Bitcoin has dropped under $27,000 as short-term holders have locked within the highest income for the reason that November 2021 all-time excessive.

Bitcoin Short-Term Holder Realized Profit Has Spiked Recently

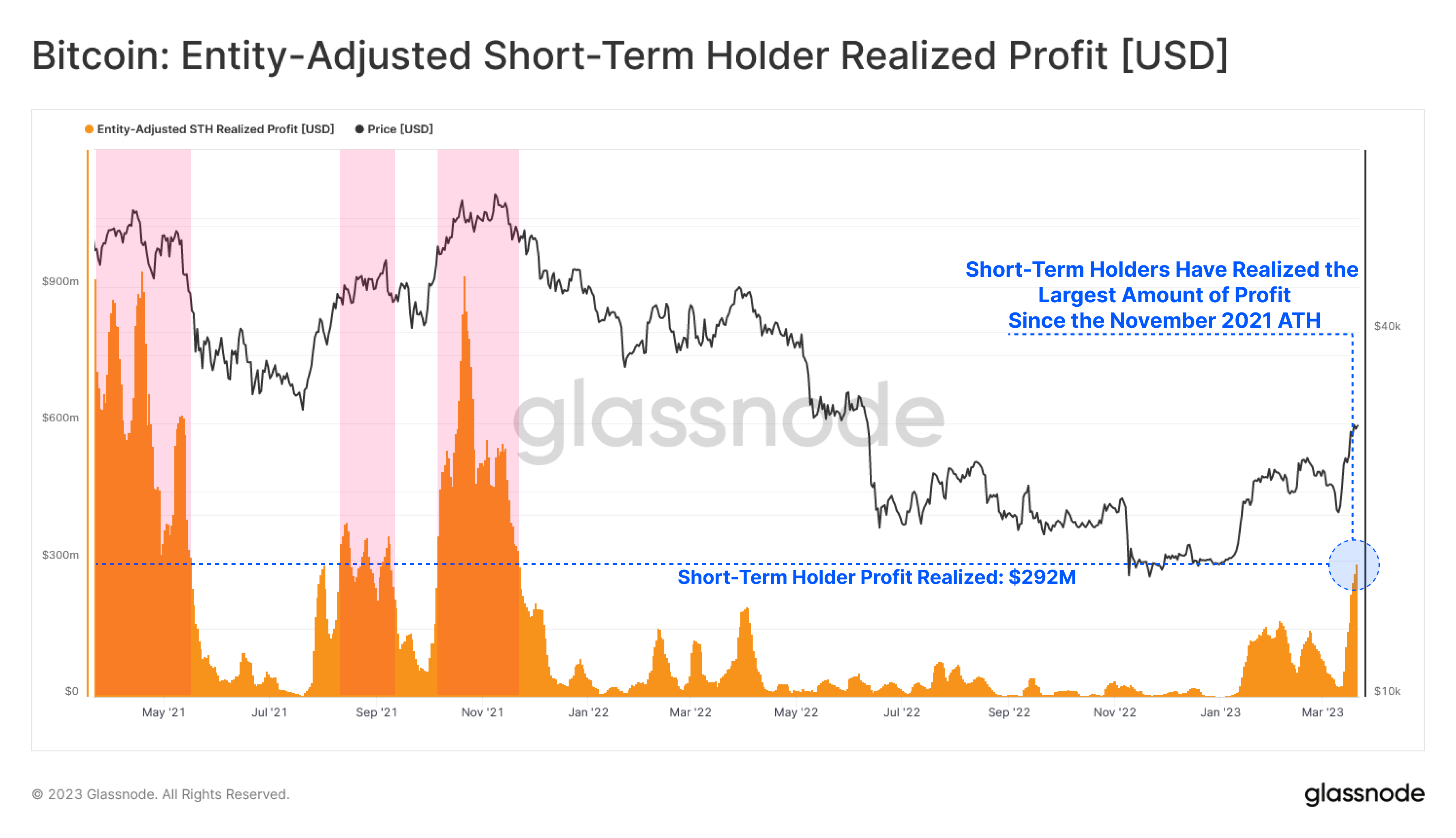

According to knowledge from the on-chain analytics agency Glassnode, the short-term holders have not too long ago realized round $292 million in income. The related indicator right here is the “realized profit,” which measures the full quantity of income (in USD) that traders throughout the Bitcoin community are locking in at present.

This metric works by going by way of the on-chain historical past of every coin being bought to see its final transacted worth. If this earlier promoting worth for any coin was lower than the worth at which it’s now being moved, then it’s being bought at a revenue.

The realized revenue indicator then provides this quantity of revenue to its worth after which repeats the method for all transactions on the BTC blockchain.

This indicator may also be utilized to a particular market part, like an investor group. The whole Bitcoin sector will be divided into two foremost investor teams: the short-term holders (STHs) and the long-term holders (LTHs).

Here, the related group is the previous, together with all traders holding onto their cash since lower than 155 days in the past. Naturally, holders carrying their cash for longer than that fall underneath the LTHs.

Below is a chart that shows the info for the Bitcoin STH realized revenue during the last couple of years.

The worth of the metric appears to have spiked fairly excessive in latest days | Source: CryptoQuant

The Bitcoin STH realized revenue metric used within the graph is the “entity-adjusted” one, that means that transactions between the wallets owned by the identical entity have been excluded from the info (an entity will be each a single investor and a gaggle of holders).

From the graph, it’s obvious that the indicator had been at fairly low values in the course of the bear market, which is sensible as the costs lined within the 155-day length would both be higher or near the identical worth as the present one, so there wouldn’t be many alternatives for STHs to reap any important income.

However, this pattern modified as soon as the rally kicked off in January, because the STHs who purchased on the low bear market costs now all of a sudden bought into some immense income.

The metric dropped in worth when the BTC worth plunged under the $20,000 mark earlier this month, however with the recent sharp uptrend up to now week, the STHs have once more began realizing some important income.

The metric’s present worth means that STHs had not too long ago realized round $292 million in features, the best worth since November 2021, when Bitcoin registered its all-time excessive worth.

Such profit-taking from these traders can harm the worth, and it might seem that the asset has already skilled the bearish impact from this, as BTC has now plunged under the $27,000 mark.

BTC Price

At the time of writing, Bitcoin is buying and selling round $26,800, up 10% within the final week.

BTC has plummeted on the each day chart | Source: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com