Cryptocurrency costs have been barely up on the time of reporting as the value of main cryptocurrencies rose marginally throughout the early morning buying and selling hours on Tuesday (13 December 2022). The world crypto market cap is $848.03B, a 0.83% improve over the past day. Meanwhile, Bitcoin and Ethereum are up 1.45% and a couple of.10%, respectively.

The value of among the main Metaverse tokens, particularly ApeCoin, Decentraland and The Sandbox, traded within the crimson right now. In this text, we’ll focus on three metaverse tokens which can be buying and selling decrease however value shopping for the dip. The trio can seemingly offer you enticing returns in 2023. The vital elements we have now thought of whereas choosing these cash embrace their utility, strong monetary backing, and knowledge on token transfers by date. However, since one shoe doesn’t match all sizes, different elements have additionally been saved in thoughts whereas doing this evaluation.

Apecoin (APE)

The reside ApeCoin value right now is USD$4.03 with a 24-hour buying and selling quantity of usd$269,824,043. ApeCoin is down 6.52% within the final 24 hours. The present CoinMarketCap rating of Apecoin is 30, with a reside market cap of USD$1,455,674,698. It has a most provide of 1,000,000,000 APE cash.

Apecoin value has gained almost 5.95% within the final one week, whereas its final one month’s efficiency is +51.31%. Apecoin is a purchase in the mean time as a result of the announcement of ApeCoin’s [APE] staking rewards have grown the hype across the token.

Many crypto communities have tried to revenue from staking rewards. Users can get their arms on the rewards by turning into part of any of the 4 staking swimming pools. One such means is to purchase APE and commit it to the pool.

Since the staking of ApeCoin has gone reside, the demand for the APE coin has elevated, rising its value. Staking can improve or cut back the value of your cash as a result of it’s affected by the market forces of provide & demand.

- Chart on 30-day energetic addresses for ApeCoin

As may be seen within the above shared picture, it’s noticed that each day energetic addresses for ApeCoin noticed an amazing spike over the previous couple of weeks. Subsequently, ApeCoin’s community development has additionally elevated. This signifies that the variety of wallets transferring APE for the very first time had gone up.

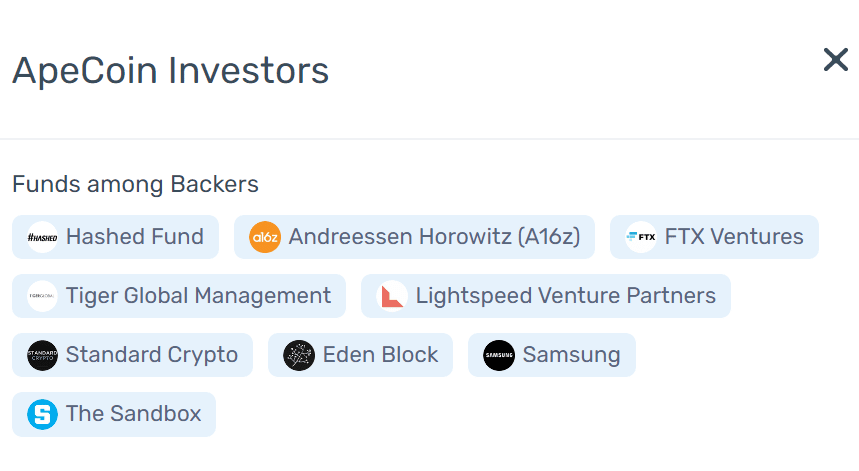

- ApeCoin Investors’ record

Decentraland

The present Decentraland value is USD$0.377683, down 0.18% within the final 24 hours. It has a 24-hour buying and selling quantity of USD$26,615,920. With a reside market cap of USD$700,634,261, the present CoinMarketCap rating of the metaverse token is 56. The most provide of MANA cash shouldn’t be accessible. In the final one week, MANA’s value has fallen by 6.74%. The previous one month and 6 months’ efficiency of the metaverse token stands at -15.14% and -54.42%.

Companies which have invested in Decentraland embrace Republic Realm, Samsung 837X, and Sotheby. Formed in 2017, Decentraland is without doubt one of the older initiatives. As of October 24, it was the third-largest metaverse token by way of market capitalization.

Decentraland Investors’ record

Token Transfers by knowledge chart:

The Sandbox

The Sandbox value right now is USD$0.551138 with a 24-hour buying and selling quantity of USD$75,106,148. The Sandbox value is down 0.43% within the final 24 hours. With a reside market cap of USD$826,415,252, the present CoinMarketCap rating of Sandbox is 49. It has a most provide of 3,000,000,000 SAND cash. In the final one week, The Sandbox value has fallen almost 8.92%; it has dropped 35.75% within the final six months.

With the digital actuality (VR) side, this venture is discovering the imaginative and prescient of the metaverse. The Sandbox is principally a sport, and it has the assist of gaming manufacturers similar to Atari, which might assist it navigate unfavorable market situations.

Another promising issue about this venture is its restricted coin provide of 3 billion tokens, of which 1.5 billion are in use. Seeing the rising recognition of “The Sandbox,” a number of initiatives have purchased land on the platform by getting into into partnerships. These embrace British multinational common financial institution HSBC, Standard Chartered Bank (Hong Kong), and PricewaterhouseCoopers (PwC).

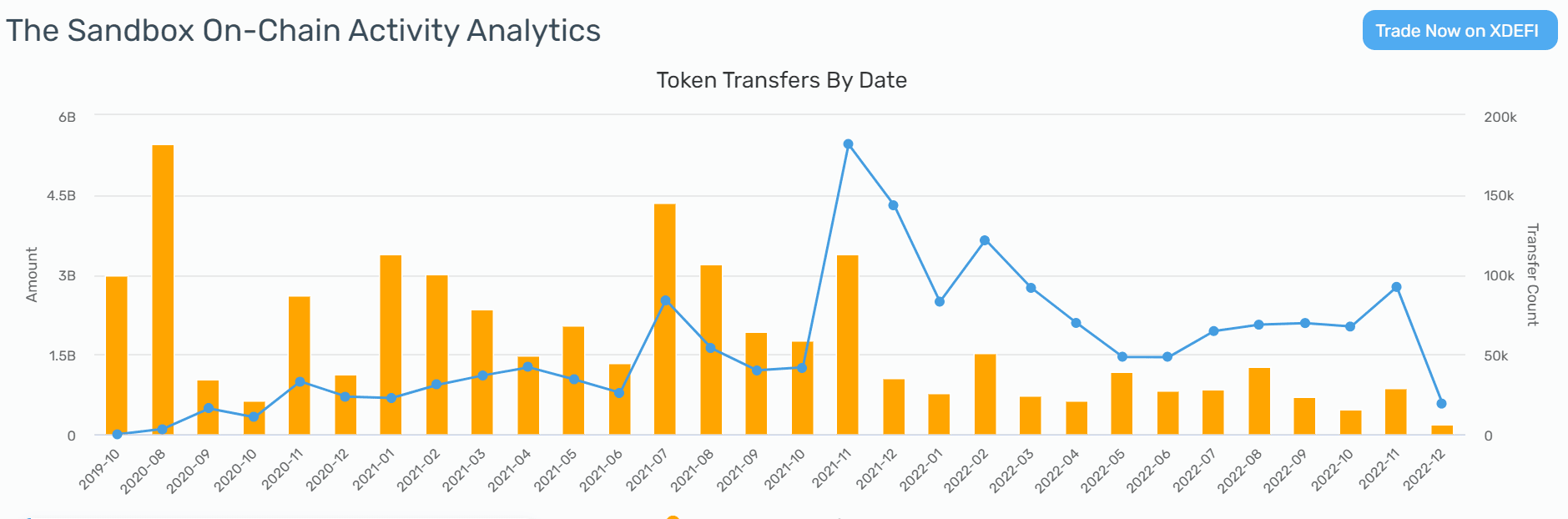

The Sandbox’s Investors’ record

Token Transfers by knowledge chart:

Conclusion

The time period “metaverse” has turn out to be a scorching matter today. The world’s largest tech corporations are investing closely to construct the metaverse for the longer term. These embrace Facebook, Microsoft, Google, Epic video games, and the record goes on. Although the know-how is but to enter the mainstream, it’s rapidly gathering the eye of tech in addition to crypto buyers. It can thus be stated that metaverse cash current an untapped alternative for 2023.

The constructive information is that since metaverse initiatives are comparatively new, coin costs are comparatively low — beneath $1 in some circumstances. This opens the funding alternative for nearly everybody. However, this doesn’t imply that every one initiatives are value your cash.

Disclaimer:

It is to be famous that the crypto market is extremely unstable, and the metaverse idea is deeply rooted in cryptocurrency and blockchain. There is all the time a chance that what appears to carry out effectively sooner or later plunges down for a number of causes. Our article shouldn’t be funding recommendation however a brief evaluation and private opinion. It is all the time advisable to do your analysis earlier than making any funding resolution.

The introduced content material might embrace the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty to your private monetary loss.