As Bitcoin continues its sturdy rally, $22,400 could possibly be the extent to look at subsequent, if this on-chain metric is something to go by.

Bitcoin Long-Term Holder Realized Price Is Currently Around $22,400

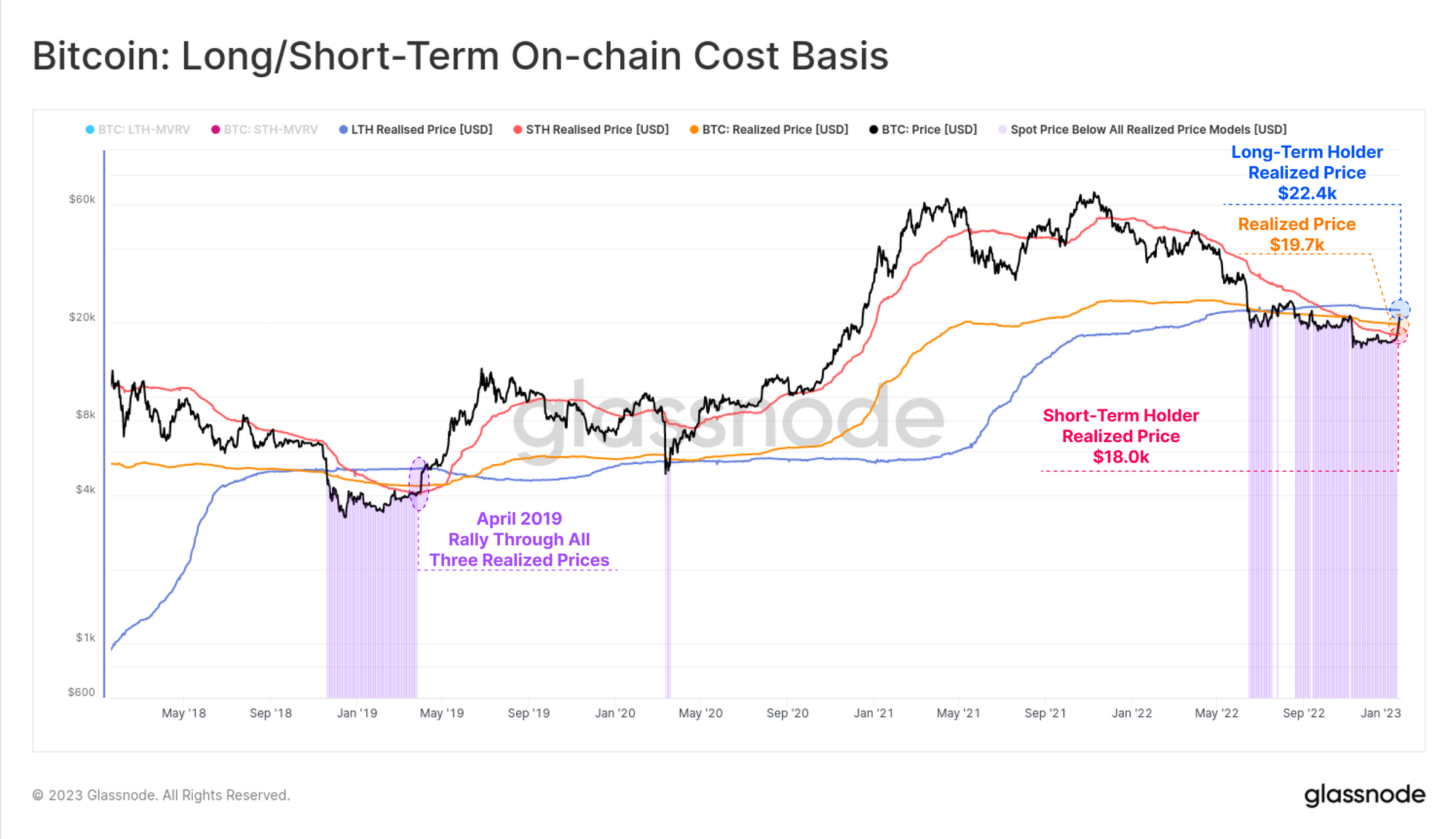

According to the newest weekly report from Glassnode, BTC broke by way of all three realized costs of the market again in April 2019. To perceive the idea of “realized price,” the realized cap must be checked out first. The realized cap is a capitalization mannequin for BTC that values every coin in circulation on the worth it was final transacted.

This is totally different from the standard market cap, which places the worth of all tokens on the identical present worth of Bitcoin. When the market cap is split by the full variety of cash in circulation, the BTC worth is obtained, a proven fact that isn’t surprising in any respect, because the market cap is calculated by multiplying the worth by the variety of cash to begin with.

However, if this identical concept is utilized to the realized cap (that’s if it’s divided by the variety of cash), a type of “realized price” will be derived. The significance of this worth is that it’s the associated fee foundation of the common holder within the Bitcoin market.

The implication of that is that if the (regular) worth of BTC declines underneath this realized worth, the common investor will be thought to have entered right into a state of loss.

All traders available in the market will be divided into two main cohorts: the “short-term holders” (STHs) and the “long-term holders” (LTHs). The former contains traders who acquired their cash lower than 155 days in the past, whereas the latter consists of holders who’ve been holding their cash for greater than that interval.

Now, here’s a chart that reveals the pattern within the realized worth for the whole Bitcoin market, in addition to that for the STHs and LTHs, during the last 5 years:

Looks like the worth of the crypto has damaged previous all however certainly one of these metrics | Source: Glassnode The Week Onchain - Week 3, 2023

As proven within the above graph, the BTC worth had been beneath all three of those realized costs for a lot of the bear market, suggesting that the common Bitcoin investor in all of the cohorts was carrying an unrealized loss.

However, in the newest rally, the crypto has to date managed to interrupt above the STH price foundation ($18,000), in addition to that of the whole market ($19,700). The LTH realized worth of about $22,400 is but to be reached by the coin.

The same rally happened again in April 2019, which marked the tip of the 2018-2019 bear market. But in that rally, Bitcoin managed to rise above all three of the realized costs.

If an identical transition is really going down on this bear market as properly, then the $22,400 stage could possibly be the one to look at for subsequent, as a break above it may indicate a return in direction of a bullish regime.

BTC Price

At the time of writing, Bitcoin is buying and selling round $21,100, up 22% within the final week.

BTC continues to maneuver sideways | Source: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com