What many suspected after the information broke in late October has now grow to be a actuality. One of the most important publicly traded Bitcoin mining firms within the U.S., Core Scientific Inc. (CORZ), has filed for Chapter 11 chapter, CNBC reported as we speak. The community cites an nameless supply.

Whether the Bitcoin mining firm will survive the crypto winter, nevertheless, stays to be seen. CORZ continues to be producing money movement, however it isn’t sufficient to repay the financing debt from the machine lease.

Therefore, the corporate won’t be liquidated in the meanwhile, however will attempt to proceed working as typical whereas reaching an settlement with the holders of senior promissory payments, who maintain the vast majority of the corporate’s debt, an individual acquainted with the matter advised the media group. Core Scientific produced a whopping 1,077 Bitcoins within the month of January, as was revealed at first of the yr.

However, in late October, the Bitcoin mining powerhouse disclosed that the drop in worth and rising competition as a result of large development within the hash fee had torn cracks within the firm’s books.

Austin, Texas-based Core Scientific issued an announcement that the corporate might run out of cash by the tip of the yr and should file for chapter safety. The state of affairs has seemingly not improved since then, particularly because the Bitcoin worth continued to plummet following the FTX collapse.

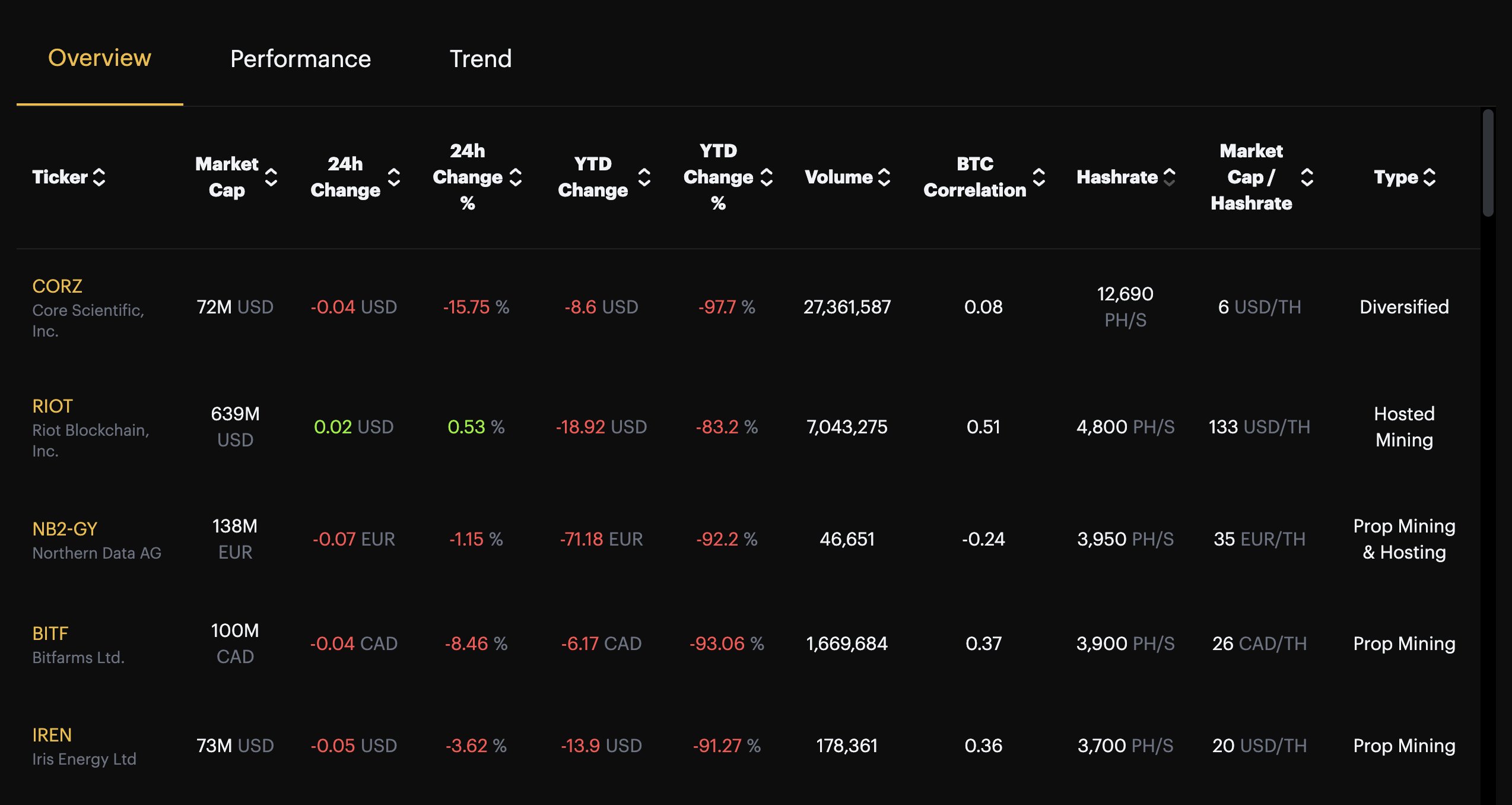

The market capitalization of CORZ, which went public by means of a particular function acquisition car (SPAC), had fallen to $78 million by Tuesday’s shut of buying and selling. CORZ peaked in July 2021, when the Bitcoin miner had a valuation of $4.3 billion. Overall, the inventory has plummeted a staggering 97.7% within the final yr.

What Impact Will The Bankruptcy Have On Bitcoin?

The influence on Bitcoin is prone to be restricted for now. While Core Scientific nonetheless owns about 5% of the worldwide hashrate, the corporate mentioned it is going to proceed to function as regular. Just yesterday, the mining firm reported that it mined 47.7 BTC on December 19 (inside 24 hours). Therefore, a collapse within the hash fee isn’t anticipated.

Today’s (*11*) day by day self-mined #Bitcoin for the final reported 24-hour interval (19-Dec-2022): 47.7 pic.twitter.com/MicVbaKguw

— Core Scientific (@Core_Scientific) December 20, 2022

Possible results on the Bitcoin worth are additionally not on the playing cards. Even earlier than the October warning, Core Scientific had already bought a big a part of its Bitcoin holdings. At the tip of October, it was revealed that Core Scientific held solely 24 BTC and $26.6 million in money. So a “colossal” BTC dump won’t happen.

At press time, the BTC worth was buying and selling at $16,859, attempting to interrupt essential resistance at $16,900. The worth wants to beat the $16,900 stage to generate additional upside momentum. Yesterday, BTC had quickly climbed to $17,054, however couldn’t completely flip this resistance stage into assist.

Featured picture from Brian Wangenheim / Unsplash, Chart from TradingView.com