The Grayscale Bitcoin Trust (GBTC) took a shocking growth yesterday, Monday, January 9, when the world’s largest personal BTC fund rose 12% in value. As TradingView data reveals, the GBTC share value stood at $8.65 on the shut of buying and selling on Friday. However, throughout the course of Monday, GBTC noticed sudden shopping for stress that pushed the worth to $9.72.

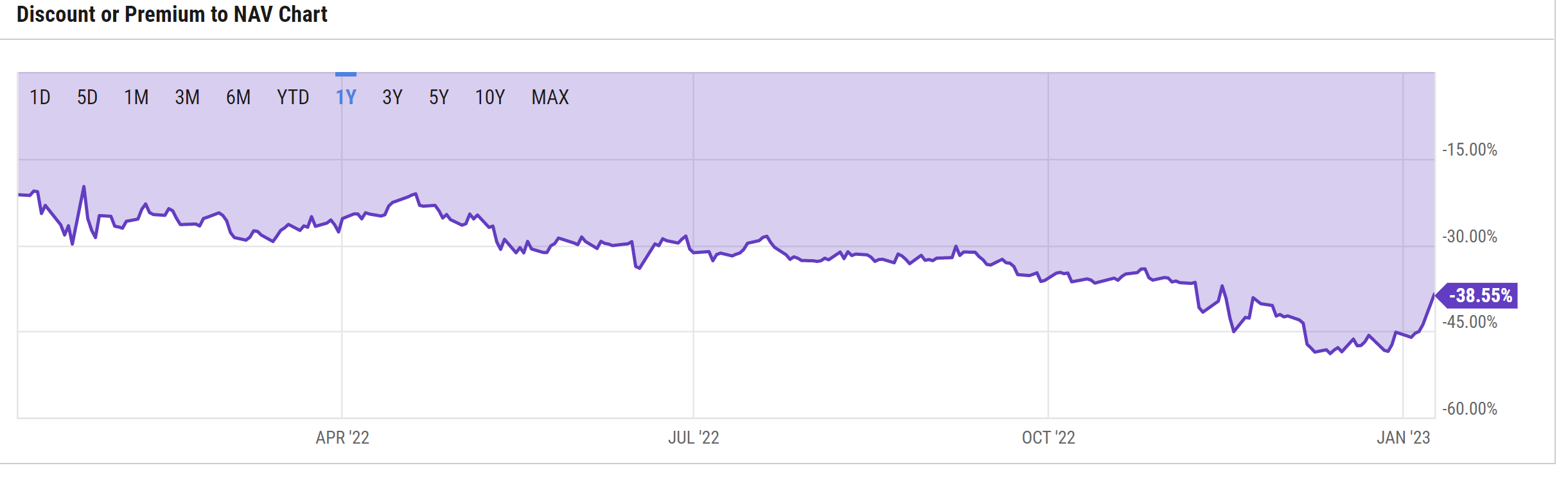

In distinction, the Bitcoin spot value stagnated across the $17,200 degree yesterday. This circumstance has contributed to the GBTC low cost shrinking considerably. Already within the first days of the yr, GBTC noticed an upswing in comparison with the spot market. While the low cost was 49% on December 30, yesterday the worth dropped to 38%.

A Strange Timing For GBTC To Rise

The growth could come as a shock to many, because the scenario surrounding Digital Currency Group (DCG) has continued to accentuate over the previous few days as a substitute of easing.

Remarkably, yesterday’s rally comes after Gemini co-founder Cameron Winklevoss let his deadline towards DCG CEO Barry Silbert move with out remark. Winklevoss had given Silbert a deadline of Sunday to launch the $900 million in frozen Gemini Earn shopper funds from Genesis Trading.

However, the expired deadline remained with no response from Cameron Winklevoss yesterday, though he gave the impression to be extraordinarily combative in his January 2 letter. As Ram Ahluwalia of Lumida Digital Assets Advisors defined on the Unchained podcast, Gemini can now file an involuntary Chapter 11 chapter towards Genesis following the expiration of the deadline to pressure the corporate to pay excellent creditor money owed.

In that case, Genesis could be bancrupt, transferring the debt to DCG, which itself has liquidity issues and maybe extra. Whether Winklevoss will make the transfer is questionable at this level, as issues went quiet round him yesterday. As analyst Samuel Andrew reported in a tweet, Genesis Trading collectors reportedly voiced:

[W]e knew in regards to the SEC a month in the past, however EDNY (DOJ) is a significant issue, [which] made everybody pause over the weekend.

Bitcoinist reported that the U.S. authorities are investigating the interior transfers between the billion-dollar crypto conglomerate and its crypto-lending arm. As Andrew assesses, the investigation by the Department of Justice of the Eastern District of New York (EDNY) is “another reason why anyone that expects a quick resolution to anything related to Genesis/Gemini should adjust those expectations.”

Redeem Grayscale’s Bitcoin Campaign Gathers Momentum

While Barry Silbert practices stalling ways, trade veteran David Bailey has launched the “Redeem GBTC Campaign” to present shareholders a voice. The group of shareholders needs to make sure that the belief is managed in a method that maximizes worth for all shareholders.

The marketing campaign has three objectives: a “credible” path to redemptions that minimizes the impression on the Bitcoin market, a discount in administration charges and a change in administration, in addition to a aggressive bidding course of for brand new sponsors of the belief.

In one among his latest tweets, Bailey revealed that the marketing campaign is choosing up large momentum. He mentioned, “We’ve now heard from 2,000 investors, representing ~25% of the shares. It’s time for change.” Bailey additionally added that:

DCG offered a fiction to Wall Street. They thought they may by no means lose management as a result of the shares are distributed so extensively throughout 850k shareholders. They laughed as they pillaged retail and retirees. Little did they know we might combat again. They’ve made 850k enemies.

What prompted the spike within the GBTC value yesterday can solely be speculated. But one motive may be arbitrageurs making the most of the huge low cost.

At press time, the Bitcoin value stood at $17,194, persevering with its slight uptrend during the last 10 days.

Featured picture from Dmitry Demidko | Unsplash, Chart from TradingView.com