SSV Network is a fast-growing supplier of liquid staking infrastructure.

The builders launched a $50 million ecosystem progress fund.

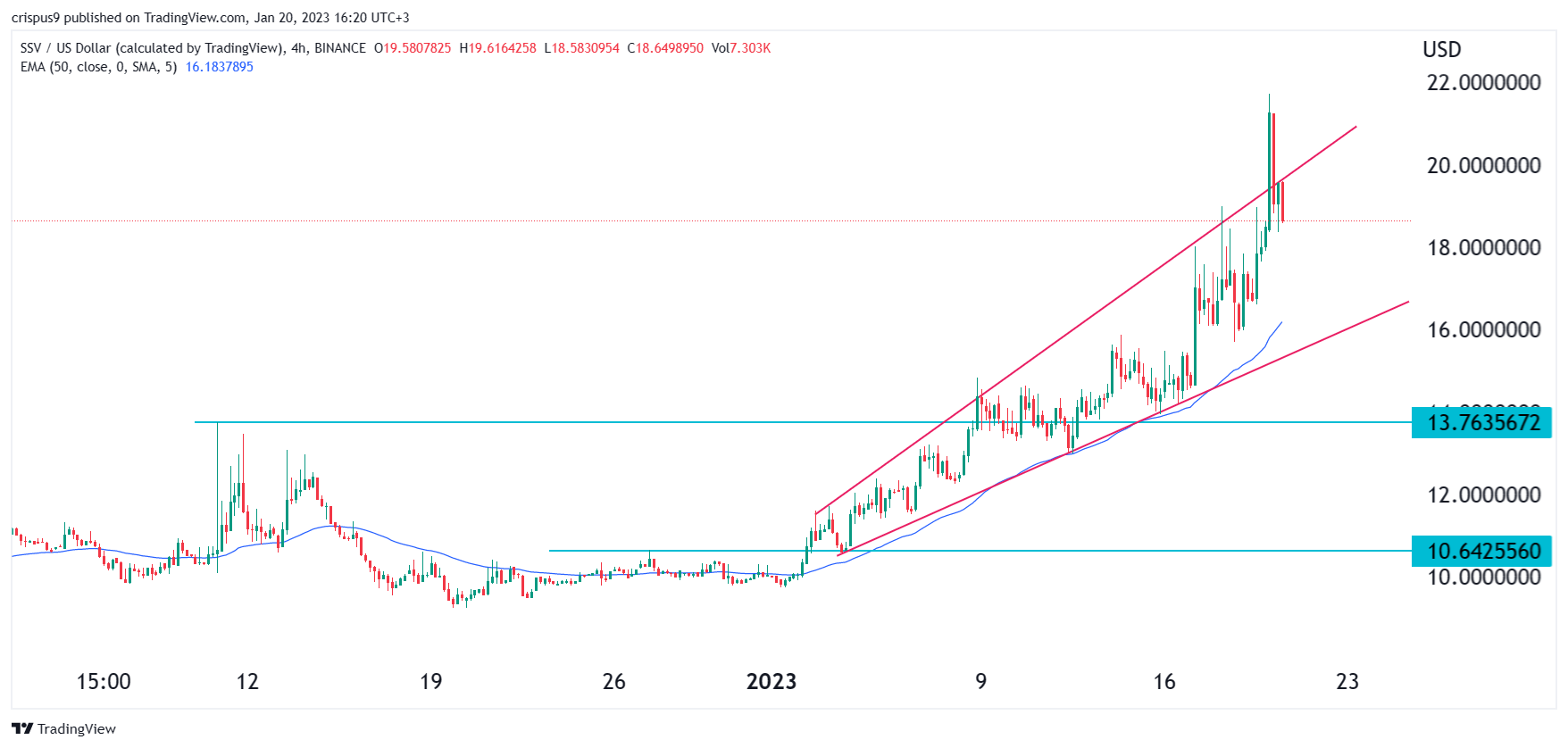

It has fashioned a rising broadening wedge and a bearish engulfing sample.

Liquid staking is doing properly as buyers look ahead to the upcoming Ethereum’s Shanghai improve. Lido DAO, the most important liquid staking supplier, has grown to change into the most important DeFi supplier on this planet. And SSV, a number one liquid staking infrastructure supplier, has seen its token develop by greater than 91% this yr.

SSV launches ecosystem fund

SSV Network introduced that it was launching a brand new $50 million ecosystem fund in a bid to develop its ecosystem. For starters, SSV doesn’t supply liquid staking itself. Instead, it companions with staking suppliers like Lido to supply a distributed validator know-how (DLT) resolution. By so doing, most builders can concentrate on what they do greatest.

SSV Network mentioned that the fund will go to builders engaged on the DVT know-how. It comes a yr after the builders launched a $3 million fund. It has distributed a few of these funds to corporations like Ankr, Stader, and Moonstake. SSV additionally allotted $10 million in 2022 as we wrote here. In a press release, the co-lead of SSV community mentioned:

”Distributing Ethereum’s safety layer has by no means been extra vital. The protocol is at present secured by a small group of corporations that, when put collectively, management the complete Blockchain. DVT’s purpose is to distribute Ethereum’s safety by providing fast and quick access to an open-source public good.”

The main catalyst for the SSV token price would be the upcoming Shanghai improve that may let Ethereum holders be capable to withdraw their staked cash. Another catalyst for the token will likely be SSV’s mainnet launch which can occur within the subsequent few months. Its testnet is already up and working. It has 763 operators and 5,307 validators with 168,824 ETH staked. At the present price, the quantity is value over $260 million.

SSV crypto price forecast

The 4H chart reveals that the SSV Network price has been in a gentle bullish pattern up to now few months. However, a better look reveals that a number of bearish patterns have began forming. The token has fashioned a bearish engulfing sample, which is often a warning signal. Further, the token has fashioned an ascending broadening wedge sample. In price motion evaluation, this sample can be a bearish signal.

Therefore, the outlook for SSV crypto price is bearish, with the subsequent stage to look at would be the decrease aspect of the ascending wedge at $16. The pattern invalidation level for this commerce will likely be at this week’s excessive of $21.67.