On-chain information exhibits the Bitcoin trade whale ratio has surged not too long ago. Here’s what it might imply for the value of the cryptocurrency.

Bitcoin Exchange Whale Ratio (72-Hour MA) Breaks Above 85%

As identified by an analyst in a CryptoQuant post, the BTC whale ratio is rising proper now. The “exchange whale ratio” right here is an indicator that measures the ratio between the sum of the highest 10 Bitcoin transfers to exchanges and the overall trade inflows.

Here, the ten largest transactions going towards exchanges are assumed to be coming from the whales, which signifies that the indicator’s worth tells us what a part of the overall trade inflows is being contributed by these humongous holders proper now.

When the whale ratio has a excessive worth, it means a big proportion of the trade deposits are being made by the whales at the moment. As one of many major causes traders use exchanges is for promoting functions, this sort of development can recommend whales are placing excessive promoting stress available on the market, and thus, could be bearish for the asset’s worth.

On the opposite hand, low values indicate whale influx exercise isn’t too vital in comparison with the remainder of the market, which is a development that may very well be both impartial or bullish for BTC.

Now, here’s a chart that exhibits the development within the 72-hour transferring common (MA) Bitcoin trade whale ratio over the previous few months:

The worth of the metric appears to have surged in current days | Source: CryptoQuant

As displayed within the above graph, the 72-hour MA Bitcoin trade whale ratio has climbed to a excessive worth not too long ago. This means that whales are extremely energetic by way of trade influx contributions proper now.

In the previous, the metric breaking above the 0.85 mark for extended intervals has usually proved to be bearish for the value of the crypto. At this worth, 85% of the inflows come from whale entities.

With the newest surge within the indicator, its worth has as soon as once more damaged into the area above the 0.85 stage, which might imply that whales could also be getting ready for one more main selloff.

However, for a bearish state of affairs to turn out to be possible, the Bitcoin whale ratio would wish to remain at these elevated ranges for a minimum of a number of days. Earlier within the month, proper earlier than the rally kicked off, the indicator did enter into this zone, however because the spike didn’t final for too lengthy, the coin’s worth didn’t really feel any bearish influence from it.

The chart additionally exhibits that the underside that fashioned quickly after the collapse of the crypto trade FTX was accompanied by fairly low values within the indicator, implying that low promoting stress from the whales could have helped it take form.

BTC Price

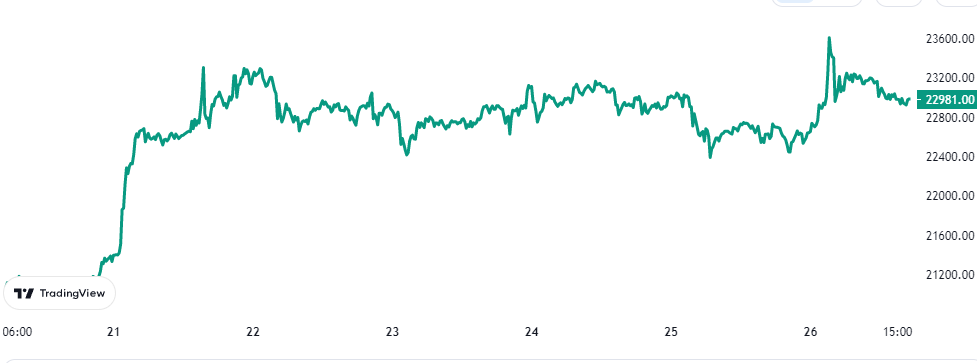

At the time of writing, Bitcoin is buying and selling round $22,900, up 11% within the final week.

Looks like the worth of the crypto hasn't moved a lot in the previous few days | Source: BTCUSD on TradingView

Featured picture from Thomas Lipke on Unsplash.com, charts from TradingView.com, CryptoQuant.com