The unlocking of hundreds of thousands of {dollars} price of DeFi tokens in 2023 might spark a big selloff as traders dump dangerous property throughout an prolonged bear market.

Several crypto tasks, together with move-to-earn undertaking Sweatcoin and (*3*) Yuga Labs, will launch further tokens into circulation based mostly on a vesting schedule in 2023, regardless of a lot of the crypto market nonetheless feeling the consequences of the collapses of serious crypto companies, together with Three Arrows Capital, Celsius, and FTX.

Vesting Schedules in Crypto Projects

Projects lock their native token into particular “vesting” good contracts to make sure the managed launch of their token at predetermined dates. A vesting schedule additionally reassures traders that the undertaking’s creators are dedicated to fulfilling the undertaking’s final objective.

While a token launch will increase a token’s market cap, traders typically promote their new tokens throughout troublesome macroeconomic situations, ensuing in value dumps.

Price information surrounding earlier token releases typically offers a window into the consequences of future releases. Here, we have a look at the potential for main sell-offs of three cryptos slated for main token releases in 2023.

Sweatcoin Could Dump 30% if Bear Market Continues

The first crypto token that would see a market dump in 2023 is Sweatcoin.

Launched in Sep. 2022 on the NEAR blockchain, Sweatcoin rewards its app customers with SWEAT utility tokens for exercising.

Sweatcoin’s good contracts will launch 326,223,776.52 SWEAT ($3,500) on Jan. 13, 2023, for a SWEAT airdrop and contributions to the SWEAT treasury, with additional unlocking of 227,105,696 SWEAT ($2,430.03) scheduled for Aug. 2023. These unlocked tokens symbolize roughly 2% of the SWEAT’s each day buying and selling quantity, in accordance to market information aggregator Coingecko.

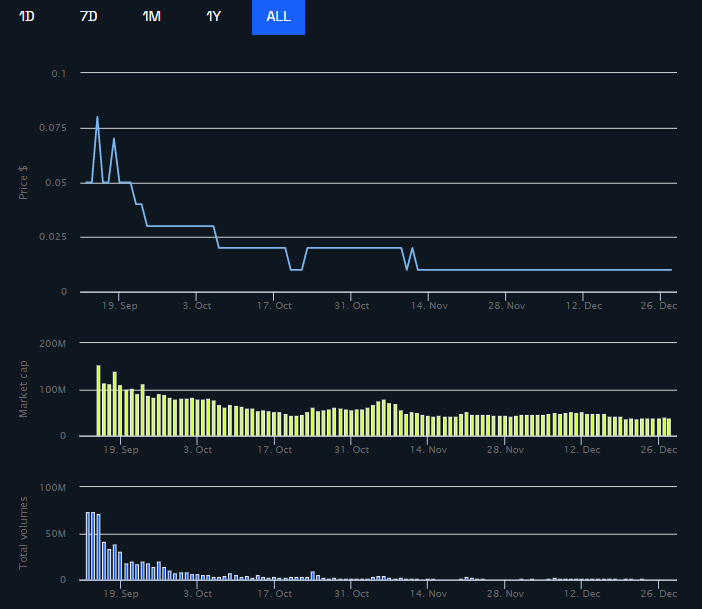

SWEAT’s preliminary airdrop of roughly 2 billion utility tokens noticed the worth spike to roughly $0.915 on Sep. 15, 2022. The subsequent unlocking of roughly 583 million SWEAT a few week later prompted the worth to tank 40%, whereas two later unlockings of comparable proportion prompted the worth to fall 20% and 30%, in accordance to information from Coingecko.

These numbers recommend Sweatcoin might drop as a lot as 30% to beneath $0.01 after 2023 token releases.

BitDAO Could Fall Below $0.25 after the Release of 188 Million BIT

The second crypto token to be careful for is Ethereum-based BIT, a tradeable governance token of BitDAO. BitDAO is a decentralized autonomous group that helps DeFi tasks via analysis and improvement, token swaps, and grants.

According to TokenUnlocks, BitDAO will launch about 188 million BIT ($53 million) on Jan. 15, 2023, representing about ten occasions the token’s buying and selling quantity.

BitDAO good contracts launched 2 billion BIT tokens in July 2021, inflicting BIT’s value to spike to $1.72 earlier than falling roughly 22% on Sep. 8, 2022. The value dropped 11% after releasing roughly 267 million BIT on Sep. 15, 2022, with an prolonged downtrend that noticed the token altering fingers at roughly $0.28 at press time.

An injection of 188 million BIT on Jan. 15, 2023, might see the worth falling beneath $0.25.

APE Likely to Fall if Crypto Winter Continues

ApeCoin (APE), launched by Yuga Labs in March 2022, is the third crypto that would dump in 2023. Yuga Labs is behind the blue-chip NFT assortment, the Bored Ape Yacht Club.

APE holders have governance rights in the ApeCoin DAO to assist drive Yuga Labs’ Web3 and metaverse improvement. Yuga Labs first rolled out 150,000, 000 APE to holders of the Bored and Mutant Ape Yacht Club NFTs, and plans to unlock 7.3 million ($26 million) APE for the ApeCoin DAO treasury on Jan. 17, 2023. Smart contracts can even launch about 33 million APE ($105 million) on March 17, 2023.

After ApeCoin’s launch in March, its value fell to $9.62 following a short rally that noticed it contact $13.00. After that, it reached a peak of $26.70 on April 29, 2022, earlier than falling sharply to $5.63 on May 12, 2022. Its downward trajectory for the remainder of the 12 months to date carefully mirrors a decline in curiosity round speculative NFTs like BAYC and metaverse-related initiatives amid an ongoing crypto winter.

Unless curiosity in the NFT market and metaverse revives in 2023, the approaching $100 million-plus token unlocks might imply extra ache for APE holders.

For Be[In]Crypto’s newest Bitcoin (BTC) evaluation, click here.

Disclaimer

BeInCrypto has reached out to firm or particular person concerned in the story to get an official assertion in regards to the latest developments, however it has but to hear again.