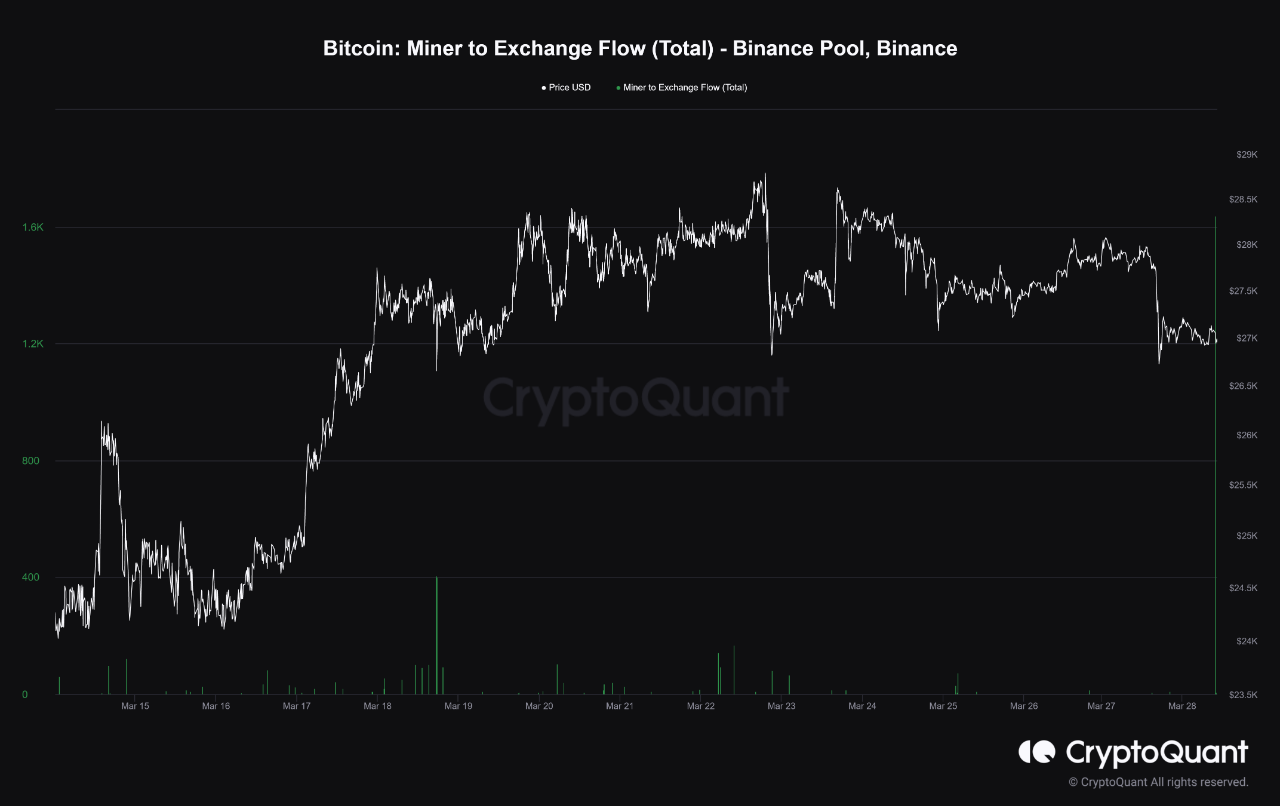

Bitcoin Miner to Exchange Flow for Binance Pool knowledge reveals that 1646 BTC transferred from the Binance mining pool to Binance trade.

Bitcoin Price Fall To $25,000 Likely

Bitcoin worth is presently buying and selling at $26,951. The 24-hour high and low are $26,606 and $27,304, respectively. Thus, the BTC price is down practically 3% prior to now 24 hours. Trader sentiment stays comparatively impartial, with Binance being sued and different current uncertainties not affecting their expectations.

As per widespread analyst Rekt Capital, BTC shut under $27,000 within the every day timeframe can be sufficient to set off the breakdown course of. Bitcoin is presently holding above the $26.5K degree. However, uncertainties and month-to-month shut threat Bitcoin worth to reclaim the 200-weekly shifting common (WMA)

Also Read: After CFTC, SEC Could Sue Binance Over Securities Offerings

The introduced content material might embrace the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability to your private monetary loss.