Events of the previous week have been completely crippling for Bitcoin.

FTX’s collapse presents as essentially the most impactful insolvency of a centralised firm within the crypto area because the demise of Mt Gox in 2014. For these unlucky sufficient to have had their funds caught up in FTX, Mt Gox presents as a sobering comparability – eight years on from the alternate shutting its doorways, clients have but to see a single cent.

Bankruptcy proceedings are lengthy, drawn out and can possible solely finish with clients getting pennies on the greenback, in any case. The actuality of an $8 billion gap within the stability sheet at FTX is just not going away anytime quickly.

Cold storage is the one secure means

These occasions couldn’t be a greater reminder of the risks inherent within the cryptocurrency area. There are not any bailouts within the crypto area. These will not be banks, lined by insurance coverage, reserve necessities or different strict laws.

The actuality is that it’s virtually inconceivable to know what exchanges are doing with clients’ deposits. Until it turns into too late that’s – we’ll possible know very quickly what precisely occurred to all of the funds caught up within the tangled net of Alameda and FTX.

There is just one means that somebody can serve their crypto property with 100% security, and that’s chilly storage. Pulling property offline means there’s zero counterparty threat, with holders not having to belief another particular person, celebration or middleman. It’s kind of akin to stuffing gold bars underneath your mattress, in a means.

Funds flowing out of exchanges and into chilly storage

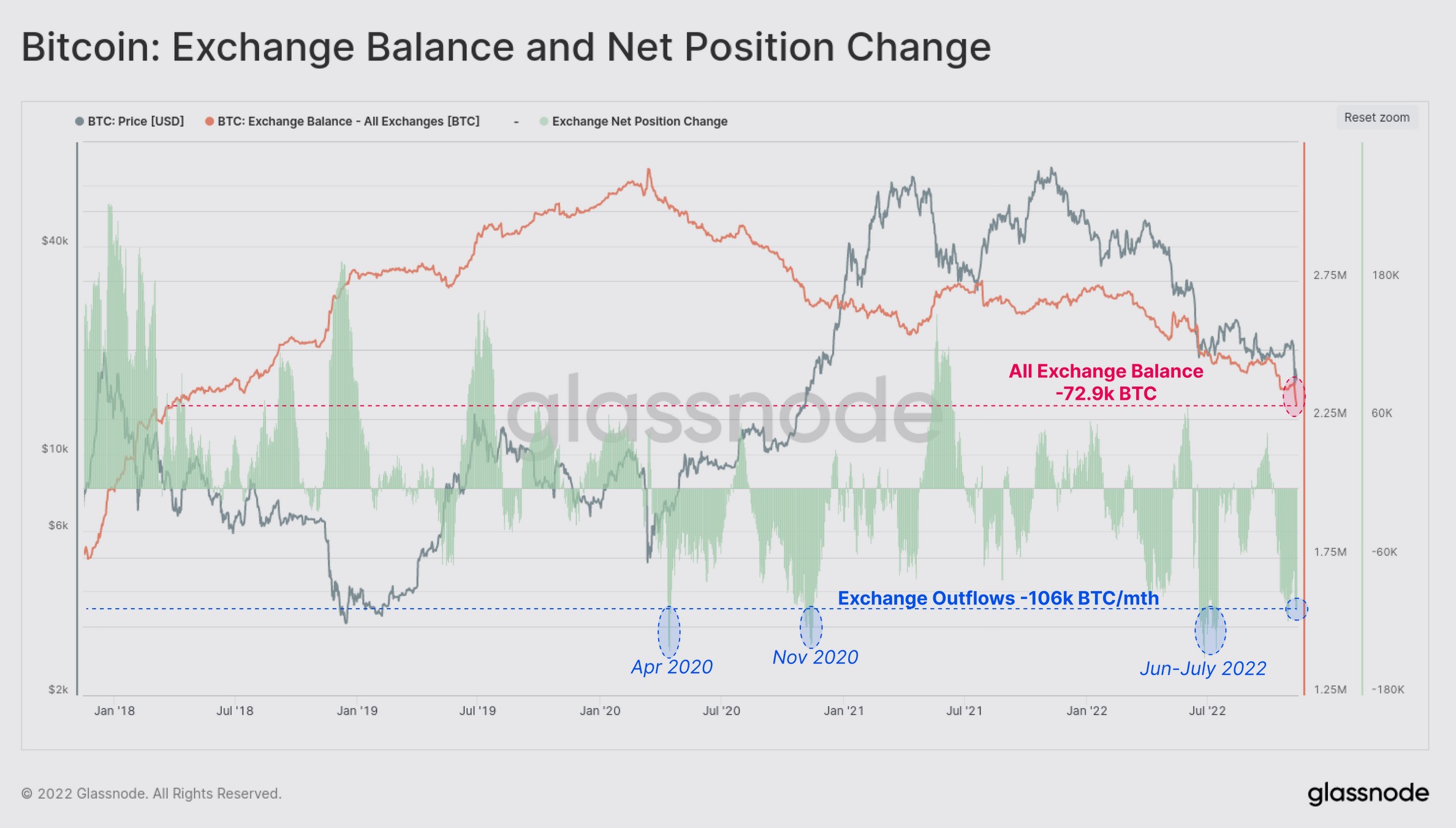

Look at information from on-chain analytics agency Glassnode, the flows of Bitcoin this previous week present fairly how a lot the market has been spooked. People are discovering out the onerous means that cold storage is the one secure solution to be.

In reality, exchanges have simply skilled one of the biggest weekly outflows in Bitcoin historical past, with practically 73,000 bitcoins departing exchanges.

This places the week in the identical realm because the panic of March 2020 when the COVID pandemic hit, in addition to June and July of this yr, when the market crashed within the wake of the Terra disaster, and all of the companies caught up in that net.

This places the week in the identical realm because the panic of March 2020 when the COVID pandemic hit, in addition to June and July of this yr, when the market crashed within the wake of the Terra disaster, and all of the companies caught up in that net.

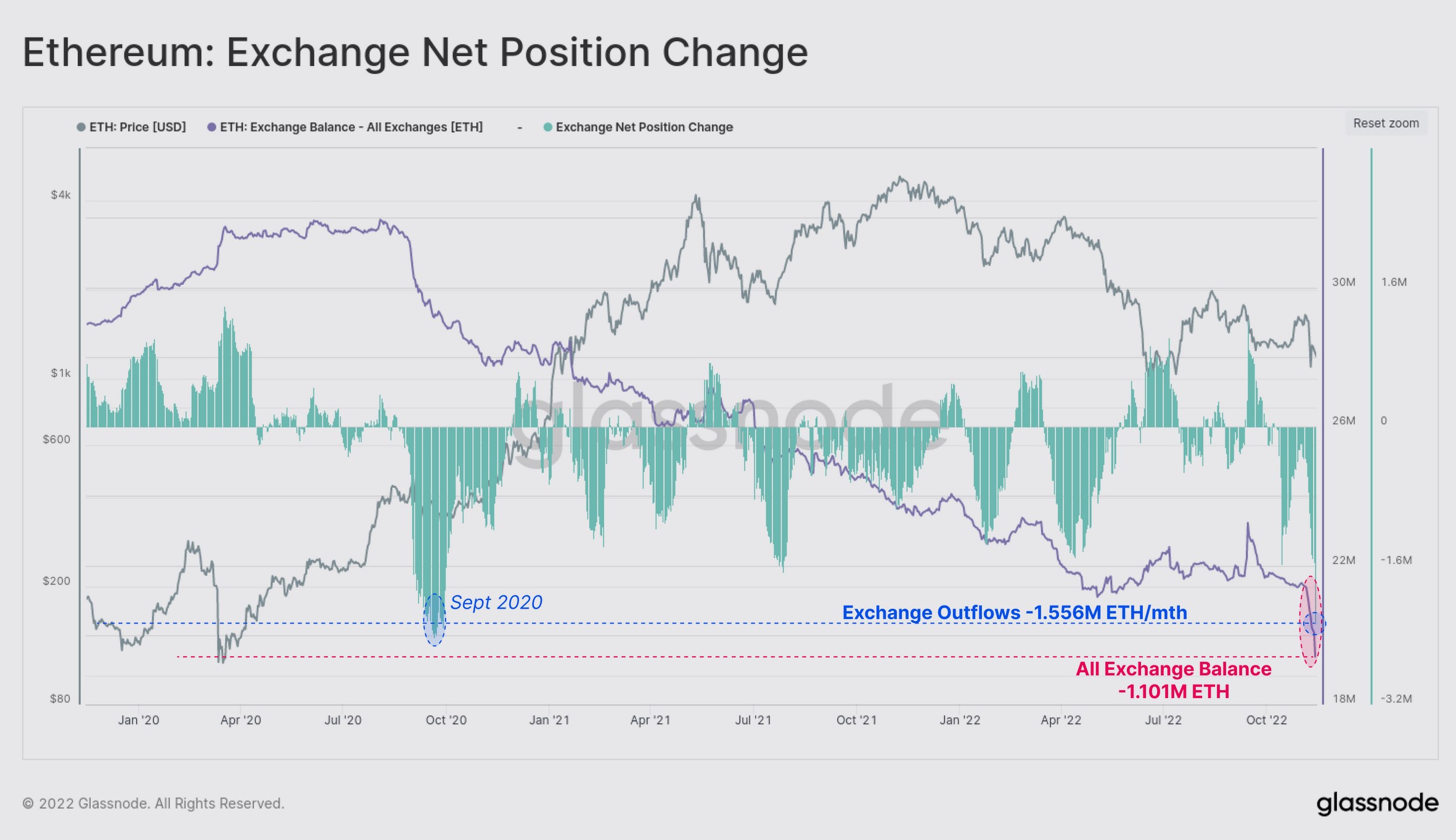

Looking at Ethereum, the sample is analogous:

Has Tether seen promoting?

Another fascinating issue to trace within the wake of these (unlucky repeated) crises is Tether. The controversial stablecoin noticed seelig down so far as 95 cents within the wake of the Terra disaster, as folks feared that it didn’t have sufficient reserves to deal with the immense promoting stress, which noticed its market dip from $83 billion on the eve of the meltdown to $63 billion a month later.

This time spherical, the response has been extra subdued – at the least up to now. Tether has skilled promoting, simply not on the identical stage as May, as its market cap has dipped from $69.8 billion to $66.3 billion, a dip of 5%.

The peg has failed to carry $1, however has come nowhere close to dipping so far as 95 cents seen in May. This time spherical, it bottomed at $0.986 – and even at that, very briefly final Thursday. While it has not reclaimed its $1, it is rather shut at solely fractions of a penny off.

In conclusion, this disaster has had an apparent impact available on the market’s sentiments. It is notable that because it was happening, CZ, Binance’s CEO, was tweeting out that anyone occupied with security merely should flip to chilly storage.

It seems that the market is listening. That and, properly, promoting. Both reactions are comprehensible, as crypto reverberates from one more crippling blow stemming from a centralised participant using poor threat administration, naivety and reckless leverage – with clients once more holding the bag.