The subsequent bull market in Bitcoin is now constructing a backside. As a end result, bears proceed to rule the market, sending the worth of bitcoin under $29,000 within the final 24 hours. Traders anticipating the bear market to conclude could have to attend longer as a result of unfavorable situations.

Will Bitcoin Retrace?

Bitcoin isn’t any stranger to retracements of upper than 20%. More substantial corrections have occurred in Bitcoin’s historical past than this present one.

Those who’ve been round lengthy sufficient to recall earlier meltdowns of greater than 50% in lower than a month can attest that that is simply one other hiccup. Since Bitcoin’s inception, there have been round seven value corrections, with the worth dropping by half. Bitcoin has at all times bounced again after every of those corrections.

Bitcoin fell by 83% in a brief time period in April 2013. When China first outlawed Bitcoin in December of that 12 months, it dropped one other 50%.

BTC/USD slides under $30k. Source: TradingView

2018 was a tough 12 months. Although it reached an all-time excessive of about $20,000 in December 2017, it was solely value about $3,000 in December 2018.

More latest traders will recall the March 2020 meltdown, when Bitcoin dropped 50% in just a few of days. In May of 2021, the identical occasion occurred.

Related studying | New Data Shows China Still Controls 21% Of The Global Bitcoin Mining Hashrate

Despite this, markets are in chaos as we speak, with Bitcoin down greater than 20% within the earlier week and greater than 50% from its all-time excessive in November 2021.

The 200 week shifting common(WMA) might be probably the most reliable and simple chart to supply some info on Bitcoin’s current place . It often rebounds again quickly from the 200 WMA. Only twice in historical past has Bitcoin fallen under the 200 WMA, and each instances it was just for a short while. For greater than a month, it has by no means been under the 200 WMA.

Bitcoin’s 200 WMA is now about $22,000. With a present value of roughly $29,000, it could most likely go decrease and even commerce sideways for some time, however the worst is probably going behind it.

Bloomberg Analyst Believes BTC Will Plummet

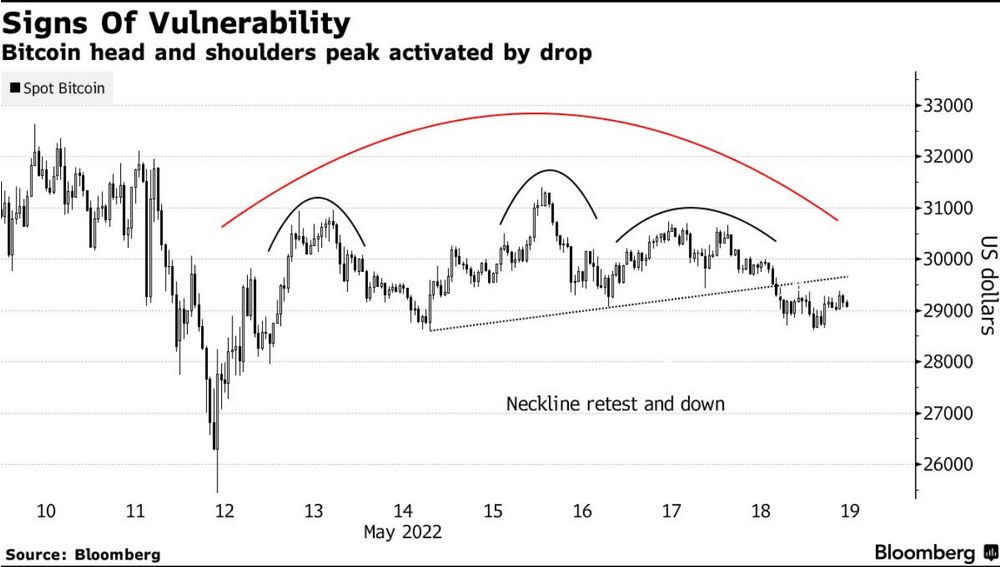

Despite a latest 15% rally from the lows reached final week, Bloomberg analysts imagine the flagship cryptocurrency will proceed to fall. BTC now seems to be extra fragile than beforehand.

According to the article, Bitcoin’s latest rally has resulted within the formation of a “saucer-top” sample on an hourly BTC chart. A Head and Shoulders sample has emerged inside it, indicating a pattern change from bullish to bearish.

Source: Bloomberg

After BTC dipped beneath the formation’s neckline, the sample was activated.

In order to keep away from an extra drop, the Bitcoin value should now surge over $30,800.

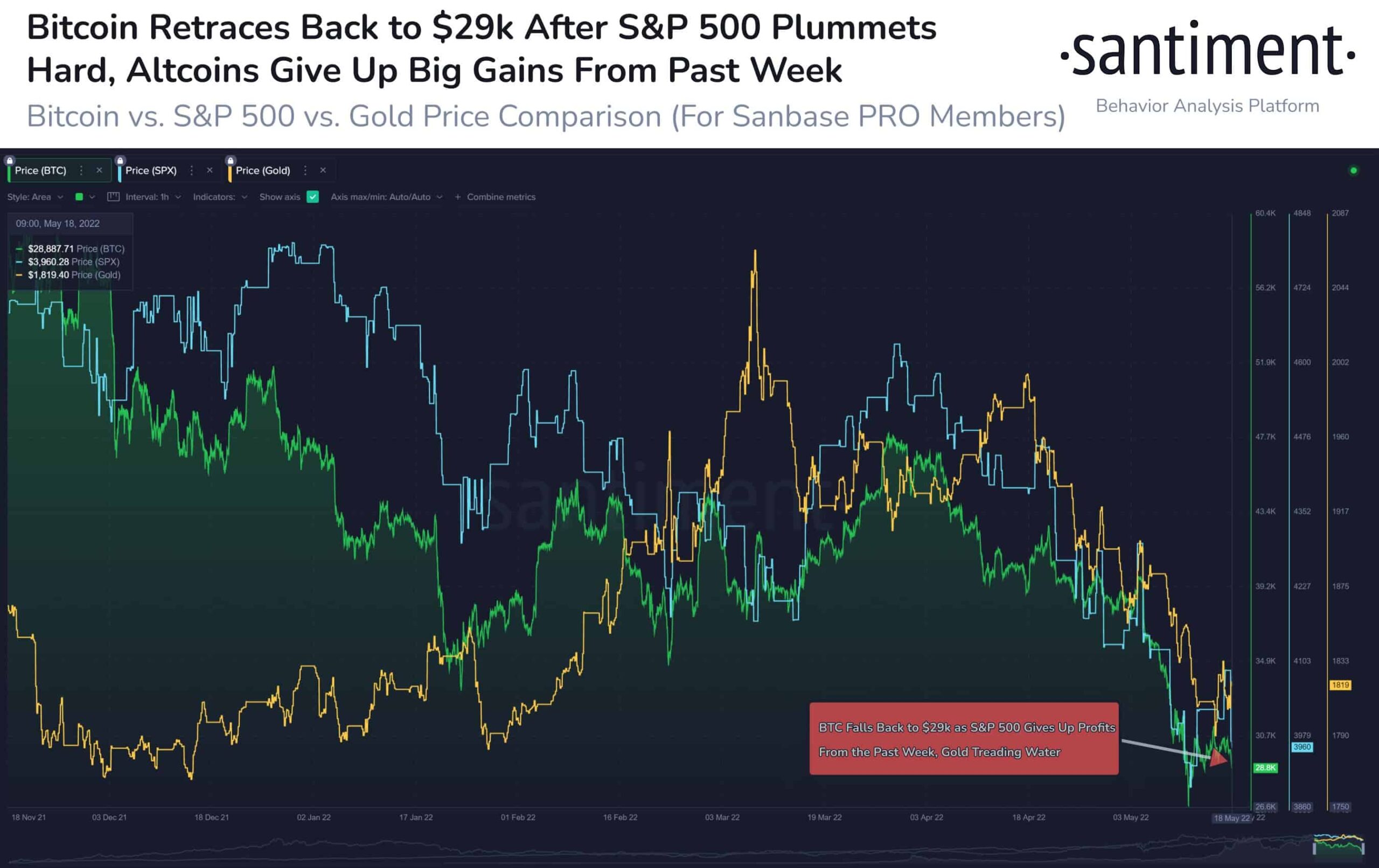

Santiment’s Bitcoin statistics reveals a lackluster market sentiment as merchants stay detached. On May 18, the S&P 500 fell greater than 3%, dragging Bitcoin down with it. Indeed, because the starting of 2022, the correlation between Nasdaq-100 and Bitcoin has remained tight, making it a great indication for anticipating Bitcoin value motion.

Bitcoin-U.S. Equity Market Correlation. Source: Santiment

Nasdaq-100 futures and different U.S. index futures are down about 1.5 p.c on the time of writing. It means that the Bitcoin value could proceed to fall. In truth, Asian and European inventory markets are down greater than 2% as we speak.

Whales, then again, seem like anticipating a backside as a way to proceed accumulating. According to Rekt Capital, Bitcoin’s RSI has now reached the extent the place long-term traders have traditionally gained probably the most.

Related studying | Funding Rates Fall To Yearly Lows Following Bitcoin’s Fall Below $29,000

Featured Image by Pixabay | Charts by TradingView