On-chain information exhibits the Bitcoin inflows to Coinbase have spiked just lately, an indication which will transform bearish for the crypto.

Bitcoin Exchange Inflows To Coinbase Register High Values

As identified by an analyst in a CryptoQuant post, a complete of 20k BTC was transferred to Coinbase just lately. The “exchange inflows” is an indicator that measures the whole quantity of Bitcoin presently being transferred to an trade (which, on this case, is Coinbase).

When this metric’s worth is excessive, traders ship many cash to the trade proper now. Since one of many predominant causes holders deposit to exchanges is for selling-related functions, this pattern can have bearish implications for the value of the crypto.

On the opposite hand, low values counsel traders aren’t making many deposits to the trade. Such a pattern may both be bullish or impartial for BTC, relying on whether or not the market-wide inflows are additionally down or not.

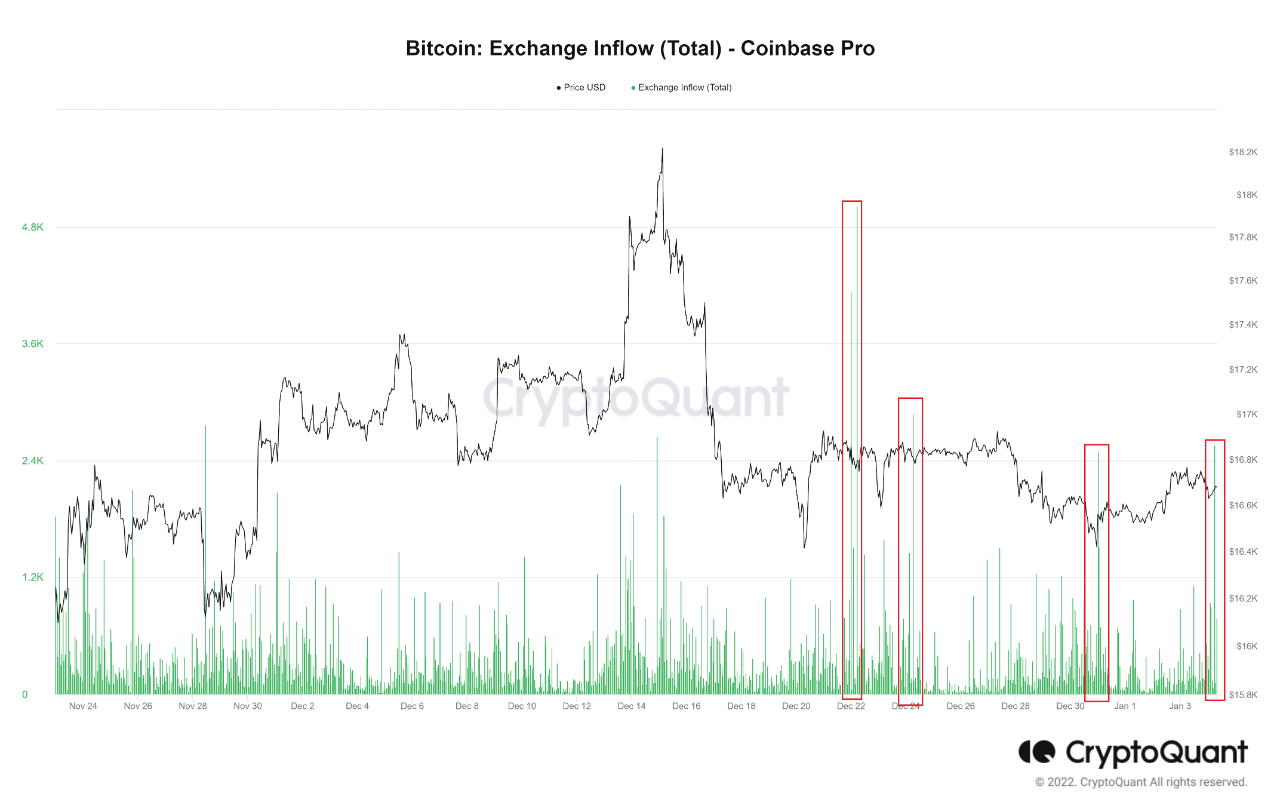

Now, here’s a chart that exhibits the pattern within the Bitcoin inflows to the crypto exchange Coinbase over the past couple of months:

Looks like the worth of the metric has been excessive on a number of events in current days | Source: CryptoQuant

As proven within the above graph, the Bitcoin trade influx to Coinbase has recorded many sizeable spikes within the final couple of weeks. However, as is obvious, there have been no important value strikes following any of those massive deposits.

These spikes weren’t that massive individually. So if the traders who made these transfers dumped their cash as quickly as they accomplished the transactions, it might make sense that they couldn’t trigger any volatility.

However, the quant notes that there might be one other state of affairs right here. What if the holders liable for these inflows haven’t pulled the set off on the promoting but? It’s commonplace for traders to deposit their cash to exchanges prematurely, ready for the precise actions within the value to exit.

All these transfers amounted to round 20,000 BTC coming into into Coinbase’s wallets. At the present trade charge, this stack could be value round $336 million, which is definitely massive sufficient to trigger volatility within the crypto’s value if offered .

“Of course, if it were sold right after the deposit, the situation would be different, but you need to be careful if it hasn’t been sold yet,” cautions the analyst.

BTC Price

At the time of writing, Bitcoin is buying and selling round $16,800, up 1% within the final week.

BTC appears to have seen a small improve in the previous few days | Source: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com