On-chain knowledge reveals Bitcoin is now buying and selling 24% beneath the realized value, right here’s how a lot deeper the crypto went throughout historic cycles.

Bitcoin Has So Far Declined 24% Under The Realized Price

As identified by an analyst in a CryptoQuant post, drawdowns beneath the realized value have been shrinking with every cycle.

A preferred capitalization mannequin for Bitcoin is the “realized cap,” which measures the cap by weighting every coin within the circulating provide in opposition to the value at which it was final moved.

This is totally different from the standard market cap, the place each coin in circulation is solely multiplied with the most recent BTC value.

Now, from this realized cap, a “realized price” will be derived by dividing the metric with the overall variety of cash in circulation.

The usefulness of this value is that it signifies the associated fee foundation of the typical holder within the Bitcoin market. This implies that at any time when the traditional value dips below this indicator, the typical investor enters right into a state of loss.

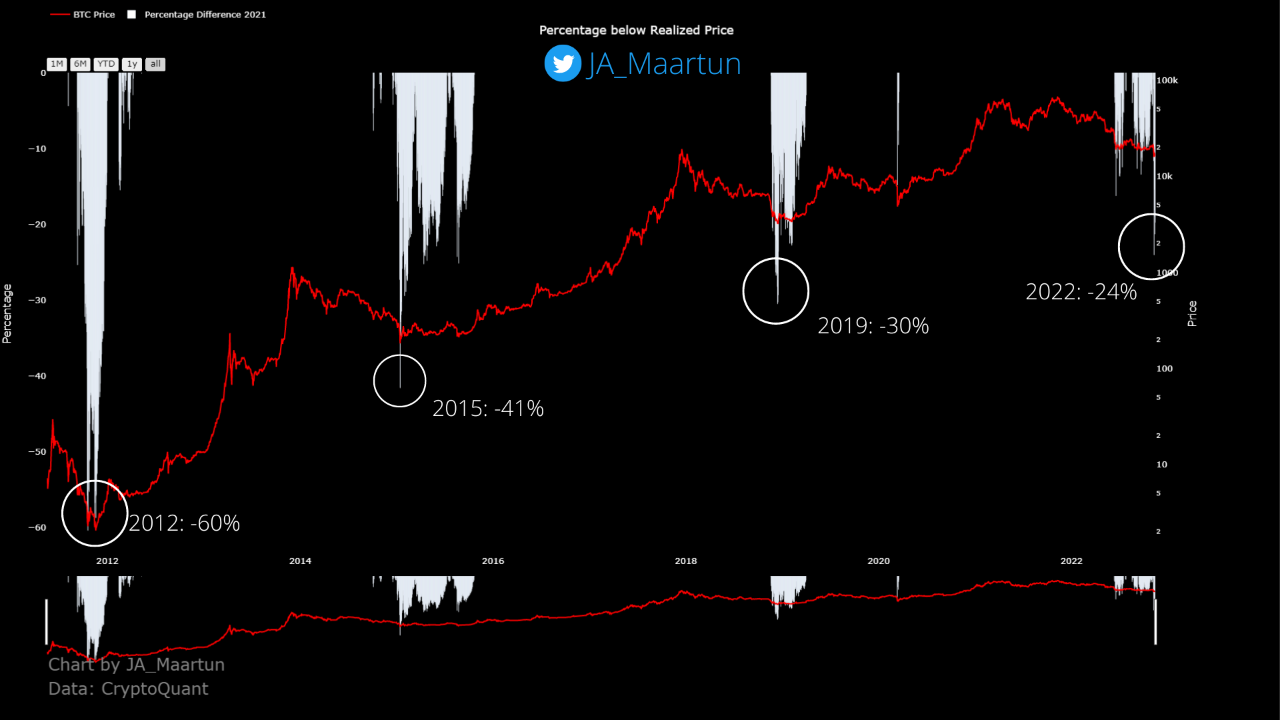

Here is a chart that reveals the chances beneath the realized value BTC has gone throughout every cycle:

Looks like the worth of the metric has plunged in current days | Source: CryptoQuant

As you possibly can see within the above graph, the most recent crash within the value of Bitcoin has taken the crypto 24% beneath the realized value, the deepest worth noticed within the present cycle thus far.

It’s obvious from the chart that the earlier bear market of 2018/19 noticed an excellent bigger drawdown, as the value had declined about 30% beneath the metric on the backside.

Comparing the 2 cycles in isolation would counsel the present bear market nonetheless must see a notable quantity of decline earlier than the identical backside values are hit.

However, issues change when the 2015 and 2012 bottoms are additionally taken into consideration. In 2012, Bitcoin went as little as 60% beneath the realized value, whereas in 2015 the decline was round 41%.

There appears to be a sample right here, and it’s that the proportion of fall beneath the indicator has been shrinking with every cycle.

If this pattern continues to carry this time as nicely, then Bitcoin might the truth is already be close to a backside for this cycle.

BTC Price

At the time of writing, Bitcoin’s price floats round $16.5k, down 1% within the final week. Over the previous month, the crypto has misplaced 14% in worth.

The beneath chart reveals the pattern within the value of the coin over the past 5 days.

The crypto continues to point out stale value motion | Source: BTCUSD on TradingView

Featured picture from Traxer on Unsplash.com, charts from TradingView.com, CryptoQuant.com