On-chain knowledge reveals that Ethereum realized volatility has now declined to uncommon ranges noticed solely 3 times earlier than in historical past.

Ethereum 1-Month Realized Volatility Has Plummeted To Just 39.8%

As per knowledge from the on-chain analytics agency Glassnode, the month of December 2022 was traditionally quiet for each Ethereum and Bitcoin. The “realized volatility” is an indicator that measures the usual deviation of day by day returns from the imply for the market in query.

The indicator is often taken over a rolling window, with the one-week and one-month variations being typically essentially the most helpful timespans for it. In the context of the present dialogue, the related metric is the one-month realized volatility.

When the worth of the metric is excessive, it means the asset’s worth has been exhibiting larger fluctuations from the common not too long ago. Such a development implies that the market is offering a excessive buying and selling danger at present. On the opposite hand, low values counsel returns haven’t deviated a lot from the imply, and therefore that the worth has been caught in stale consolidation.

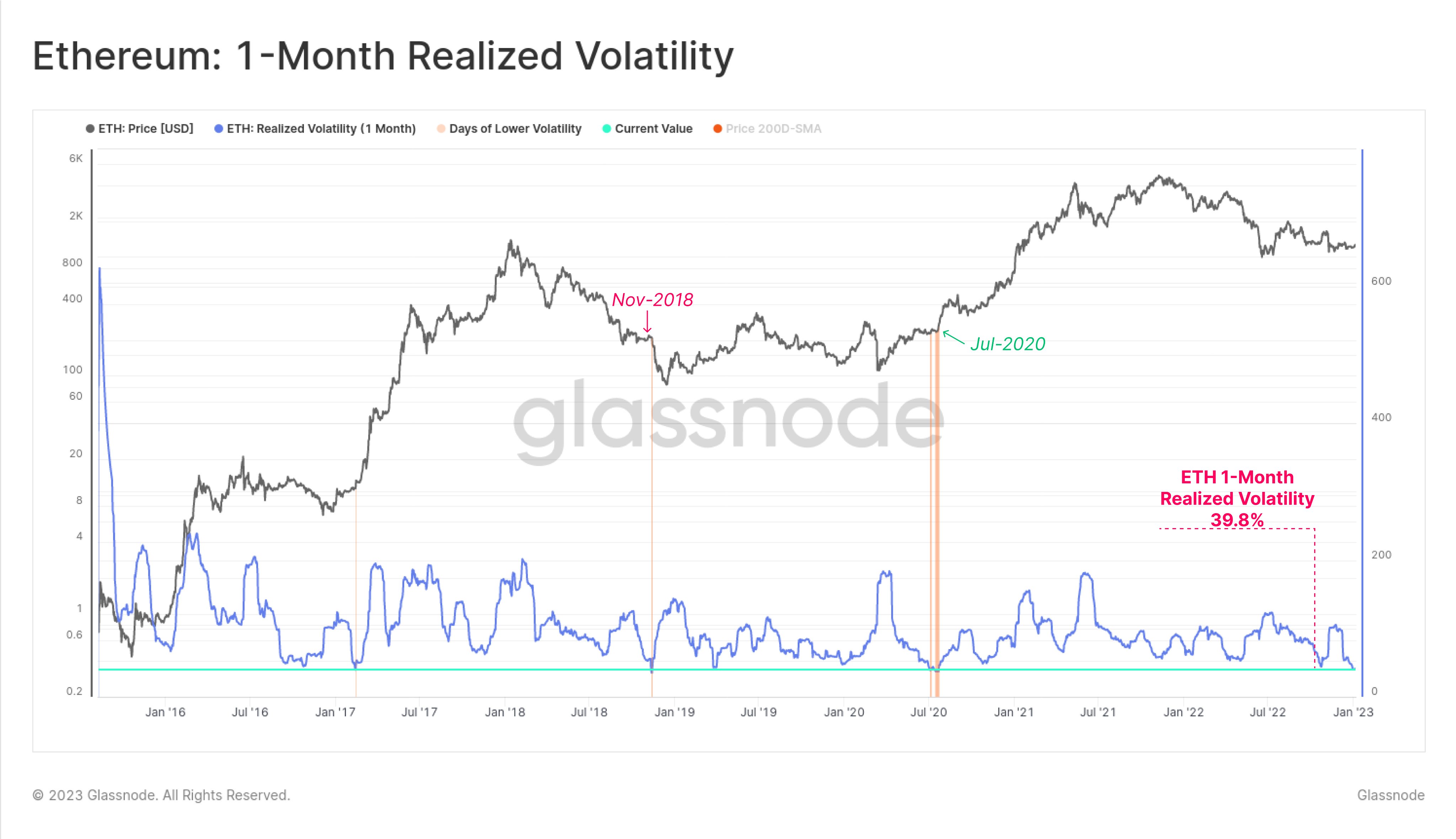

Now, here’s a chart that reveals the development within the one-month Ethereum realized volatility over the previous couple of years:

Looks like the worth of the metric has declined in current days | Source: Glassnode on Twitter

As displayed within the above graph, the Ethereum one-month realized volatility has plunged to only 39.8% not too long ago, suggesting that the previous month has had little or no range in day-to-day returns. This present degree of the indicator is definitely a traditionally low worth, and as is obvious from the chart, there have solely been three situations within the historical past of the crypto the place the worth has been this steady.

Interestingly, after every prevalence of the volatility hitting these lows, the worth has made a pointy transfer and the indicator has jumped again up. An necessary instance of this was again in November 2018, when the worth of ETH collapsed towards the underside of the bear market in a sudden transfer, after the metric had reached these uncommon ranges.

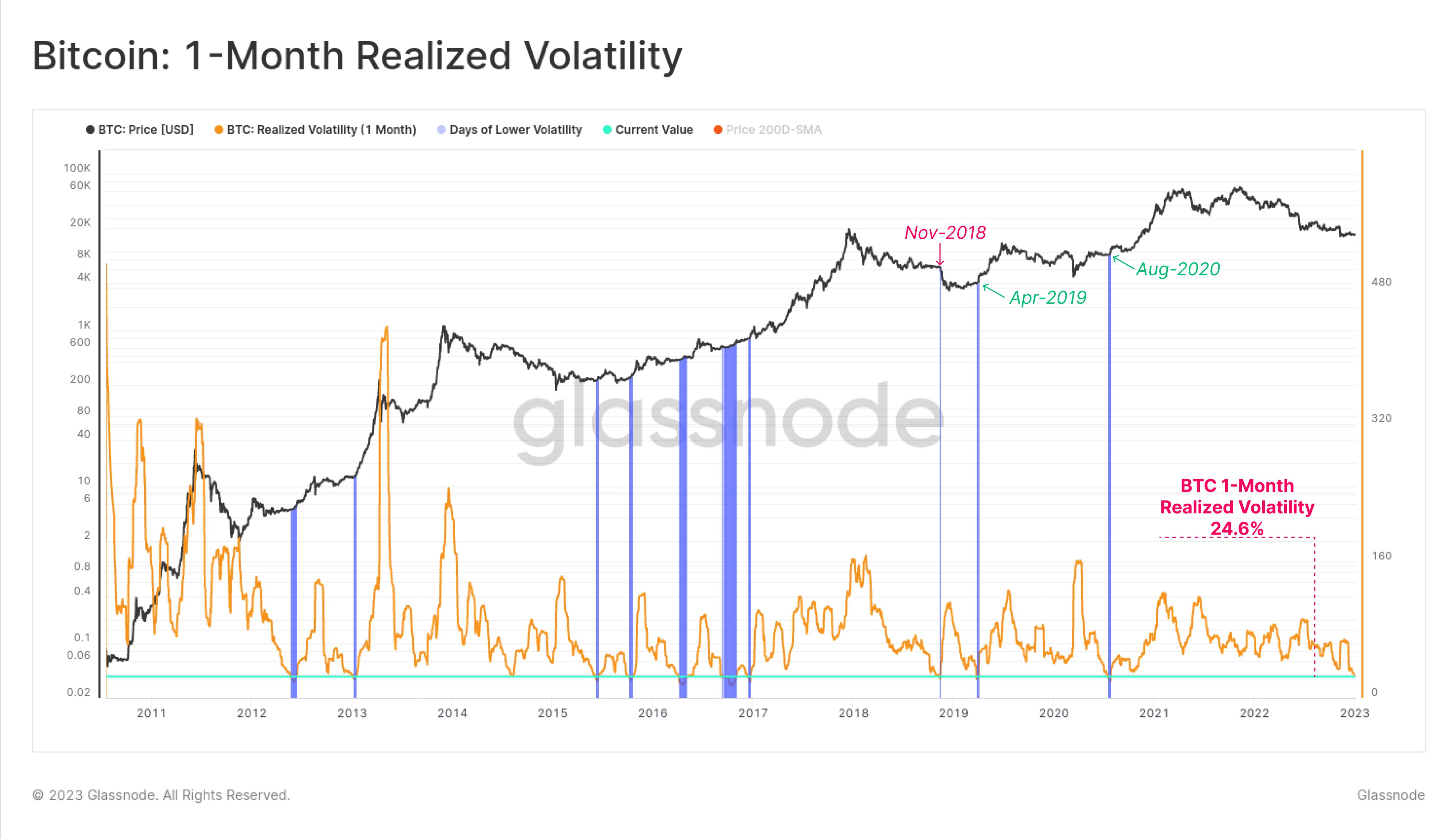

Glassnode additionally factors out that, identical to for Ethereum, the one-month realized volatility for Bitcoin has additionally plunged to historic lows not too long ago, because the under chart highlights.

The worth of the metric appears to have hit very low values not too long ago | Source: Glassnode on Twitter

As you possibly can see above, the Bitcoin one-month realized volatility has solely been decrease than the present worth (24.6%) just a few occasions in all the historical past of the crypto. A notable occasion right here was additionally in November 2018, the place, identical to ETH, BTC crashed all the way down to type its backside.

If these historic traits are something to think about, then the present extraordinarily low values within the one-month volatility for Ethereum and Bitcoin might imply each the cryptos could quickly see a big spike within the metric quickly, however the accompanying worth transfer might be towards both route.

ETH Price

At the time of writing, Ethereum’s price floats round $1,300, up 8% within the final week.

ETH has shot up in the course of the previous day | Source: ETHUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com