As the present Bitcoin halving cycle continues to advance, right here’s what the earlier cycles seemed like at comparable factors of their lifespan.

The newest Bitcoin Cycle Recently Passed The 150,000 Blocks Milestone

A “halving” is a periodic occasion the place Bitcoin’s mining rewards (that’s, the block rewards that miners obtain for fixing blocks) are reduce in half. This takes place each 210,000 blocks or roughly each 4 years.

As the block rewards are mainly the quantity of latest BTC provide being created, being halved implies that the asset turns into extra scarce. This is why the halving is a characteristic of the BTC blockchain; by controlling shortage like this, the inflation of the coin could be checked.

So far, Bitcoin has noticed three halving occasions: first in November 2012, second in July 2016, and third in May 2020. The subsequent such occasion is estimated to happen someday in 2024. In the start, the reward for mining a block was 50 BTC, however immediately, in any case these halvings, miners are receiving simply 6.25 BTC per block.

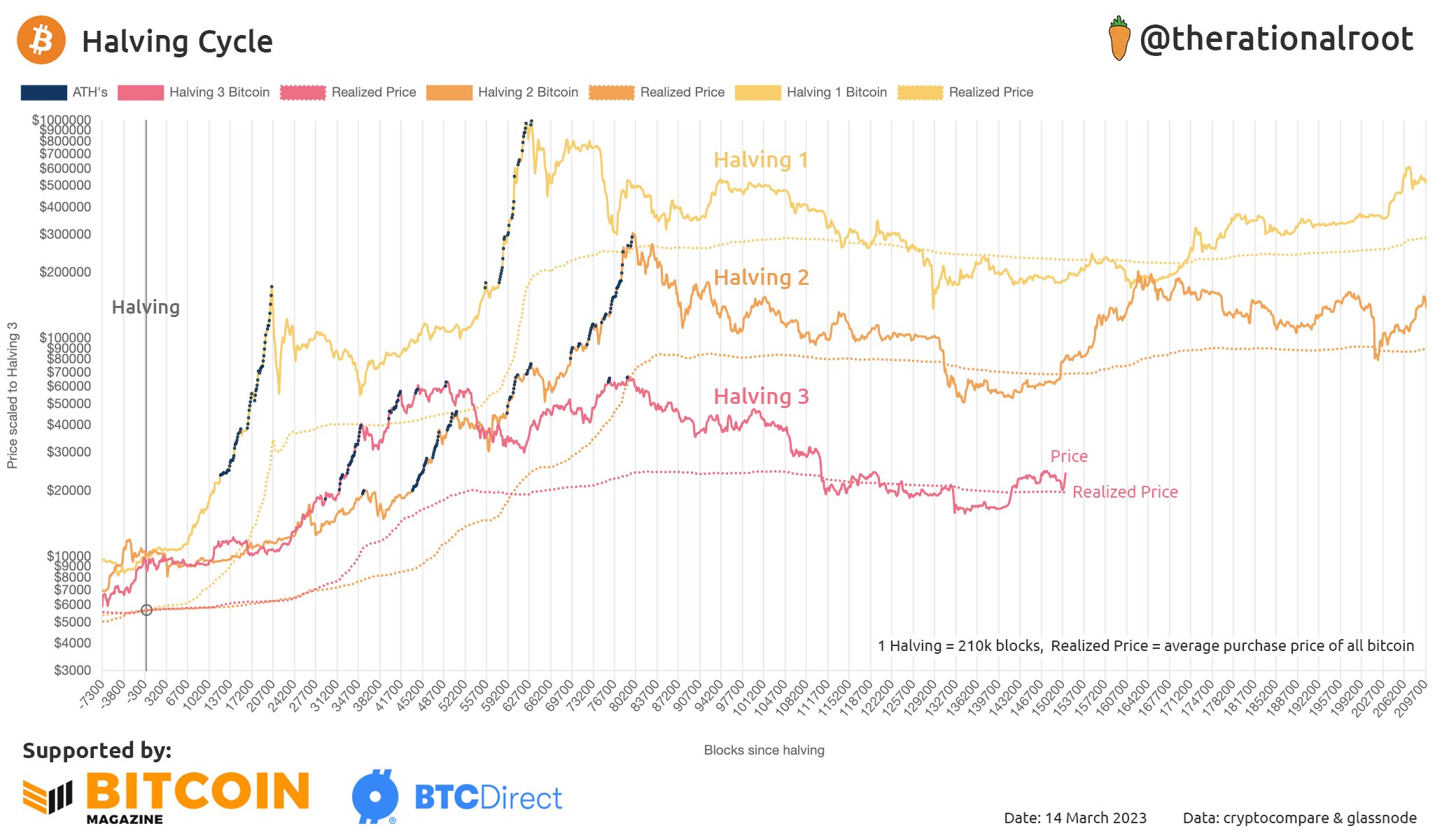

Since halvings are periodic, they’re a preferred manner of mapping BTC cycles through the use of them as the beginning and finish factors. An analyst on Twitter has achieved the identical and has in contrast the totally different cycles up to now in opposition to one another utilizing the variety of blocks because the cycle begins because the widespread denominator between them.

Here is a chart depicting this comparability:

The earlier two halving cycles in contrast with the present one up to now | Source: therationalroot on Twitter

As you may see within the above graph, the totally different Bitcoin cycles up to now have proven some comparable options. Especially the earlier and present ones share some weird similarities.

The tops of each these cycles seem to have shaped after an analogous variety of blocks had been created within the cycles. The halving 1 cycle noticed this occur earlier, however not by an excessive amount of nonetheless. The bear market bottoms of all three cycles additionally had intently timed occurrences, with the halving 2 and three cycles once more sharing a tighter timing.

Although the timing isn’t as hanging because the bottoms, the most recent cycle build up a rally out of the bear lows additionally appears much like what occurred within the second cycle, the place the April 2019 rally came about.

Something that additionally appears to have held up all through these cycles is the connection between the worth of Bitcoin and its realized worth. The realized price is a metric derived from the realized cap, which is the capitalization mannequin for the cryptocurrency that goals to offer a “fair value” for it.

In brief, what the realized worth signifies is the common acquisition worth or value foundation available in the market. This implies that when the worth dips underneath this degree, the common holder enters into the loss territory.

During bull markets, this degree has acted as help in all of the cycles, whereas this conduct has flipped in bearish durations, the place the extent has supplied resistance to the asset as a substitute.

From the chart, it’s seen that Bitcoin retested this degree very just lately and efficiently bounced off it, with the worth of the asset gaining some sharp upwards momentum.

If the sample held all through the halving cycles is something to go by, this might recommend {that a} bullish transition has now taken place available in the market and a rally much like the April 2019 rally may need begun.

BTC Price

At the time of writing, Bitcoin is buying and selling round $24,600, up 11% within the final week.

BTC has surged in current days | Source: BTCUSD on TradingView

Featured picture from iStock.com, chart from TradingView.com