On-chain information from Santiment reveals Ethereum whales had been promoting in the course of the previous 12 months whereas sharks had been shopping for extra of the asset.

Ethereum Sharks Added 3.61 Million ETH To Their Holdings In Past Year

According to information from the on-chain analytics agency Santiment, there was a considerable shift within the provide held by the massive holders within the ETH market lately. The related indicator right here is the “Supply Distribution,” which tells us what share of the Ethereum provide is at present being held by which pockets teams.

The pockets teams right here confer with cohorts divided primarily based on the entire variety of cash they’re holding proper now. For instance, the 1 to 10 cash group consists of all addresses on the community which are carrying a stability quantity between 1 and 10 ETH in the intervening time.

If the Supply Distribution metric is utilized to this group, then it’s going to measure (amongst different issues) the mixed stability held by the wallets satisfying this situation.

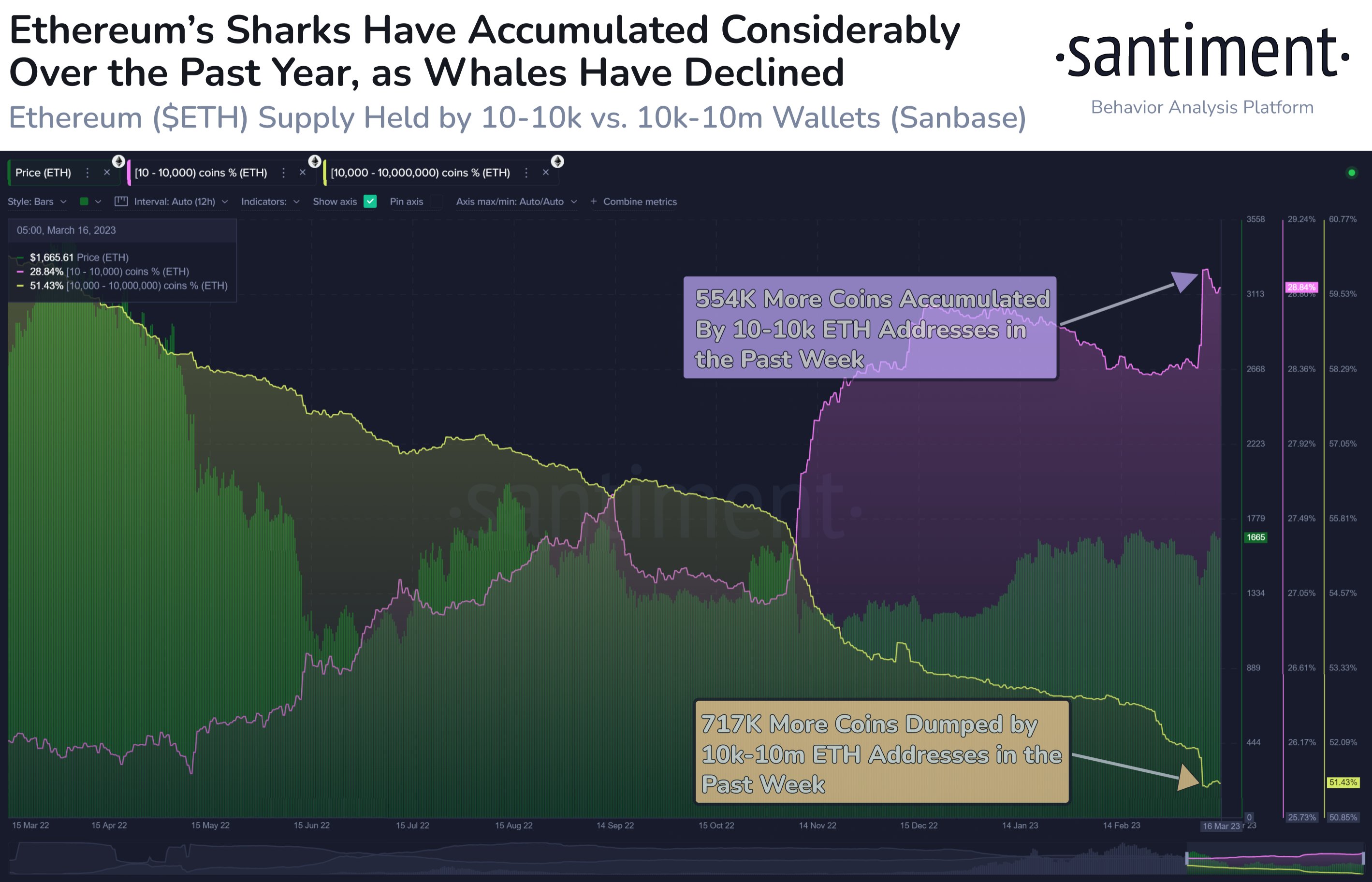

Now, within the context of the present dialogue, the pockets teams of curiosity are the ten to 10,000 cash and 10,000 to 10,000,000 cash cohorts. Here is a chart that reveals the pattern within the Supply Distribution for these Ethereum teams over the previous 12 months:

The values of the 2 metrics appear to have gone reverse methods in latest months | Source: CryptoQuant

The vary of the primary pockets group converts to about $17,300 on the decrease finish and $17.3 million on the higher certain (each on the present USD worth), whereas the second’s is value $17.3 million and $17.3 billion.

These teams correspond to 2 necessary cohorts within the Ethereum market referred to as the sharks and whales. As these teams maintain such giant quantities of cash, their actions can generally have noticeable impact on the value (with whales being the extra influential of the 2, naturally, since they maintain considerably greater balances of their wallets).

As displayed within the above graph, the holdings of the sharks have adopted a internet upwards trajectory over the past 12 months, with an particularly sharper uptrend seen following the FTX crash again in November 2022.

In whole, this cohort has added 3.61 million ETH or $6.3 billion to their holdings in the course of the previous twelve months. There has additionally been some fast accumulation from these holders within the final week, the place their provide has grown by about 554,000 ETH.

As for the whales, these humongous holders seem to have dumped a internet quantity of the asset in the course of the previous 12 months. In all, these traders have distributed a whopping 9.43 million ETH on this interval, which is value about $16.4 billion on the present alternate charge.

The cohort has additionally proven extra fast promoting up to now week, presumably to benefit from the present profit-taking alternative, and has shed their holdings by about 717,000 tokens.

It looks like the Ethereum market has undergone a shift in how the availability is distributed among the many totally different holder teams, with smaller holders choosing up the availability being bought by the bigger holders.

However, regardless of this vital distribution, Ethereum whales nonetheless maintain about 51.4% of the entire ETH provide, whereas sharks have round 28.8% of the availability of their wallets.

ETH Price

At the time of writing, Ethereum is buying and selling round $1,700, up 33% within the final week.

ETH surges up | Source: ETHUSD on TradingView

Featured picture from Jake Gaviola on Unsplash.com, charts from TradingView.com, Santiment.internet