Data reveals a considerable amount of shorts have been liquidated within the Bitcoin futures market previously day as BTC pushes above $19,000.

$93 Million Bitcoin Shorts Were Wiped Out In Only 1 Hour

As per information from the on-chain analytics agency Glassnode, quick liquidations have spiked previously day. A “liquidation” takes place when a by-product alternate has to forcibly shut up a contract on the Bitcoin futures market.

Contracts normally liquidate when a sure proportion of the margin – the collateral quantity that the holder needed to put up with the intention to open the place, is misplaced as a result of BTC value shifting reverse to the route the investor bets on.

In the crypto futures market, massive liquidations taking place without delay isn’t an unusual sight attributable to a few causes. First, a lot of the property within the sector are typically very risky, so sudden value swings can happen with out warning.

And second, many by-product exchanges supply leverage (a mortgage quantity taken towards the margin) as excessive as 100x within the authentic place. High leverage being accessible in a risky atmosphere like this ends in a big threat of positions being liquidated.

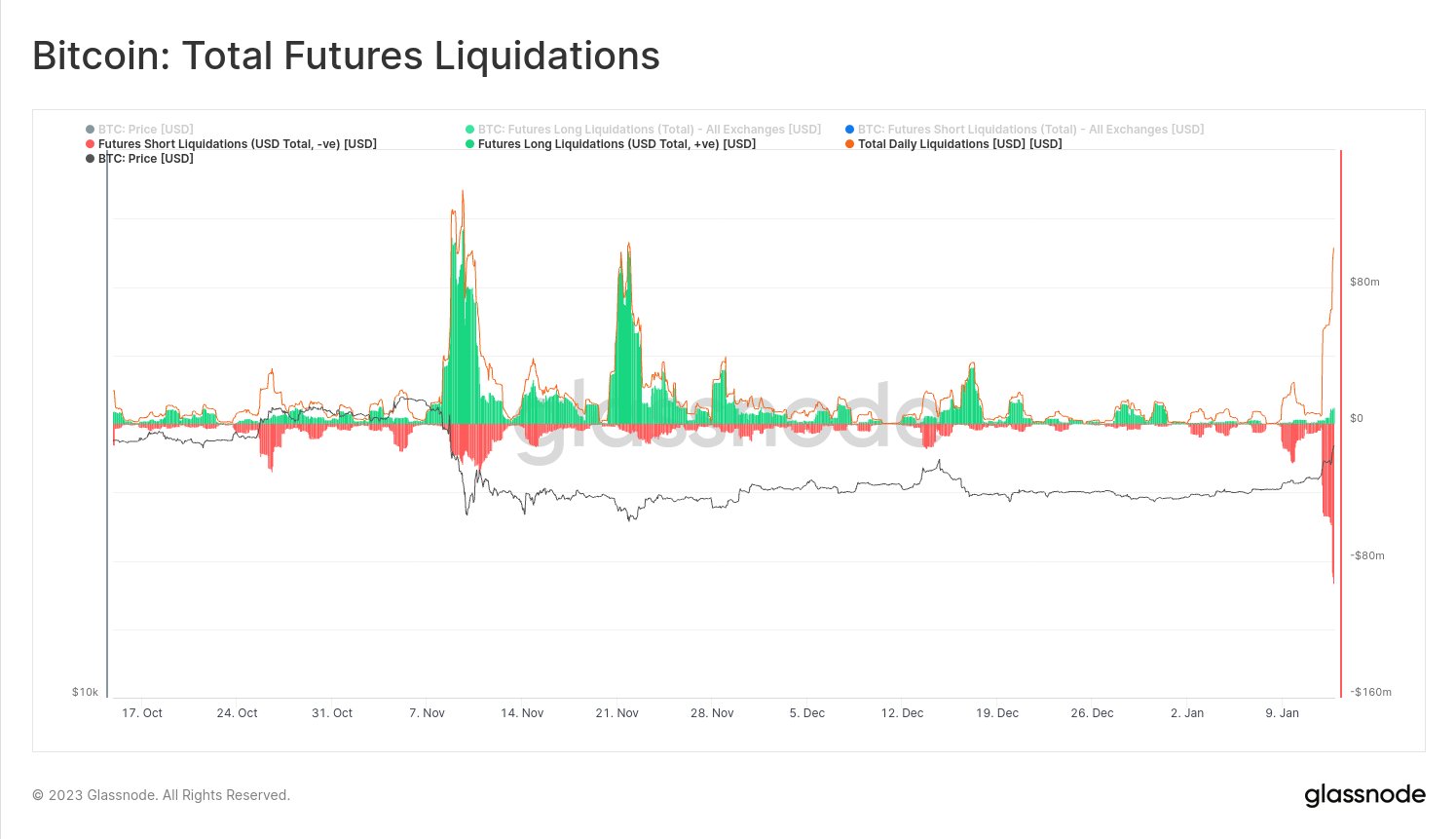

Now, the related indicator right here is the “total futures liquidations,” which tracks the entire quantity of each quick and lengthy liquidations which can be happening within the Bitcoin futures market at present.

Here is a chart that reveals the pattern on this metric over the previous few months:

The worth of the metric appears to have been deep pink in current days | Source: Glassnode on Twitter

As displayed within the above graph, the Bitcoin futures liquidations have largely concerned quick contracts in the previous few days. This pattern is sensible, as a pointy upwards transfer within the value was the set off for these liquidations.

During the FTX crash again in November, which noticed the alternative sort of value transfer, numerous longs have been worn out as an alternative, as will be seen from the chart.

Usually, a big sufficient fast transfer within the value can set off simultaneous mass liquidations that solely feed mentioned value transfer additional. This amplified value transfer then liquidates much more contracts, and on this approach, liquidations cascade collectively. A mass liquidation occasion like that is popularly known as a “squeeze.”

Glassnode notes that $93 million briefly contracts have been flushed in only a single hour through the previous day. These fast liquidations counsel the Bitcoin rally triggered a brief squeeze within the futures market.

The value has now shot up much more following this squeeze, as is usually the case, and BTC is now above $19,000 for the primary time because the collapse of the crypto alternate FTX.

BTC Price

At the time of writing, Bitcoin is buying and selling round $19,000, up 13% within the final week.

(*1*)

Looks like BTC has climbed up within the final couple of days | Source: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com