On-chain knowledge exhibits the Bitcoin binary CDD has been taking place lately, an indication that promoting strain could also be getting exhausted out there.

Bitcoin 21-Day MA Binary CDD Has Been Observing Downtrend Recently

As identified by an analyst in a CryptoQuant post, there was some heavy distribution occurring out there only a whereas in the past. The related indicator right here is “Coin Days Destroyed” (CDD). A coin day is the quantity that 1 BTC accumulates after sitting nonetheless in a single handle for 1 day.

When a coin that was beforehand dormant (and was thus carrying some coin days) makes some motion on the chain, its coin days counter resets again to zero, and the coin days it had gathered are stated to be “destroyed.” The CDD metric measures the overall quantity of such coin days being destroyed throughout the community on any given day.

When this indicator has a big worth, it means long-term holders are probably shifting or promoting their cash as this cohort tends to stack up enormous numbers of coin days. “Binary CDD,” the model of the metric getting used right here, tells us whether or not the supply-adjusted CDD is kind of than the common supply-adjusted CDD.

Related Reading: Bitcoin Bottom Or More Pain? Here’s What BitMEX Founder Arthur Hayes Thinks

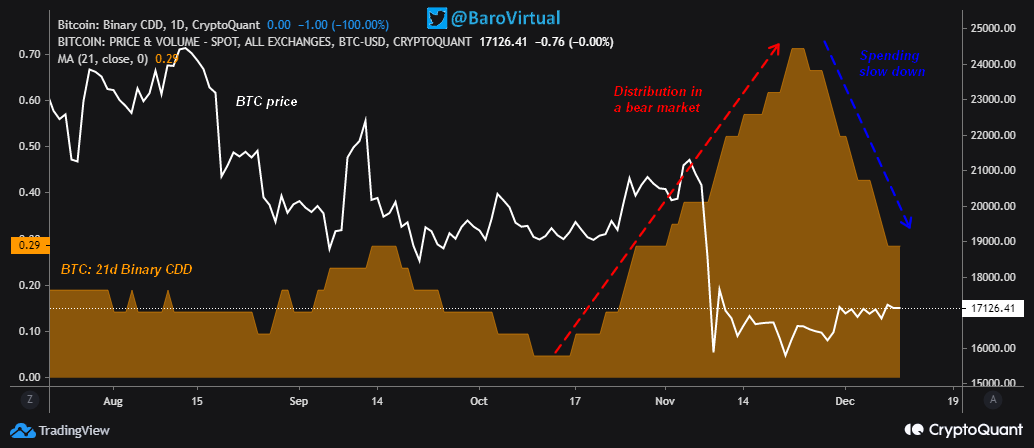

As the identify already implies, this indicator can have solely two values, 0 and 1. It’s 0 when the Bitcoin CDD is lower than the common, whereas it’s 1 when it’s extra. Here is a chart that exhibits the pattern within the 21-day shifting common worth of this metric over the previous few months:

Looks just like the 21-day MA worth of the metric has been on the best way down in current days | Source: CryptoQuant

As you may see within the above graph, the 21-day MA Bitcoin binary CDD had been climbing up between mid-October and late November, suggesting that the long-term holders had been dumping. The BTC value took a big hit whereas this pattern was happening. However, within the final couple of weeks or so, the indicator has been quickly taking place as a substitute.

This could possibly be an indication that the promoting strain that was beforehand current within the BTC market is now getting exhausted, which is one thing that may pave means for a bottom formation within the value.

BTC Price

At the time of writing, Bitcoin’s price floats round $17k, down 1% within the final week. Over the previous month, the crypto has gained 1% in worth.

Below is a chart that exhibits the pattern within the value of the coin over the past 5 days.

The worth of the crypto appears to have dipped down within the final twenty-four hours | Source: BTCUSD on TradingView