Data exhibits the Bitcoin mining hashrate has continued its sharp plunge up to now week, as miners surrender on account of low revenues.

Bitcoin 7-Day Average Mining Hashrate Has Rapidly Gone Down Recently

According to the newest weekly report from Arcane Research, a miner capitulation may not have a lot influence on the worth this time.

The “mining hashrate” is an indicator that measures the overall quantity of computing energy related to the Bitcoin community.

When the worth of this metric goes up, it means miners are bringing extra machines on-line proper now. Such a development exhibits miners are bullish on the crypto in the long run.

On the opposite hand, a lower within the indicator’s worth suggests miners are disconnecting a few of their rigs presently. This sort of development implies miners aren’t discovering the blockchain enticing to mine on in the meanwhile.

Now, here’s a chart that exhibits the development within the Bitcoin mining hashrate over the past six months:

The worth of the metric appears to have been quickly trending down in latest days | Source: Arcane Research's Ahead of the Curve - November 29

As you’ll be able to see within the above graph, the Bitcoin mining hashrate hit a brand new all-time excessive not too way back. But since then, the metric has been taking place.

The motive behind the downtrend is that the ATH ranges of the metric result in the network difficulty reaching a brand new excessive, which meant that revenues shrunk down for the person miners.

As the block rewards are fastened and shared among the many miners, extra miners imply a smaller piece of the pie for everybody concerned.

The lower within the hashrate has been particularly speedy over the last week, because the indicator has shed round 10% of its worth within the interval.

When miners come beneath heavy stress like they’re proper now, they don’t have any selection however to unload their Bitcoin reserves.

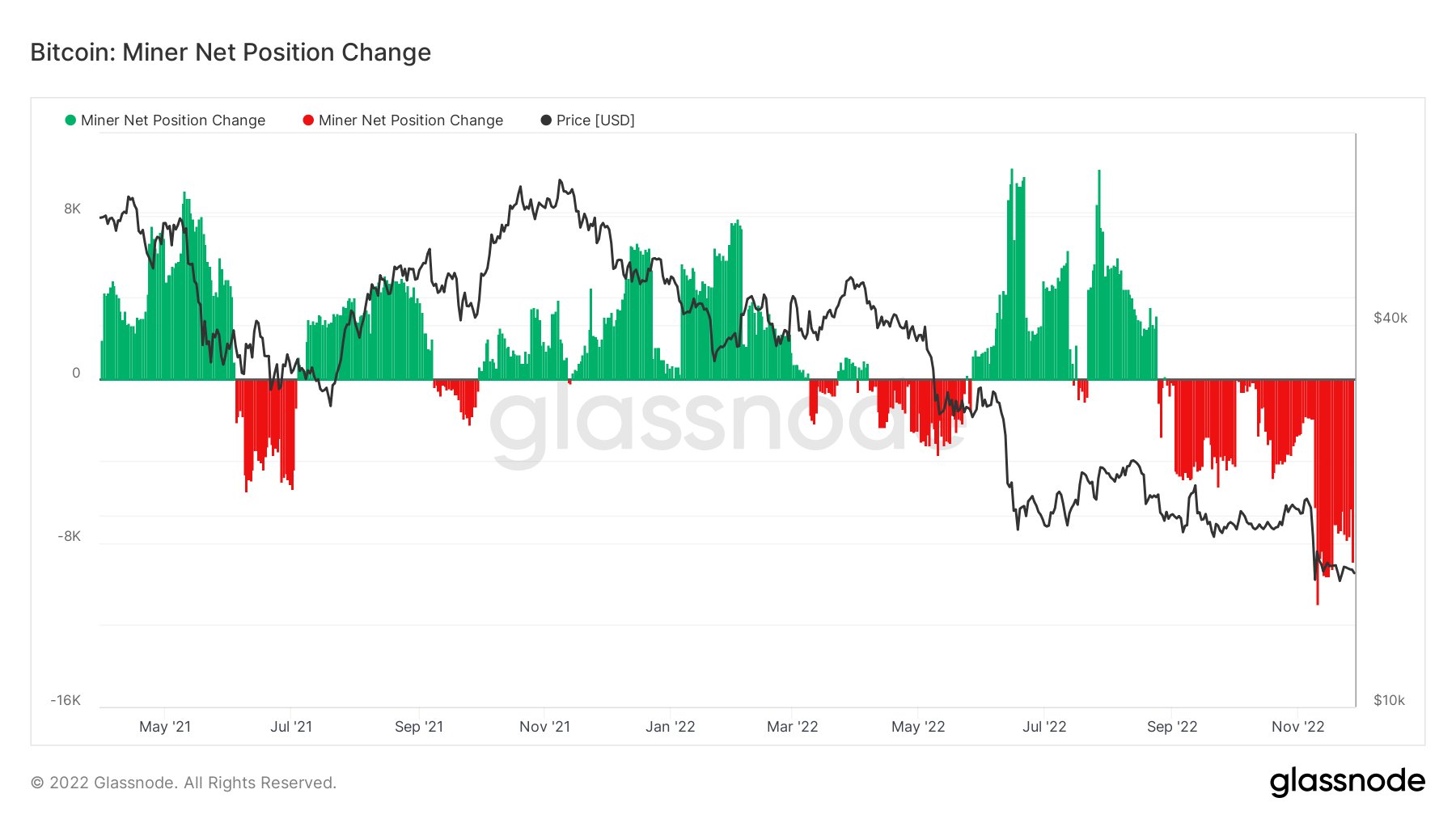

As the under chart exhibits, miners have certainly been doing a little heavy promoting just lately as they’ve been transferring numerous cash out of their wallets.

Looks like miners have been promoting aggressively within the final couple of weeks | Source: Will Clemente on Twitter

Such miner capitulations have traditionally resulted in huge crashes within the value of Bitcoin. One earlier occasion of such an occasion was through the plummet of November 2018.

However, the report believes that the market surroundings is completely different in the present day, and thus it’s unlikely that the miners giving up would have any vital impacts on the worth this time.

BTC Price

At the time of writing, Bitcoin’s price floats round $16.8k, up 2% within the final week.

BTC has surged up | Source: BTCUSD on TradingView

Featured picture from Dmitry Demidko on Unsplash.com, charts from TradingView.com, Arcane Research