Key Takeaways

- Grayscale is the largest Bitcoin fund in the world

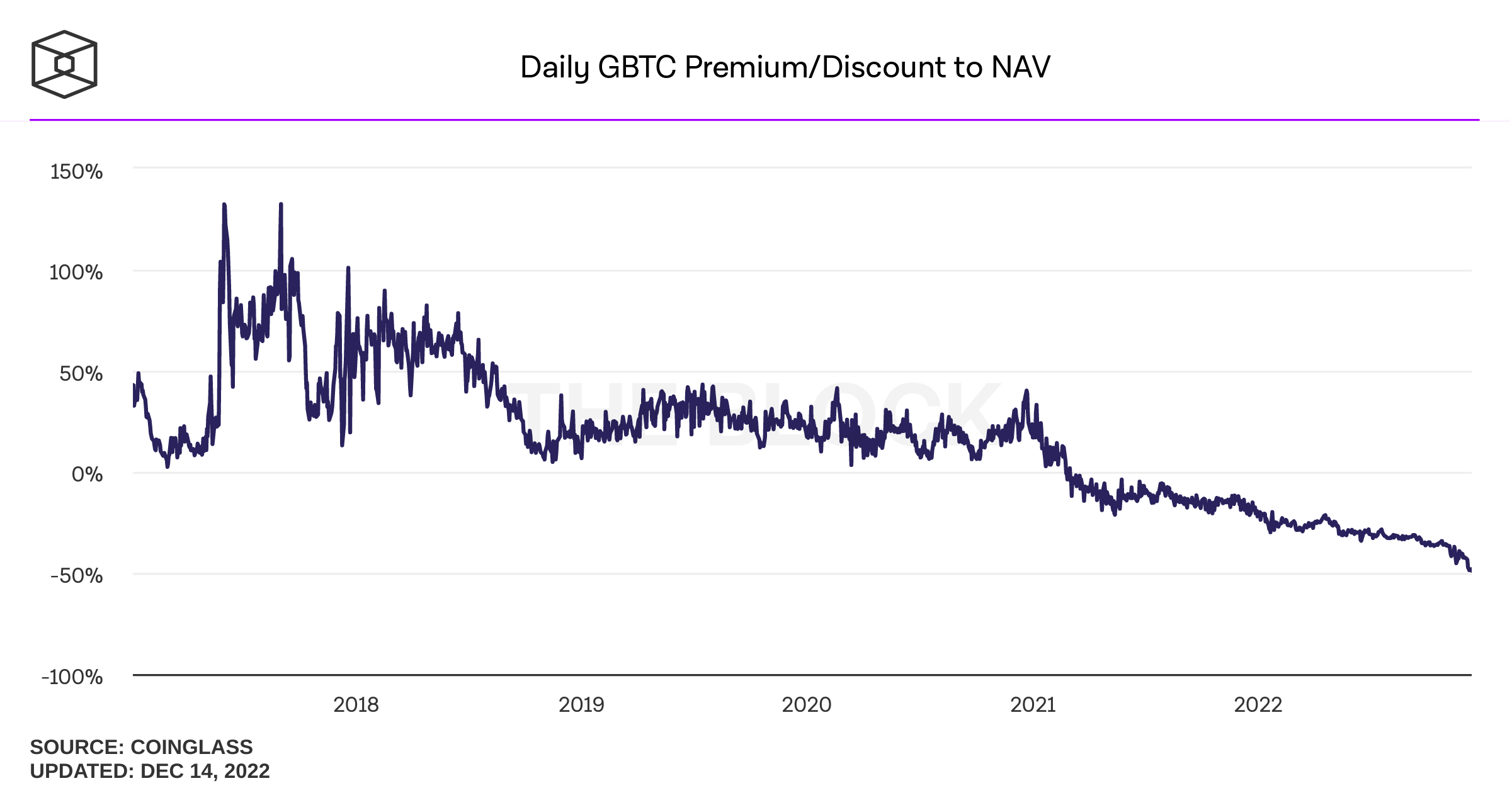

- Discount to underlying asset (Bitcoin) has reached document ranges, breaching 50%

- Concern about reserves, larger charges and different hurdles clarify the discount, which doubtless gained’t shut anytime quickly

The discount to internet asset worth of the Grayscale Bitcoin belief is at all-time highs. The discount briefly pushed previous 50%, earlier than pulling again barely to the place it at present sits at 48.8%.

This comes off the again of the SEC reaffirming its causes for denying Grayscale’s utility to transform the belief into an exchange-traded fund.

The Grayscale Bitcoin Trust is the largest Bitcoin fund in the world, however it has hardly ever traded at the identical stage as its underlying asset, Bitcoin. The above chart reveals that it had, till this yr, traded at a premium since its launch in comparison with Bitcoin.

This fund permits accredited traders to achieve publicity to Bitcoin with out worrying about storing or managing their holdings. It beforehand traded at a premium as demand for shares surged, with establishments wanting Bitcoin publicity. This comfort does come at a price, nonetheless – and a reasonably hefty one at 2%.

Demand falls for Grayscale in 2022

Since March, the Grayscale shares have been buying and selling at a discount to Bitcoin. The fund has $10.7 billion in property below administration, a stark 65% fall in the final yr, reflecting the massacre in the crypto markets.

But the discount to Bitcoin means shareholders are getting hit twice as exhausting.

“The fact that Grayscale’s Bitcoin Trust is now trading at nearly 50% discount is just awful for holders of GBTC. It really highlights the vast differences in structure quality between different investment vehicles,” Bradley Duke, co-CEO at ETC Group, informed CoinDesk final week.

A decline in inflows has been borne out of better competitors as many aggressive funds have launched, particularly in Europe, in addition to a number of filings for Bitcoin ETFs in the US. The discount can be as a result of traders haven’t any method to redeem their holdings for Bitcoin in the belief, however all the whereas are being charged a 2% price.

However, these elements have usually been dulled by arbitrage merchants making the most of the dichotomy in costs. But happenings this yr have lowered that, too.

Concern about Grayscale’s reserves

Over the final month, concern has swelled in the market that Grayscale’s mum or dad firm, Digital Currency Group (DCG) might file for chapter. This is because of the points surrounding crypto dealer Genesis, whose mum or dad firm can be DCG.

Genesis have denied they may imminently file for chapter, however the agency was caught up in the FTX collapse and is at present present process restructuring. Genesis halted withdrawals on November 15th.

This concern has been elevated by questions round Grayscale’s reserves. Namely, whether or not they’re true to their phrase and are holding all the underlying Bitcoin securely. With many main crypto firms publishing proof of reserves in the aftermath of the FTX disaster with a view to assuage buyer worry, Gray scale refused.

“Due to security concerns, we do not make such on-chain wallet information and confirmation data publicly available through a cryptographic Proof-of-Reserve, or other advanced cryptographic accounting procedure,” Grayscale wrote in a press release.

7) We know the previous level specifically can be a disappointment to some, however panic sparked by others will not be a ok purpose to avoid complicated safety preparations which have stored our traders’ property protected for years.

— Grayscale (@Grayscale) November 18, 2022

As I wrote at the time, I actually can’t fathom how safety issues are an element right here. The blockchain is constructed in order that this type of data is offered to the public.

Below is admittedly complicated from @Grayscale

Would love elaboration past simply “security”

Does anybody have recommendations as to how revealing on chain pockets could possibly be a safety concern?

Only factor I can consider is quantum issues (p2pk) however I do not assume that holds right here? https://t.co/0QcVO6wV1x

— Dan Ashmore (@DanniiAshmore) November 19, 2022

Final ideas

All in all, the discount sums up traders’ concern round Grayscale, in addition to the additional charges and different hurdles which exist in comparison with proudly owning the underlying. Arbitrage trades are self-destructive by nature, and therefore it’s notable that the discount is so massive and has continued for therefore lengthy.

Then once more, there may be danger right here, as the identical factor which I’ve been writing about for some time now – a lack of transparency – implies that it can’t be recognized for 100% certainty what’s going on behind the scenes. And that’s the reason we’re seeing a 50% discount.