On-chain information exhibits the Bitcoin alternate whale ratio has continued to say no just lately, an indication that will show to be bullish for the crypto’s value.

Bitcoin Exchange Whale Ratio 72-Hour MA Has Been Going Down Recently

As identified by an analyst in a CryptoQuant post, the bitcoin alternate ratio on a 72-hour shifting common has been on a decline. The “exchange whale ratio” is an indicator that measures the ratio between the sum of the highest 10 Bitcoin transactions to exchanges and the full exchange inflow.

Since the ten largest deposits to exchanges are often from the whales, this metric tells us what a part of the full alternate inflows is being contributed by these humongous holders. Thus, when the worth of the indicator is excessive, it means whales are making up a excessive a part of the inflows proper now.

As one of many most important causes buyers deposit to exchanges is for promoting functions, this type of development could be a signal of heavy dumping from this cohort, and will subsequently be bearish for the worth of the crypto. On the opposite hand, low values of the ratio indicate whales aren’t making a disproportionate contribution to the inflows at present, which might be bullish for the value of BTC.

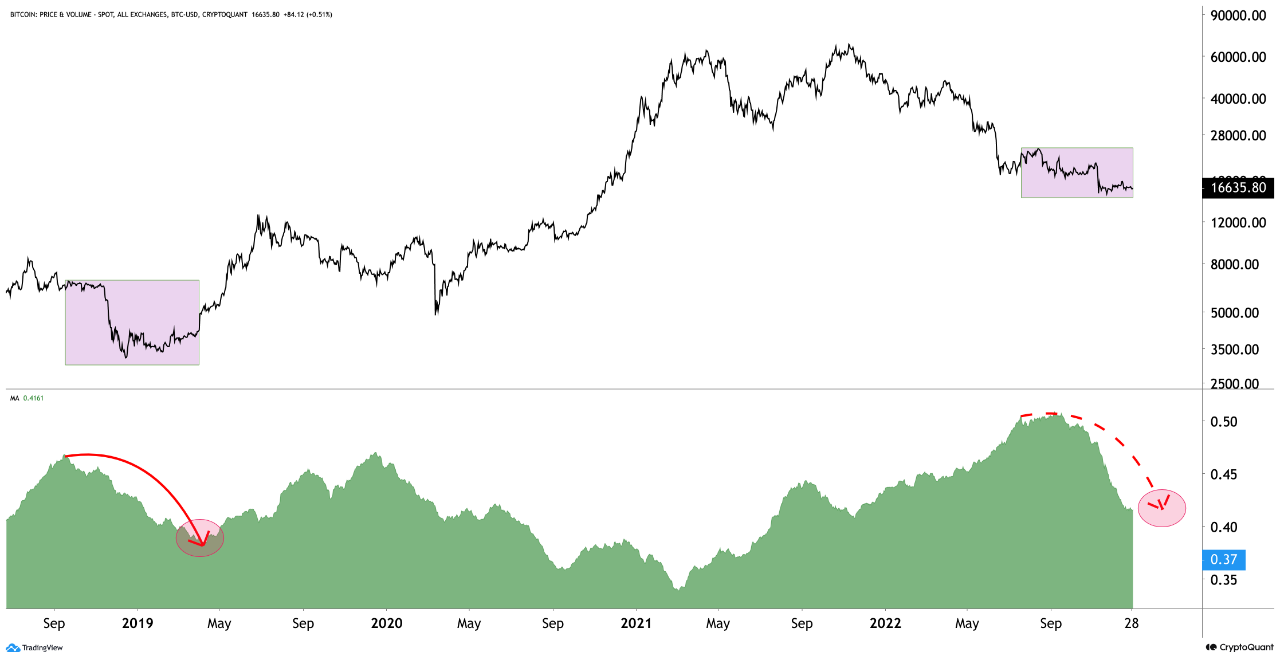

Now, here’s a chart that exhibits the development within the 72-hour shifting common (MA) Bitcoin alternate whale ratio over the previous few years:

The 72-hour MA worth of the metric appears to have noticed some downtrend in latest months | Source: CryptoQuant

As the above graph shows, the 72-hour MA Bitcoin alternate whale ratio was rising within the first half of the 12 months, exhibiting that whales have been more and more dumping the coin as the value plummeted. By Q3 2022, nonetheless, the metric noticed a slowdown, and in the previous few months of the 12 months, the development had reversed and the indicator began a downtrend.

This implies that whales have been dropping their promoting strain just lately. Interestingly, an analogous sample was additionally seen within the interval between late 2018 and early 2019, as will be seen from the chart. In that cycle’s bear market, this development within the whale ratio coincided with the value bottoming out.

Once the whale ratio had completed its decline in that bear market, Bitcoin lastly started to see some upwards momentum. If the identical development follows this time as nicely, then the present downtrend of the whale ratio might additionally result in some bullish aid for BTC buyers.

BTC Price

At the time of writing, Bitcoin’s value floats round $16,700, down 1% within the final week.

Looks like the worth of the crypto has gone up throughout the previous day | Source: BTCUSD on TradingView

Featured picture from Dylan Leagh on Unsplash.com, charts from TradingView.com, CryptoQuant.com