CryptoQuant knowledge on January 20 shows an unusually sharp spike in Bitcoin miners’ outflow, an sudden growth contemplating the stable efficiency of BTC costs prior to now few buying and selling days.

Miners’ Position Index (MPI) Rising

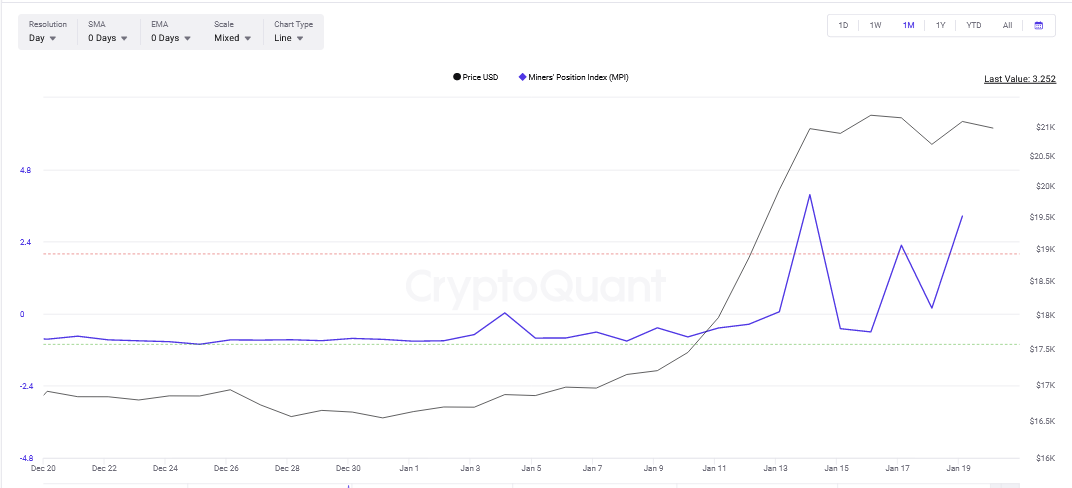

The Miners’ Position Index (MPI) is up from -0.85 registered on December 31, 2022, to +3.25 on January 19, 2023. The growth might point out that miners are transferring their cash, at a quicker tempo, to centralized exchanges.

The MPI is a transferring ratio between the entire miner outflows to the entire one-year transferring common of the entire miner outflows. All denominations are in USD.

Per CryptoQuant’s interpretation, the upper the MPI ratio, the upper the percentages that miners are sending mined cash to centralized exchanges, heightening the dangers of a worth plunge.

For a healthful image, it is suggested that the MPI be used with different metrics since there are assumptions that miners are expressly promoting their cash in high exchanges like Binance, Coinbase, and even in over-the-counter (OTC) exchanges.

Nonetheless, when used with totally different technical indicators, MPI flows can present a tough indicator of Bitcoin miners’ monetary state. The actions of the miners could present a sign of the place the market is likely to be headed subsequent.

In proof-of-work networks like Bitcoin, miners are compensated with cash to safe the platform towards exterior assaults and ensure transactions. Bitcoin distributes 6.25 BTC for each block they efficiently mine. This interprets to round $131,000 in BTC. A block is launched roughly each 10 minutes.

The worth of Bitcoin explains the upper curiosity from miners in comparison with different proof-of-work networks like Litecoin. With a hash fee of 275 EH/s as of January 20, Bitcoin stays probably the most safe blockchain by this metric.

Bitcoin Miners Have to Sell

Miners must expend power and purchase gear and for this reason they’re mentioned to be obligatory sellers. Miners, due to this fact, have to maneuver cash to crypto exchanges for money to pay for providers corresponding to electrical energy or chipset producers to stay aggressive.

Since the Bitcoin community is clear and all actions will be tracked, devoted analytics’ platforms and merchants typically monitor their actions. Recent knowledge factors to those miners transferring cash, presumably to exchanges for money.

The spike from -0.85 to +3.25 coincides with the stalling of Bitcoin costs under $21,500. This retracement follows a pointy growth that noticed the coin energy above $20,000 with rising participation ranges, as buying and selling volumes present.

Analysts mentioned the revival is due to shifting macroeconomic elements, particularly within the United States, and up to date knowledge exhibits that inflation is falling and labor situations are firming after the results of COVID-19.

Feature picture by Andrey Rudakov/Bloomberg, chart by Trading View