According to a filing with the SEC, the crypto-favoring firm MicroStrategy has elevated its Bitcoin (BTC) holdings by buying roughly 2,395 BTC for a complete of $42.8 million in money between November 1 and December 21. This transaction came about by means of the corporate’s MacroStrategy subsidiary. However, in accordance with the official announcement, the corporate has additionally parted methods with a small chunk of its Bitcoin assets.

MicroStrategy Sells 704 Bitcoins

The following day, on December 22, the company bought roughly 704 Bitcoin for a complete of $11.8 million, with the expectation that the loss will outweigh prior capital features. The transaction that might end in a tax profit came about at a median worth of round $16,776 per Bitcoin.

Read More: Crypto Analyst Predicts Bitcoin (BTC) Bull Run In 2023

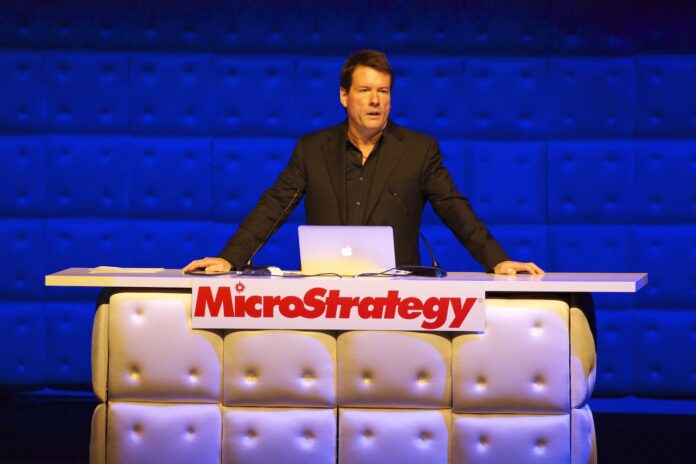

Bitcoin maximalist Michael Saylor made the announcement on Wednesday that MicroStrategy has purchased 2,500 Bitcoins for round $42.8 million. As of the twenty seventh of December, the agency possesses near 132,500 Bitcoins, which have been bought for greater than $4 billion at a median worth of $30,397 per coin.

The U.S. based mostly analytics firm stated in its submitting,

MacroStrategy acquired roughly 810 bitcoins for roughly $13.6 million in money, at a median worth of roughly $16,845 per bitcoin, inclusive of charges and bills.

MicroStrategy’s Crypto Push

According to the submitting made on December twenty eighth, the enterprise has reportedly bought roughly $46.4 million price of shares, which is a part of a beforehand revealed technique to promote as much as $500 million price of Class A typical inventory; that it may possibly use to boost the quantity of Bitcoin it possesses.

During premarket buying and selling, the worth of MSTR shares has moved fractionally increased. And, on the time of writing, the worth of Bitcoin is presently being traded at $16,660. This represents a lower of 1.09% on the day, with an additional decline of 1.10% throughout the week as per crypto market tracker CoinMarketCap.

Also Read: Popular Crypto Influencer Picks His Top 3 Cryptos For 2023 Bull Run

The offered content material might embrace the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty in your private monetary loss.