Data reveals that Bitcoin buyers have turned fearful once more because the market sentiment has now dropped to the bottom worth since early January.

Bitcoin Fear And Greed Index Is Currently Pointing At “Fear”

The “fear and greed index” is an indicator that tells us concerning the normal sentiment amongst buyers within the Bitcoin (and wider cryptocurrency) market. The metric makes use of a numeric scale that runs from 0-100 for displaying this sentiment.

All values of the index above the 50 mark indicate that the buyers are grasping proper now, whereas these beneath this threshold recommend that the market is fearful presently.

Although the cutoff could also be clear in idea, in precise follow the values near 50 (between 46 and 54) are thought of to symbolize a type of “neutral” sentiment.

There are additionally two different particular sentiments, known as extreme fear and excessive greed. The former of those takes place at values underneath 25, whereas the latter happens at ranges higher than 75.

The significance of the acute worry area is that bottoms within the worth of Bitcoin have traditionally taken form when buyers have held this sentiment. Similarly, tops have fashioned whereas excessive greed has gripped the market.

Now, here’s a meter that reveals what the sentiment within the Bitcoin and wider cryptocurrency sector seems to be like in the intervening time:

The market sentiment appears to be that of worry proper now | Source: Alternative

As you possibly can see above, the Bitcoin worry and greed index presently has a worth of 34, which signifies that the buyers share a sentiment of worry proper now. This change in mentality is current, nevertheless, as the most recent worth plunge within the cryptocurrency is what has pushed buyers in the direction of being fearful.

The beneath chart reveals how the index’s worth has modified throughout the previous 12 months:

Looks just like the metric's worth has plunged in current days | Source: Alternative

From the graph, it’s seen that the metric had fairly low values throughout the Bitcoin bear market, however with the beginning of the rally in January, the sentiment had sharply improved and hit greed values.

The market sentiment stored between greed and impartial over the past couple of months since then, however over the previous two days, the indicator has plummeted. The present values of the index are the bottom since early January when the market sentiment first began to enhance. This signifies that the worth decline has successfully reset any developments that buyers made when it comes to mentality throughout the newest rally.

A optimistic takeaway from the sentiment decline, nevertheless, might be that Bitcoin could also be now extra profitable to purchase because the probabilities of a backside normally turn into greater the extra the index goes down.

A buying and selling philosophy known as contrarian investing is the truth is primarily based on this concept, the place buyers desire to purchase when the market is at its worst and promote when buyers are grasping. Perhaps it will be at instances like now {that a} contrarian investor would transfer to purchase extra of the cryptocurrency.

BTC Price

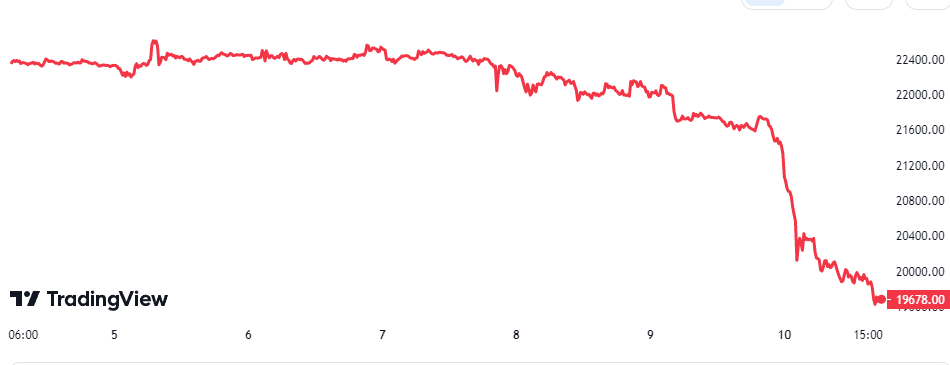

At the time of writing, Bitcoin is buying and selling round $19,700, down 12% within the final week.

BTC has plunged throughout the previous day | Source: BTCUSD on TradingView

Featured picture from Thought Catalog on Unsplash.com, charts from TradingView.com, Alternative.me